Governor of People's Bank of China Pan Gongsheng delivers a keynote speech during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Governor of People's Bank of China Pan Gongsheng delivers a keynote speech during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Collaboration among central banks and governments is key to addressing financial challenges arising from deglobalization, decoupling and de-risking pressures, officials and financial leaders said at the HKMA-BIS High-Level Conference on Tuesday.

The conference, cohosted by the Hong Kong Monetary Authority and the Bank for International Settlements, aims to discuss key challenges that central banks and policymakers are facing, such as persistent inflation pressures and the “higher-for-longer” interest rate environment, as well as the future of the monetary system amid financial innovation.

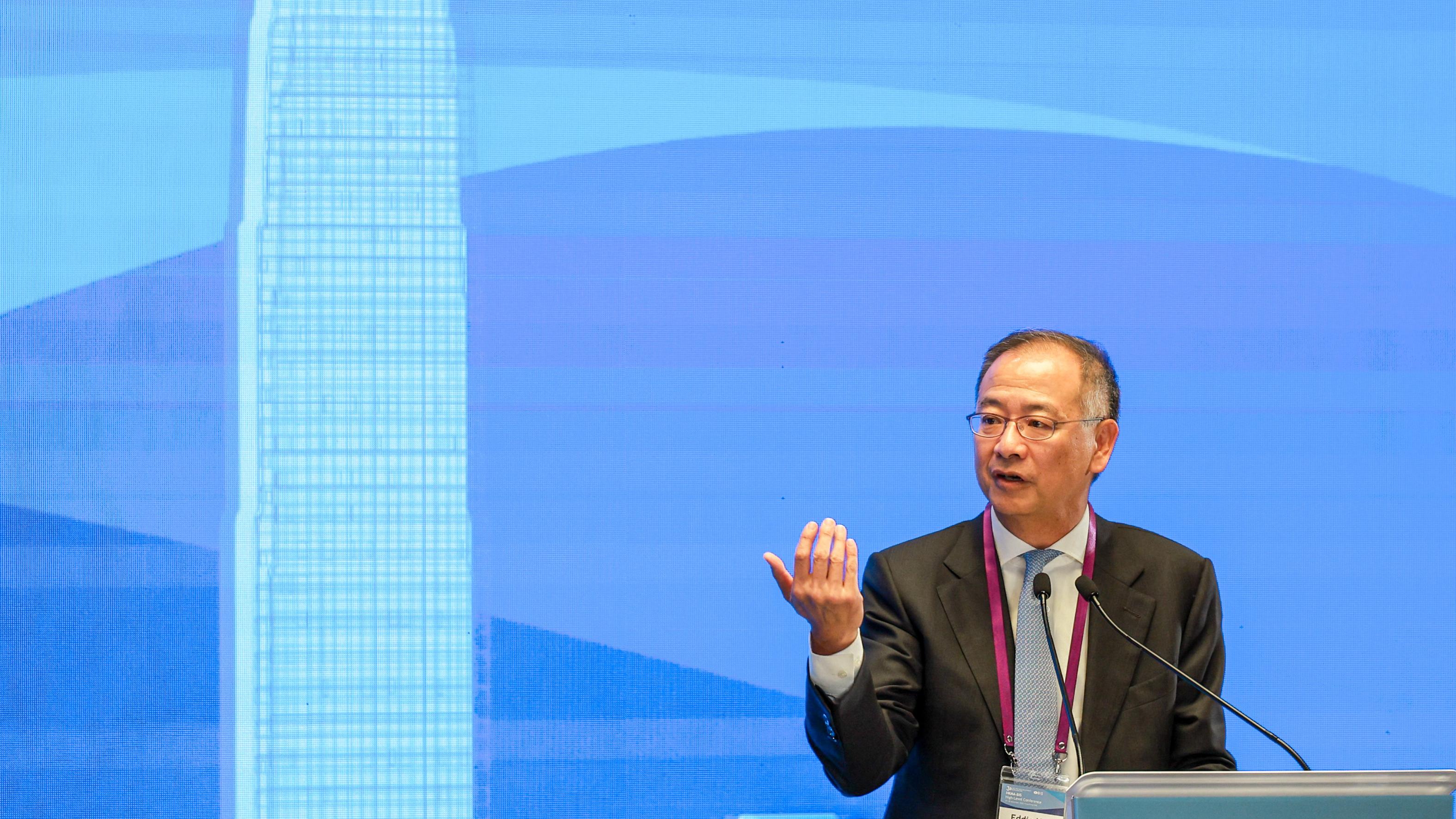

Chief Executive of Hong Kong Monetary Authority Eddie Yue Wai-man delivers his welcoming remarks during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Chief Executive of Hong Kong Monetary Authority Eddie Yue Wai-man delivers his welcoming remarks during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Hong Kong Monetary Authority Chief Executive Eddie Yue Wai-man noted that the increasing utilization of financial innovation and the transition toward a climate-friendly economy, among other factors, present substantial challenges.

“As we envision the path forward, it is crucial to understand the importance of reflecting on the past to guide our future actions,” he said.

“The Bank for International Settlements plays a special role in terms of enabling and facilitating policy dialogue and cooperation among central banks,” Yue added.

Financial Secretary Paul Chan delivers his keynote remarks during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Financial Secretary Paul Chan delivers his keynote remarks during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Financial Secretary Paul Chan Mo-po said the Hong Kong Special Administrative Region can play a vital role in fostering international collaboration amid the mounting pressures of global decoupling and economic imbalance.

He warned that the fragmentation of international financial markets could lead to increased costs, reduced liquidity, and a weakened global financial system.

“Such economic divisions could also potentially increase tensions and conflicts among regions. All these elements will potentially bring more sustained, inflationary pressures,” Chan noted.

As an international financial hub, Hong Kong can utilize its regulatory regime — which has proven robust from the Asian financial crisis in the late 1990s to the global financial crisis in 2008 — to “actively foster collaboration”, he said.

“Fortunately, a full-blown decoupling now seems less likely to happen, given the temporary easing in geopolitical tensions and a highly interconnected nature of the global economy and financial system,” Chan said.

“Many economies, such as those in the Middle East and Europe, are diversifying their investments and strengthening their connections with economies in Asia,” he noted.

Chan also highlighted that the longstanding collaboration between Hong Kong and the Bank for International Settlements underscores a shared commitment to fostering international cooperation and ensuring global financial system stability.

General Manager of Bank for International Settlements Agustín Carstens delivers a keynote remarks during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

General Manager of Bank for International Settlements Agustín Carstens delivers a keynote remarks during the Hong Kong Monetary Authority High-Level Conference on Nov 28, 2023. (ANDY CHONG / CHINA DAILY)

Agustin Carstens, general manager of the Bank for International Settlements, said he believes that Asia’s core advantages stem from its past experience in dealing with financial crises amid slowing economic growth, an aging population structure, and climate change.

Hailing Asia’s robust and resilient policy framework, established after the Asian financial crisis, Carstens said these policies ensure financial stability, and they have also proven beneficial in managing high inflation environments following the pandemic.

Over the past quarter-century, Asia has seen an average economic growth rate of 5.5 percent, accounting for two-thirds of global economic growth during the period. Asia’s share of the global economy has risen from 30 percent in 1998 to over 45 percent today, he noted.

Among the world’s five largest economies, three are in Asia: China, Japan, and India. Asia’s per capita GDP has also surged from less than $4,000 in 1998 to $18,000, he said.

The two-day event, which kicked off on Monday, drew over 300 participants, including central bank governors, CEOs of financial institutions, and pundits from Hong Kong and other parts of Asia.

It is the first major event in Hong Kong to bring together central bank governors from various nations since the pandemic.

The event commemorates the 30th anniversary of the HKMA and the 25th anniversary of the BIS Representative Office for Asia and the Pacific.

Pan Gongsheng, governor of the People’s Bank of China, and Norman Chan Tak-lam, senior adviser of the Hong Kong Academy of Finance and former chief executive of the Hong Kong Monetary Authority, also attended the conference.

Contact the writer at tianyuanzhang@chinadailyhk.com