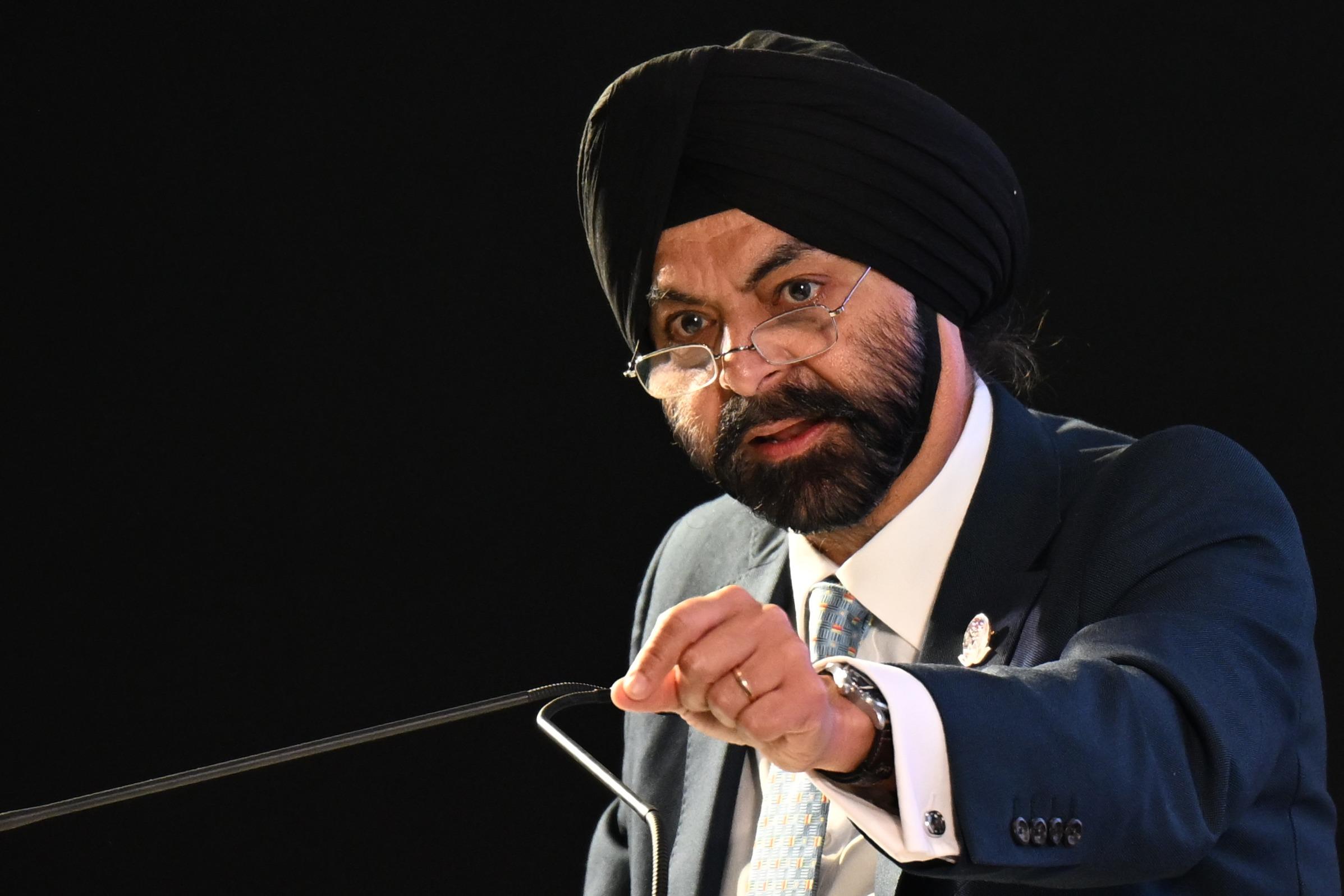

World Bank chief Ajay Banga speaks during the G20 Finance Ministers, Central Bank Governors (FMCBG) and Finance & Central Bank Deputies (FCBD) meetings, at the Mahatma Mandir in Gandhinagar on July 16, 2023. (PHOTO / AFP)

World Bank chief Ajay Banga speaks during the G20 Finance Ministers, Central Bank Governors (FMCBG) and Finance & Central Bank Deputies (FCBD) meetings, at the Mahatma Mandir in Gandhinagar on July 16, 2023. (PHOTO / AFP)

GANDHINAGAR, India - The world economy is in a difficult place but it is not destined to stay there, World Bank President Ajay Banga said on Monday.

The World Bank last month cut its 2024 forecast for global economic growth to 2.4 percent from 2.7 percent earlier, citing global monetary tightening.

"The fact is that the world economy is in a difficult place. It has outperformed what everybody has thought but it won't mean there won't be more challenges," Banga said on the sidelines of a G20 meeting in the Indian city of Gandhinagar.

The World Bank said real global GDP is set to climb 2.1 percent this year. That's up from a 1.7 percent forecast issued in January but well below the 2022 growth rate of 3.1 percent

"Forecast is not equal to destiny. We can change destiny, that's what we should think of right now," Banga said.

ALSO READ: World Bank seeks grants, new capital to fight global crises

In its Global Economic Prospects report released last month, the World Bank said real global GDP is set to climb 2.1 percent this year. That's up from a 1.7 percent forecast issued in January but well below the 2022 growth rate of 3.1 percent.

The development lender cut its 2024 global growth forecast to 2.4 percent, citing the lagged effects of central bank monetary tightening and more restrictive credit conditions that were reducing business and residential investment.

These factors will slow growth further in the second half of 2023 and into 2024, but the bank released a new 2025 global growth forecast of 3.0 percent.

READ MORE: WB urges inclusive growth to unlock South Asia's potential

In January, the World Bank had warned that global GDP was slowing to the brink of recession, but since then, strength in the labor market and consumption in the US had exceeded expectations.