Two potential homebuyers look at a property model at a real estate sales promotion in Chengdu, Sichuan province, on Feb 24. (LIU ZHONGJUN / CHINA NEWS SERVICE)

Two potential homebuyers look at a property model at a real estate sales promotion in Chengdu, Sichuan province, on Feb 24. (LIU ZHONGJUN / CHINA NEWS SERVICE)

"Happy families are all alike; every unhappy family is unhappy in its own way."

That's how Leo Tolstoy's novel Anna Karenina starts. China's real estate giants may be forgiven if they invoke Tolstoy to make sense of their current situation.

Because of the COVID19 epidemic, future apartments will pay more attention to health and safety ...

Zhang Xiaoduan, Cushman & Wakefield’s senior director of research in South and West China

The residential property market in China is now rife with prospective homebuyers whose preferences have been transformed in the wake of the COVID-19 pandemic.

Following stay-in orders associated with partial or full lockdowns across the country, people are spending more time at home. Suddenly, the functionality of a home has been redefined by circumstances relating to the virus outbreak.

ALSO READ: Delayed real estate demand stages return in Chinese market

How should a modern home be in the post-pandemic era? What features should it have? What are the factors that homebuyers must consider before spending their hard-earned money on buying a residential property? What are the implications for developers, construction contractors, architects, and interior designers?

Such questions now populate the housing market discourse. Analysts suggest property developers should urgently start to focus on homebuyers' new preferences if they are serious about turning around the fortunes of the industry.

Even as the pandemic has the rest of the world in its tentacles, it is relenting, and almost subdued, in China where several prevention and control measures appear to be paying off.

This has huge ramifications for the country's massive property industry, one of the mainstays of the economy. According to surveys, the stagnant transactions in the housing segment of the market in February and March may see a rebound in demand sooner than later.

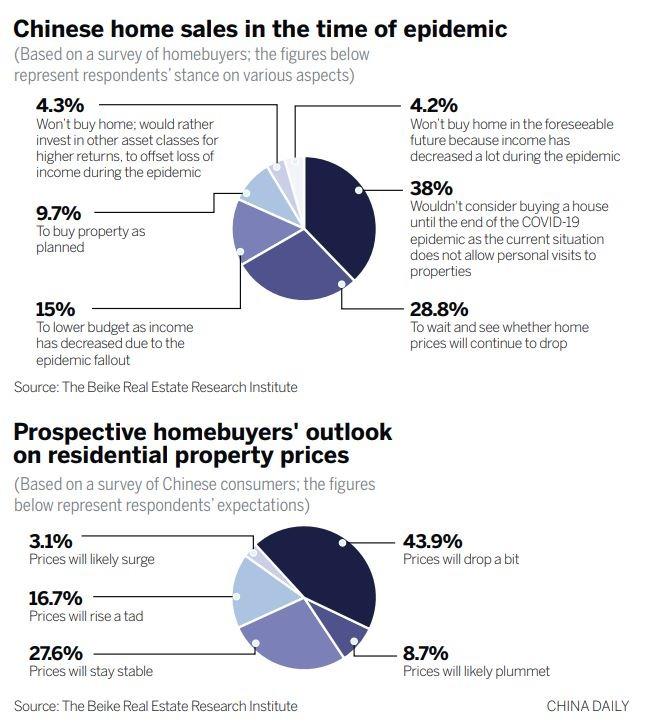

For instance, a survey conducted jointly by the Beike Real Estate Research Institute, which is part of real estate online brokerage Ke, and online financial news outlet Hexun shows that despite most people postponing their homebuying plan, the epidemic per se has not dampened their purchase enthusiasm.

Residential properties like apartments in large cities, which boast sophisticated medical facilities and high-quality property management, figure among the most preferred choices of prospective homebuyers.

Merely 8.5 percent of those polled for surveys expressed their intention to cancel their homebuying plans due to the COVID-19 pandemic. And 38 percent said they will make the purchase after the epidemic subsides in China. That's because they cannot go out for a physical viewing of properties at the moment. Another 29 percent prefer to wait for a while as they believe home prices will go down.

Another survey conducted by E-House (China) Enterprise Holdings Ltd earlier in March showed a similar pattern. Up to 65 percent of the 10,353 families polled said they are about to buy a new flat or upgrade to a better apartment.

A worker at a residental complex construction site in Taiyuan, Shanxi province. (ZHANG YUN / CHINA NEWS SERVICE)

A worker at a residental complex construction site in Taiyuan, Shanxi province. (ZHANG YUN / CHINA NEWS SERVICE)

In the survey, 56 percent of the polled said their current living rooms are not big enough or riddled with limited space that does not allow leisure activities. Some 52 percent complained about the lack of hallway. A hallway is now seen as a necessary space to change into fresh clothes and sanitize themselves before entering the main areas of home.

And more than 43 percent found their dining room too small to squeeze in all the members of the household for a family dinner. More than 19 percent said they need more bedrooms to avoid human-to-human transmission; 14 percent expect to have at least two bathrooms for use during peak times; 9 percent found their balcony too small to do any physical exercise; 7 percent said they need more space for study and work; 5 percent want more space for stocking life supplies; nearly 5 percent hope their home will have more intelligent or smart facilities as well as air-and water-purifying systems.

"Recent surveys indicate Chinese people's home requirements have changed from the basic needs of living to a pursuit of quality life, which is a call for developers to adopt more diversified and creative home designs," said Ding Zuyu, CEO of E-House (China) Enterprise Holdings Ltd.

"The epidemic will further alter homebuyers' decisions. Especially those looking to buy a home with better living conditions, will find a responsive market," said Xie Chen, head of research with CBRE China.

Cosmopolitan cities with sufficient resources for living remain the premier choice for the majority (51 percent). During the recent work-fromhome period, many people realized they need independent office-like space at home, as nearly 42 percent hope to buy a bigger apartment with enough space for their parents and kids living together, the Beike Real Estate Research Institute report said.

"The outstanding performance of first-tier cities and their surrounding city clusters in battling the epidemic proved the importance of living there. They have sufficient medical, educational and life-support facilities. We expect these cities' property markets to recover soon after the COVID-19 epidemic is subdued," said Yang Yuechen, Knight Frank's head of research and consultancy in Shanghai and Beijing.

Another lesson learnt from the epidemic is the importance of medical facilities and property services. As many as 63 percent of the respondents said they are more willing to pay for high-quality property management, and 46 percent care about sophisticated medical resources in the vicinity of their homes.

"Because of the COVID-19 epidemic, future apartments will pay more attention to health and safety, comfort and function, services and management," said Zhang Xiaoduan, Cushman &Wakefield's senior director of research in South and West China.

Price is still the decisive determinant in choosing a property. Nearly 44 percent of respondents believe that home prices will edge down within a small range after the epidemic ends. And nearly 28 percent think home prices will be stable.

Homebuyers may find prices a tad lower as falling interest rates will reduce the monthly instalment payments of property mortgages, according to Xie of CBRE.

At the same time, property developers facing high pressure on capital flows are expected to offer more promotional offers and discounts, said Yang with Knight Frank.

There is market-wide consensus that real estate is clearly one of the major industries hit hard by COVID-19.

In the first quarter, transactions for new homes tumbled almost 26 percent from a year ago, data from the National Bureau of Statistics showed. And the combined transaction volume in the first three months in 66 cities monitored by Beike shrank nearly 26 percent year-on-year to 42.47 million square meters.

The situation in the secondary market is more critical. Trade volume of pre-owned residential properties slumped nearly 45 percent in the first quarter from a year ago, which is the lowest in the past five years, according to the Beike Real Estate Research Institute.

There were 14 out of the 17 major cities that Chinese residential property agency Lianjia monitors reported price falls in the home market throughout March compared to the levels of January and February.

Without doubt, the impact of the contagion is strong, but that's going to be only temporary, analysts said. The pent-up demand will spur a wave of sales in the post-COVID period, analysts said.

Industry observers said there is no sign the central government will alter its macro-controls on the real estate industry, which could ensure orderly conduct in the marketplace. The annual Central Economic Work Conference last December set the tone by noting that "to make sure the property market is developed steadily and healthily, we must uphold the principle that 'housing is for living in, not for speculation', and to implement policies in accordance with each city's condition while the long-term mechanism for stable land prices, home prices and market expectation is being created."

Third-and fourth-tier cities are more vulnerable in confronting the impact of COVID-19, as the property sector there is not backed by strong industries and steady demand seen in first-and second-tier cities, said Zhang of Cushman& Wakefield.

READ MORE: China's home prices to stay mostly stable this year

"This underscores the importance of effective local measures in accordance with a city's specific circumstances."

Xu Xiaole, chief market analyst with the Beike Real Estate Research Institute, said the bottom line is that the epidemic has not changed the fundamentals of the property market. "Instead, COVID-19 provides an opportunity for everybody to re-examine the value of their property, push for the improvement of property services, and drive the whole industry into a new era of living," said Xu.