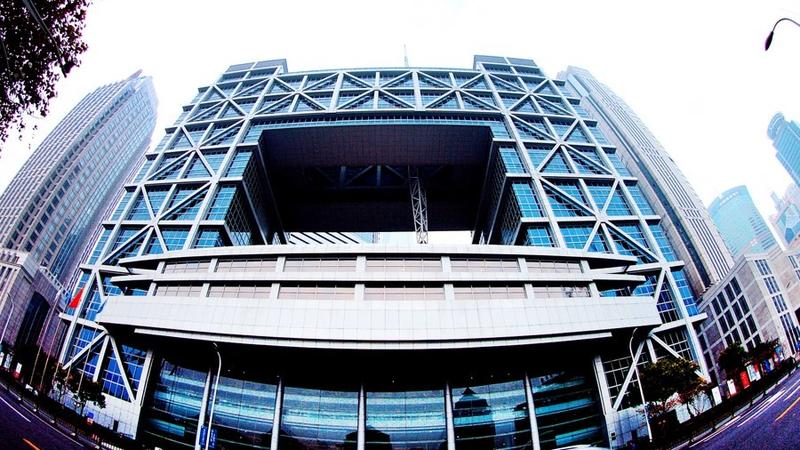

This undated file photo provided by the Shanghai Stock Exchange (SSE) shows an outside view of the SSE in Shanghai, east China. (PHOTO / XINHUA)

This undated file photo provided by the Shanghai Stock Exchange (SSE) shows an outside view of the SSE in Shanghai, east China. (PHOTO / XINHUA)

BEIJING — A new index will debut on March 21 to help shareholders better assess how listed companies on the Science and Technology Innovation Board (STAR) market are managing factors related to environmental, social, and governance (ESG) criteria.

This index, the Shanghai Stock Exchange STAR ESG index, will select the top 50 listed companies in terms of ESG performances to mirror the overall ESG performances of the STAR market, the Shanghai bourse said.

READ MORE: China stock exchanges to reduce fees by 920m yuan in 2024

The bourse also announced two other indexes set to be launched on March 4 that will track the performances of listed firms on the STAR market with different scales such as revenue growth, market value, and research and development.

The STAR market was launched on the Shanghai bourse on July 22, 2019. It was designed to support companies in high-tech and strategic emerging sectors, aiming to facilitate the innovative transformation of the economy and promote institutional improvements in the capital market.