In this Dec 20, 2012 photo, a woman walks beneath signage for the Hong Kong Monetary Authority (HKMA). (DALE DE LA REY / AFP)

In this Dec 20, 2012 photo, a woman walks beneath signage for the Hong Kong Monetary Authority (HKMA). (DALE DE LA REY / AFP)

Hong Kong is poised to enhance offshore renminbi liquidity, facilitate the development of more-diverse renminbi products, and expand the use of the yuan in equity market trading in Hong Kong.

The first currency-swap enhancement is the expansion of both the intraday and overnight repo from 10 billion yuan to 20 billion yuan, providing an additional 20 billion yuan in liquidity to the market. The second enhancement is the extension of the overnight repo operating hours from 6 pm to 5 am the next day, making operation more flexible and streamlined, especially for those in other time zones

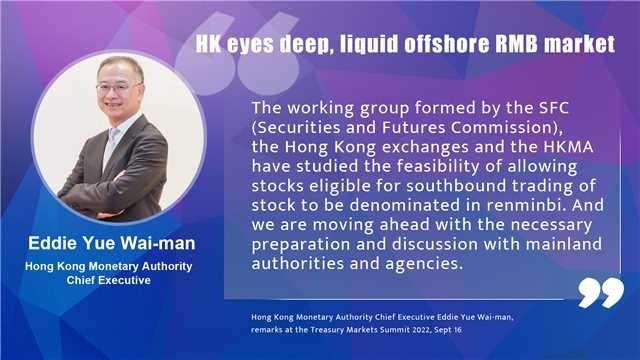

Such moves will contribute to the two-way liberalization of financial markets by developing a deep and liquid offshore renminbi market, Hong Kong Monetary Authority Chief Executive Eddie Yue Wai-man said on Friday.

Yue made the remark in Hong Kong at the Treasury Markets Summit 2022. The event was organized by the HKMA and the Treasury Markets Association.

ALSO READ: HKMA raises interest rate by 75 basis points after Fed hike

“The HKMA constantly monitors the need for further enhancements to keep renminbi liquidity in Hong Kong at the optimal level”, said Yue, who is also the honorary TMA president.

In July, the People’s Bank of China and the HKMA announced the enhancement of the currency-swap agreement, with the swap size expanding from 500 billion yuan ($71.3 billion) to 800 billion yuan.

“Hong Kong’s facility will be the largest of any jurisdiction and also the only one that is not subject to renewal, giving us an effective liquidity backstop to support the development of the offshore renminbi market in Hong Kong,” Yue said.

ALSO READ: HKMA chief says Exchange Fund to ride out financial storm

The first currency-swap enhancement is the expansion of both the intraday and overnight repo from 10 billion yuan to 20 billion yuan, providing an additional 20 billion yuan in liquidity to the market. The second enhancement is the extension of the overnight repo operating hours from 6 pm to 5 am the next day, making operation more flexible and streamlined, especially for those in other time zones. The third one is the reduction of repo rates of the overnight rate repo with the spread over CNH HIBOR lower, from 15 to 25 basis points.

The second approach to currency-market liberalization is facilitating the development of more-diverse renminbi products, and the expansion and enhancement of the Connect programs to promote cross-boundary use of the renminbi is crucial, Yue said.

“We will also consider enhancements to the Southbound Bond Connect to enrich Hong Kong’s bond market, and we are discussing incremental enhancement of the Wealth Management Connect with the mainland authorities, for example, by improving service arrangements, expanding the product scope, and allowing more financial institutions to participate,” Yue said.

The HKMA chief executive pledged to develop the offshore renminbi derivatives market by introducing risk-management products to meet global investors’ hedging needs and to develop Hong Kong as a risk-management center. The Swap Connect and the introduction of the mainland government bond futures in Hong Kong are important steps to allow global investors to conduct hedging for their mainland bond investments, he said.

ALSO READ: HKMA buys HK$8.07b from market to defend currency peg

The third vital step to market liberalization is to expand the use of the renminbi in equity-market trading in Hong Kong. “The working group formed by the SFC (Securities and Futures Commission), the Hong Kong exchanges and the HKMA have studied the feasibility of allowing stocks eligible for southbound trading of stock to be denominated in renminbi. And we are moving ahead with the necessary preparation and discussion with mainland authorities and agencies.” Yue said.

To facilitate the ecosystem of offshore renminbi financing business, the upgrading of the financial infrastructure in the financial system is vital, he said.

“We are upgrading the Central Moneymarkets Unit (CMU) into a major international central securities depository in Asia, so that we can better support the conductivity between the mainland and international financial markets in cross-border clearing, settlement and custodian operations,” Yue said.

“Our three-year program of operation includes, first, enhancing efficiency and risk management including a launch of a new collateralized lending service in April this year. Second, upgrading the system for greater flexibility by launching a completely new CMU platform in 2025,” he added.

The third upgrade relates to the strengthening of cross-border links through the CMU, including enhancing automated access to mainland central securities depositories in the first quarter of this year to facilitate the Bond Connect operations. The last upgrade refers exploring the system enhancements to provide Northbound Bond Connect investors with a single access to the entire onshore bond market.

Despite short-term market fluctuations, Yue believed there are several key drivers that continue to help global investors interested in diversifying into renminbi assets over the medium to long term.

These factors include: continued inclusion of onshore equities and bonds into major global indexes; the mainland’s long-term economic growth prospects; increasing recognition of the renminbi as a stable reserve currency; and portfolio managers’ seeing a lower correlation between renminbi assets and other global financial market assets.

These factors will pave the way for a structural and long-term shift that will motivate global investors to think more strategically about their exposure to the mainland. This in turn will spur demand for the renminbi and facilitate the further opening-up of the mainland capital markets in a self-reinforcing cycle.

“Our unique and irreplaceable role in connecting the mainland and the rest of the world will continue to provide us with many exciting opportunities that we must be ready to seize,” Yue said. “We will continue to participate actively in this journey to support Hong Kong’s status as an ever-evolving and highly resilient international financial center for the mutual benefit of the nation, and the international investment community.”