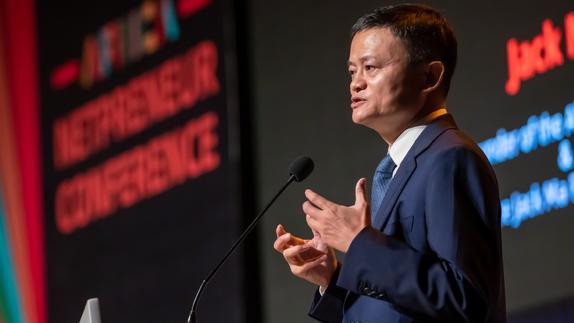

In this Nov 17, 2019 photo, Jack Ma delivers a speech at the Africa Netprenuer Conference. (Photo / Xinhua)

In this Nov 17, 2019 photo, Jack Ma delivers a speech at the Africa Netprenuer Conference. (Photo / Xinhua)

SHANGHAI - Alibaba Group Holding Ltd co-founder Jack Ma has cut his stake in the company over the past year to 4.8 percent from 6.2 percent, cashing out around US$8.2 billion at its current share price, the firm’s annual filing released on Friday showed.

Alibaba did not disclose the average selling price of his divestment. Its share price has risen around 40 percent since Ma reported his 6.2 percent holding in the company a year ago

The divestment comes as Ma retired as the Chinese e-commerce company’s executive chairman in September and pulled back from formal business roles to focus on philanthropy.

ALSO READ: Jack Ma dethroned as China's richest by Tencent's Pony Ma

Alibaba did not disclose the average selling price of his divestment. Its share price has risen around 40 percent since Ma reported his 6.2 percent holding in the company a year ago.

The stock’s stellar performance has been helped by forecast-beating earnings growth, even as China’s economy sharply slows, as more people shop online for essentials due to the COVID-19 pandemic.

Alibaba Executive Vice Chairman Joseph Tsai also reduced his stake in the company over the same period, to 1.6 percent from 2.2 percent. The offloaded shares were worth US$3.3 billion as of Friday.

ALSO READ: SoftBank's Masayoshi Son and Alibaba's Jack Ma part ways

Both Ma and Tsai have been steadily less involved in Alibaba’s regular operations since Daniel Zhang was announced as Ma’s successor as company chairman. He assumed that role formally in September 2019.

Throughout this year, the two have donated millions of units of personal protective equipment (PPE) via their individual charity arms to hospitals worldwide to help fight the spread of COVID-19.

An April 2019 filing with the US Securities and Exchange Commission stated that Ma would plan to sell up to 21 million shares within one year to support his philanthropic efforts.

READ MORE: China's US$136b e-commerce haul signals consumer comeback