Pedestrians walk past a branch of Ping An Bank of Ping An Insurance (Group) of China in Shenyang, Northeast China's Liaoning province, March 21, 2018. [Photo/IC]

Pedestrians walk past a branch of Ping An Bank of Ping An Insurance (Group) of China in Shenyang, Northeast China's Liaoning province, March 21, 2018. [Photo/IC]

The headwinds that toppled Ant Group Co’s initial public offering now threaten a US$22 billion dream of the Chinese mainland’s Ping An Insurance (Group) Co -- to pivot from a finance group to a tech giant and be valued like one.

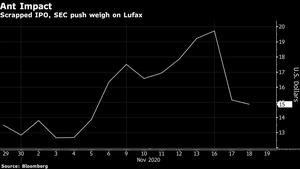

While Ping An’s Lufax Holding Ltd, which offers wealth management and retail lending services, was able to complete its US IPO days before new mainland rules torpedoed Ant’s US$35 billion sale, the stock has given up early gains and is now a target for short sellers. Renewed threats by US regulators to delist mainland stocks also threaten Ping An’s plans to take more of its in-house startups public.

While Ping An’s Lufax Holding Ltd, which offers wealth management and retail lending services, was able to complete its US IPO days before new mainland rules torpedoed Ant’s US$35 billion sale, the stock has given up early gains and is now a target for short sellers

Ant’s IPO suspension “fundamentally changed near-term investment appetite” for mainland fintech stocks, with Lufax as “the community’s No. 1 consensus short,” according to a Nov 5 report from Procensus, which polled 84 global investors managing US$15.3 trillion.

Short interest represented about 34 percent of Lufax shares outstanding as of Nov 17, up from just 5 percent when the Ant deal was pulled, according to data compiled by IHS Markit. Ping An owns about 39 percent of Lufax after the IPO.

The Shenzhen-based finance firm, which gets three-quarters of its revenue from insurance, trades at about 10 times 2019 earnings; Alibaba Group’s ratio is six times higher.

ALSO READ: Ping An, Sunshine 'among bidders for US$1b Tahoe Life'

Ping An has pledged to plow more than US$22 billion into research from big data to blockchain to make it more “tech” than “fin,” while carving out some of its units through public listings to maximize value.

Ten Startups

The finance group has developed at least 10 startups in recent years after using technology to improve its traditional insurance and banking services. The units, including publicly traded health-care portal Ping An Healthcare & Technology Co and fintech provider OneConnect Financial Technology Co, are aligned in five groups targeting finance, health, real estate, autos and urban life.

The mainland’s move to place lending limits and boost capital requirements on fintech firms presents headwinds for the tech units, which also face threats in the US. The Securities and Exchange Commission intends to propose a regulation this year that would lead to the delisting of companies for not complying with US auditing rules, people familiar with the matter have said.

Lufax plunged 23 percent on the Bloomberg News report Tuesday, paring gains to 8 percent since its IPO last month. OneConnect fell 3.1 percent, though it has still doubled this year. Ping An Healthcare was little changed last week in the Hong Kong Special Administrative Region (HKSAR) and has gained 78 percent in 2020.

The rapidly evolving regulatory framework for fintech firms and other issues like data privacy could delay the IPOs of Ping An’s other units, according to Sanjay Jain,Singapore-based head of financials at Aletheia Capital Ltd.

“Big tech will have to contend with growing regulatory oversight in various aspects, it is a global trend and unavoidable,” he said.

Other units that Ping An intends to take public include Ping An Smart City and Ping An HealthKonnect, which provides management tools for hospitals and other health-care businesses.

“Ping An’s pace of spinning off its tech subsidiaries in the past four years has not been as smooth as it originally guided the market, if we look at both the number of IPOs and their valuations,” said Leon Qi, an HKSAR-based analyst at Daiwa Capital Markets.

Investors have yet to fully realize what technology can bring to Ping An, not just the value from IPOs, but synergies with its core business, executives including former Co-CEO Lee Yuan Siong have argued in recent years. Ping An declined to comment for this story.

While management has said it’s not in a hurry to launch IPOs for the tech units, a crackdown on peer-to-peer lending held up the listing of Lufax for a few years. What was once the largest P2P lender morphed into a wealth-management platform as the number of firms was cut to three from more than 5,000.

ALSO READ: Ping An bets on bond ETFs to catch up as Vanguard entry nears

“The company might have been ready to list a couple of years ago, but the regulations were still unclear,” Lufax Chief Executive Officer Gregory Dean Gibb said in an interview. Now, “the rules are clear, the requirements are clear.”

Gibb spoke just three days before Jack Ma and other senior executives at Ant were summoned by mainland regulators, derailing the record IPO. New regulations to root out monopolistic practices shaved almost US$290 billion off the market value of mainland tech giants in two days.

Lufax Exposed

While Lufax may not be impacted by the mainland’s new rules as much as Ant, it remains “quite exposed” to the risks of regulatory caps on its lending rates, said Kevin Kwek, an analyst at Sanford C Bernstein.

The China Banking and Insurance Regulatory Commission is probing a few companies including Ping An for violating regulatory requirements on small business financing costs

The China Banking and Insurance Regulatory Commission is probing a few companies including Ping An for violating regulatory requirements on small business financing costs. Ping An Puhui Financing Guarantee Co, part of Lufax’s platform that makes micro loans, bundled Ping An’s insurance products while lending to clients jointly with Industrial Bank Co and charged high fees, pushing up their costs, according to a Nov 21 statement on the regulator’s website.

Gibb said Lufax’s offering of larger loans to small businesses by combining its financial and data strength better meet client needs. Its access to Ping An’s distribution network also provides a moat against rival tech giants and banks, he said.

The regulatory tightening is unlikely to slow Ping An’s push to innovate and invest in fintech and healthtech, as the company’s roots in the finance sector suggest that regulatory requirements are “in their muscle memory already,” said Bloomberg Intelligence’s HKSAR-based analyst Steven Lam.

READ MORE: China's Ping An boosts stake in HSBC after historic plunge

“Valuations can be easily affected by external factors, but the key is whether Ping An can identify good businesses with a sustainable future,” he said.