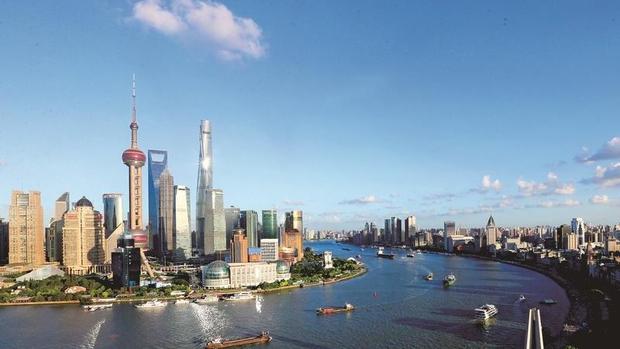

This undated photo shows a view of the Lujiazui area in Shanghai, East China. (PHOTO / XINHUA)

This undated photo shows a view of the Lujiazui area in Shanghai, East China. (PHOTO / XINHUA)

BEIJING - The State Administration of Foreign Exchange (SAFE) Friday published nine new measures to facilitate cross-border trade, investment, and financing in the latest effort to promote financial opening up.

In the next step, the State Administration of Foreign Exchange will improve foreign exchange policies for technological innovation and micro, small, and medium-sized enterprises

The new measures, concerning both current accounts and capital accounts, further streamline foreign exchange management and shorten procedures of related cross-border business, said Wang Chunying, deputy director and spokesperson of the SAFE.

ALSO READ: Experts: Bank rating downgrades unjustified

For instance, the existing pilot policies to facilitate cross-border financing are promoted nationwide, the fund used for foreign direct investment becomes more convenient, and the negative list management for incomes under capital accounts is further improved.

Wang said the measures will effectively stimulate market vitality and better serve the high-quality development of the real economy.

ALSO READ: China's forex reserves up in November

In the next step, the SAFE will improve foreign exchange policies for technological innovation and micro, small, and medium-sized enterprises, further facilitate cross-border trade, investment, and financing, and help stabilize foreign trade and investment, Wang said.