In this March 30, 2017 photo, the Bank of Korea (BOK) headquarters building stands in Seoul, South Korea. (PHOTO / BLOOMBERG)

In this March 30, 2017 photo, the Bank of Korea (BOK) headquarters building stands in Seoul, South Korea. (PHOTO / BLOOMBERG)

South Korea raised interest rates on Thursday, becoming the first major Asian economy to start exiting record-low borrowing costs as financial risks are seen to pose a bigger threat to the economy than the latest virus wave.

Recent data suggest the Korean economy has largely held up amid a surge in local and global delta cases. Exports have rallied so far in August, business confidence has strengthened and optimism still prevails among consumers

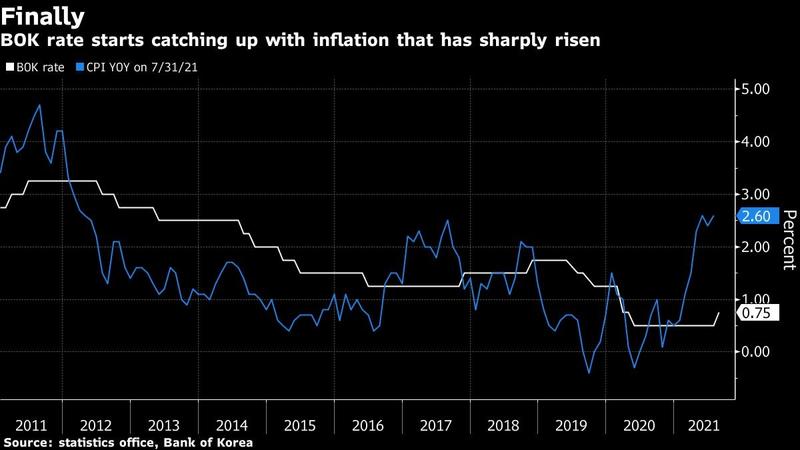

In a statement released after a quarter-percentage-point hike to 0.75 percent, the Bank of Korea said it will “gradually adjust” the degree of support for the economy, taking into account COVID-19 developments, financial imbalances and other factors. The central bank kept its growth forecast for this year unchanged from May, but raised its inflation outlook above target to 2.1 percent.

The move shows the focus of monetary policy in Korea has shifted from propping up the economy to curbing a debt-driven asset bubble that risks spiraling out of control. How the BOK’s tightening move affects growth and markets will be closely watched by other central banks seeking to chart a way out of pandemic-era stimulus.

The BOK forecast the economy will expand 4 percent this year, suggesting it sees limited economic damage from the recent surge in infections and strict curbs on activity. Its step toward normalization contrasts with the hesitancy of the Reserve Bank of New Zealand to increase borrowing costs last week as the country headed back into a lockdown.

“The BOK just couldn’t wait any longer when it has consistently stressed its focus on household debt and financial imbalances,” said Kim Sanghoon, a fixed-income strategist at KB Securities Co. “It’s not like the economy is plunging amid the latest virus wave, but household debt is something that can’t be ignored any more.”

ALSO READ: S. Korea unveils US$450b push for global chipmaking crown

Recent data suggest the Korean economy has largely held up amid a surge in local and global delta cases. Exports have rallied so far in August, business confidence has strengthened and optimism still prevails among consumers. The BOK expects consumption to improve as vaccination picks up and the extra budget offers support, the statement showed.

Meantime, policy makers have become increasingly troubled by the prospect of financial imbalances destabilizing the economy, with the presidential chief of staff joining the drumbeat of warnings. Household debt growth is setting new records, adding fuel to an already overheated housing market and other assets.

Rate increases that help rein in asset price gains while leaving the recovery unruffled could help regain some support for President Moon Jae-in’s party if they are seen as dovetailing with government measures. A presidential election is due next spring and unaffordable housing is one of the key factors that has drained support from Moon’s administration.

Bond futures fell on the decision. The rate increase could also gave the won a leg up, after the currency has led losses against the dollar in Asia this month. The won was up 0.1 percent against the dollar at to 1,166.70 as of 10:47 am in Seoul, while the benchmark Kospi Index erased gains of as much as as 0.4 percent.

Korea was the region’s front runner in tightening in 2017, following a series of rate increases by the Federal Reserve. Compared with then, the BOK’s shift now comes before the Fed’s tapering, another indication of the level of concern among local policy makers to bring overheating markets to heel.

Korea was the region’s front runner in tightening in 2017, following a series of rate increases by the Federal Reserve. Compared with then, the BOK’s shift now comes before the Fed’s tapering, another indication of the level of concern among local policy makers to bring overheating markets to heel.

Lee’s comments at a media conference later Thursday will be scrutinized for hints on the pace of tightening. Any dissenting votes calling for a hold would suggest the bank will at least pause before raising rates again. A unanimous vote, on the other hand, would show strong support for tightening, boosting bets for another near-term move.