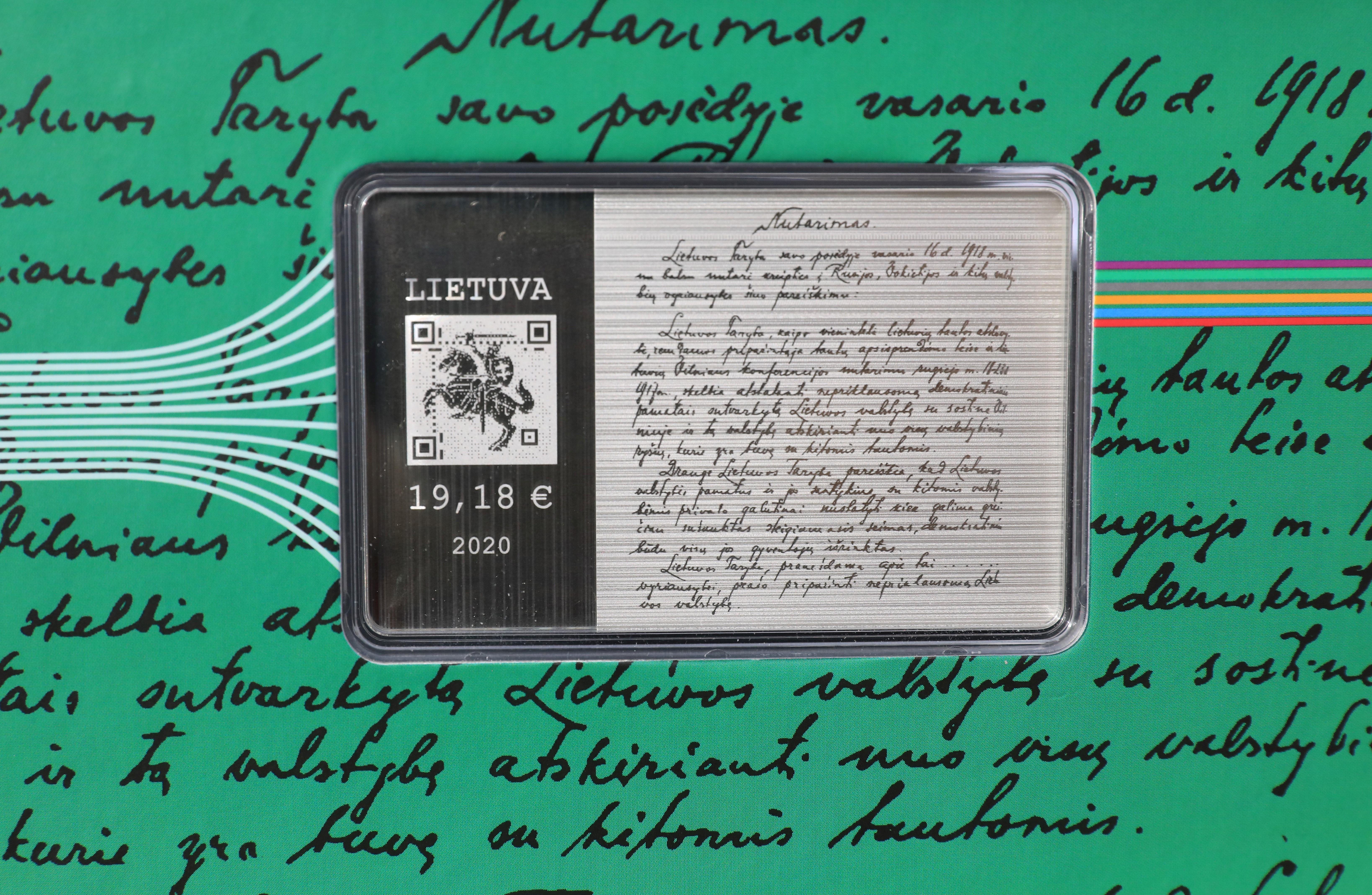

A picture taken on July 9, 2020, shows a view of a credit card-shaped silver coin (with a value of 19.18 euros), which allows digital tokens to be traded, during a press conference to present the eurozone's first central bank-produced digital coin in Vilnius, Lithuania. (PHOTO / AFP)

A picture taken on July 9, 2020, shows a view of a credit card-shaped silver coin (with a value of 19.18 euros), which allows digital tokens to be traded, during a press conference to present the eurozone's first central bank-produced digital coin in Vilnius, Lithuania. (PHOTO / AFP)

LONDON - A total of 130 countries representing 98 percent of the global economy are now exploring digital versions of their currencies, with almost half in advanced development, pilot or launch stages, a closely-followed study shows.

The research by the US-based Atlantic Council think tank published on Wednesday said significant progress over the past six months meant that all G20 countries with the exception of Argentina were now in one of those advanced phases.

Eleven countries, including a number in the Caribbean, and Nigeria, have already launched central bank digital currencies (CBDCs) as they are known

Eleven countries, including a number in the Caribbean, and Nigeria, have already launched central bank digital currencies (CBDCs) as they are known.

Two other big emerging economies, India and Brazil, also plan to launch digital currencies next year. The European Central Bank is on track to begin its digital euro pilot ahead of a possible launch in 2028, while over 20 other countries will also take significant steps towards pilots this year.

In the United States, though, progress on a digital dollar is only "moving forward" for a wholesale (bank-to-bank) version, the Atlantic Council's research said, whereas work on a retail version for use by the wider population has "stalled".

ALSO READ: IMF working on global central bank digital currency platform

US President Joe Biden ordered government officials to assess the risks and benefits of creating a digital dollar in March 2022.

The heavyweight status of the dollar in the financial system means any US move has potentially enormous global consequences, but the Federal Reserve said back in January that Congress, rather than it, should decide whether a digital version is launched.

The global push for CBDCs comes as physical cash use falls and authorities look to fend off the threat to their money-printing powers from bitcoin and 'Big Tech' firms.

READ MORE: G7 to discuss digital currency standards, crypto regulation

It said that Sweden remained one of Europe's most advanced with its CBDC pilot, while the Bank of England is pressing on with work on a possible digital pound that could be in use by the second half of this decade.

Australia, Thailand, South Korea, and Russia all intend to continue pilot testing this year too.

READ MORE: Trade settlements via central bank currencies trial planned

Despite the growing interest in CBDCs, however, some countries that have launched them - such as Nigeria - have seen a disappointing take-up, while Senegal and Ecuador have both cancelled development work.