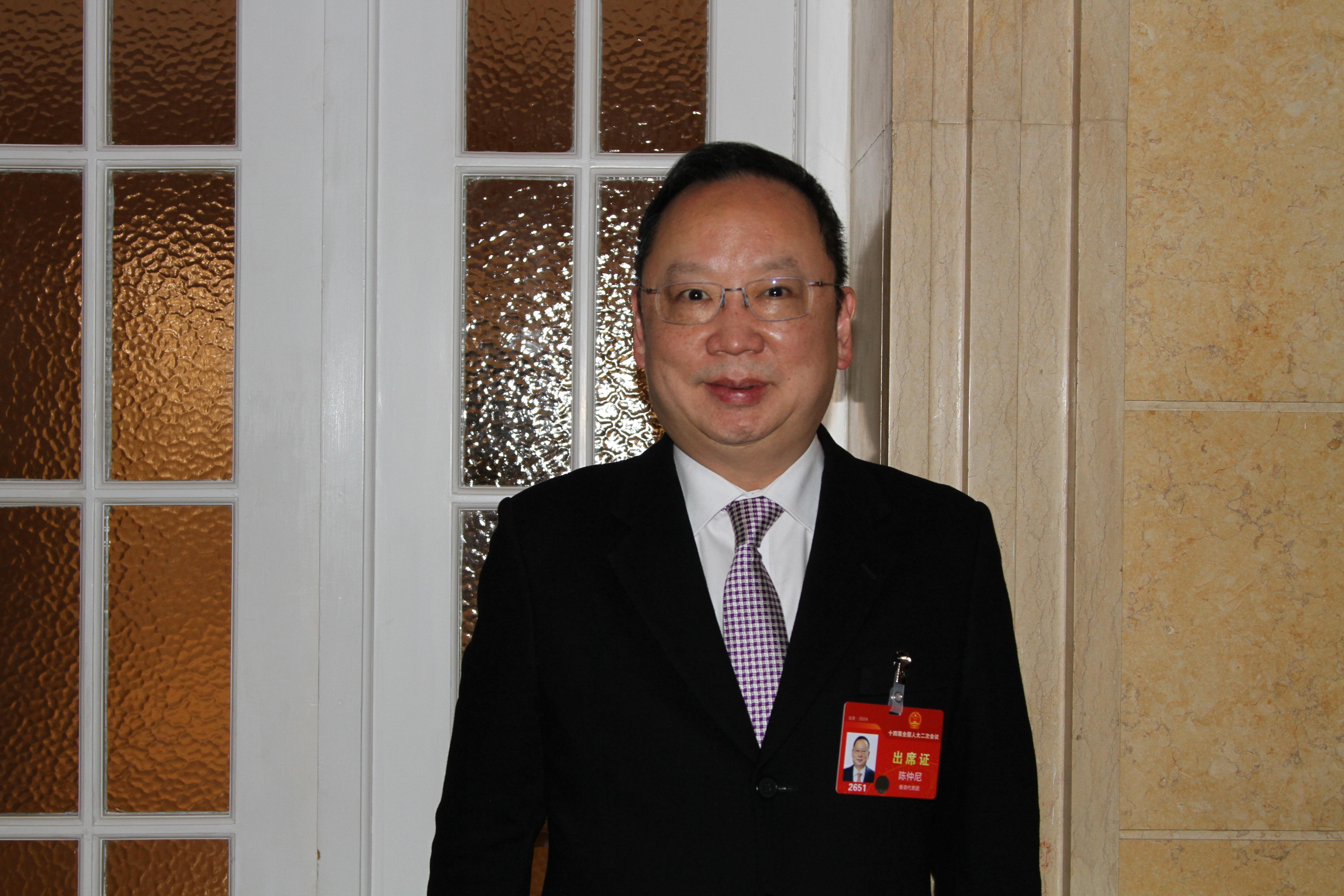

Rock Chen Chung-nin, a deputy to the National People's Congress from Hong Kong, takes an interview with China Daily during the currenct NPC session in Beijing. (LIU YIFAN / CHINA DAILY)

Rock Chen Chung-nin, a deputy to the National People's Congress from Hong Kong, takes an interview with China Daily during the currenct NPC session in Beijing. (LIU YIFAN / CHINA DAILY)

As growing connectivity between the capital markets in Hong Kong and the Chinese mainland bears fruit, now is the time to further extend the cross-border connect programs, spearheaded by the “step-by-step” launch of the primary equity connect, according to financial guru Rock Chen Chung-nin.

Cross-border financial cooperation was further expanded with more mutual access market models targeting bonds and wealth management products. Nevertheless, investors on each side of the border are still barred from the primary equity market on the other side.

Chen, a Hong Kong deputy to the National People’s Congress — the country’s top legislature — made his remarks in an interview with China Daily during the annual gathering of the NPC, which kicked off in Beijing on Tuesday.

It is not the first time that Chen has called for the launch of the primary equity connect, through which investors in the mainland and Hong Kong can subscribe to each other’s markets’ initial public offerings.

He submitted a similar motion during the annual NPC session last year. “The major difference is that this year we answered to the regulatory bodies' concerns over ‘a lack of investor protection’,” said Chen, who is also chairman of Pacific Falcon Investment Group and a member of Hong Kong’s Legislative Council.

New products are normally designed to enrich investors’ portfolios but have not yet demonstrated they are safe for the public to invest in, Chen noted.

To prevent retail investors from suffering unnecessary losses, the financial veteran said the proposed IPO connect should be implemented in a “step-by-step” manner. In the initial stage, the program should be open only to professional investors. Retail investors could be later added after it has been seen to operate smoothly, he explained.

On the product side, listed companies should first meet certain requirements in terms of market capitalization, profitability, or sales revenue to be eligible for inclusion in the mutual access program, he added.

Financial connectivity between Hong Kong and the Chinese mainland has improved significantly since the launch of the Shanghai-Hong Kong Stock Connect in November 2014 and the Shenzhen-Hong Kong Stock Connect in December 2016 — programs that allow investors on the Chinese mainland to trade shares listed in Hong Kong, and vice versa.

According to official statistics, the accumulative transaction value of the Shenzhen-Hong Kong Stock Connect amounted to 75.43 trillion yuan ($10.5 trillion) as of the end of 2023, of which the Northbound hit 60.77 trillion yuan and the Southbound reached 14.67 trillion yuan.

Cross-border financial cooperation was further expanded with more mutual access market models targeting bonds and wealth management products. Nevertheless, investors on each side of the border are still barred from the primary equity market on the other side.

“The process of enhancing market interconnection has been quite successful over the past years, and it is a sophisticated design, which gives full play to the financial strengths on each side of the border while benefiting both,” said Chen.

“And it is time for us to consider opening up more choices for investors,” he added.