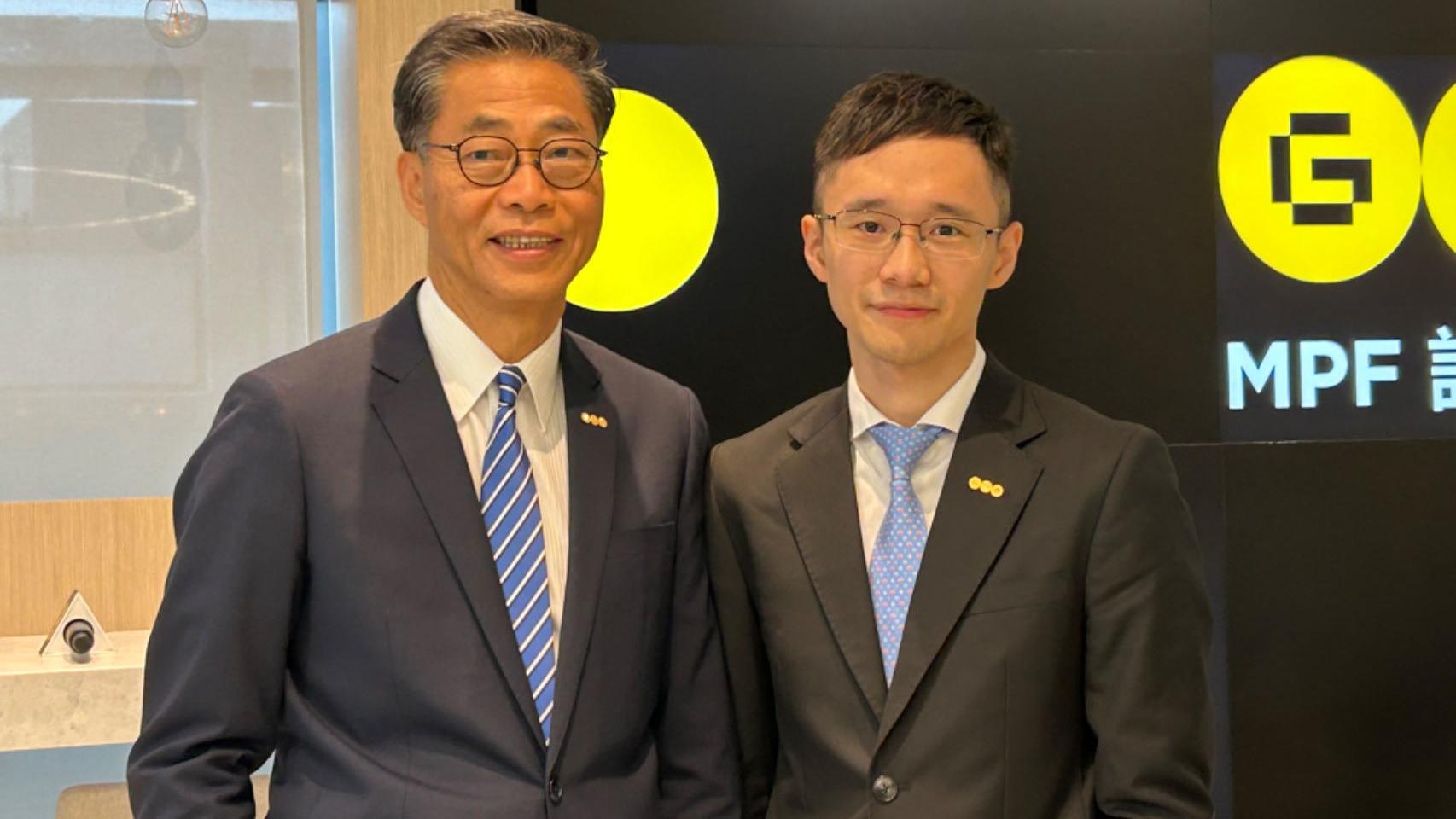

Michael Chan (left), managing director of GUM, and Martin Wan, investment and strategic analyst of GUM, review the performance of the Mandatory Provident Fund in 2023 and provide their outlook for 2024 on Jan 5. (LI XIAOYUN/ CHINA DAILY)

Michael Chan (left), managing director of GUM, and Martin Wan, investment and strategic analyst of GUM, review the performance of the Mandatory Provident Fund in 2023 and provide their outlook for 2024 on Jan 5. (LI XIAOYUN/ CHINA DAILY)

The Mandatory Provident Fund (MPF) recorded a return rate of 3.5 percent in 2023, marking a turnaround after two consecutive years of negative returns. On average, each member pocketed HK$8,171 ($1,046), according to a report released by consulting firm GUM on Friday.

The company predicted that the compulsory pension fund program will continue to deliver such single-digit returns in 2024, hovering between 3 percent and 4 percent.

Over the past year, the US stock market continued its strong performance with a return of 27.9 percent, while the performances of the Chinese mainland and Hong Kong markets fell below expectations, recording losses ranging between 10 percent and 15 percent

The provisional figures released by the Mandatory Provident Fund Scheme Authority on Thursday indicate that total MPF assets amounted to around HK$1.14 trillion as of year-end 2023. Among all six MPF fund types, equity funds exhibited the poorest performance, registering a modest return rate of 0.8 percent. Mixed assets funds outperformed the other five types with a return rate of 7.2 percent.

READ MORE: MPF members lose HK$11,400 on average in August

Over the past year, the US stock market continued its strong performance with a return of 27.9 percent, while the performances of the Chinese mainland and Hong Kong markets fell below expectations, recording losses ranging between 10 percent and 15 percent. This resulted in a divergence of 43.4 percent in investment returns between these two markets, GUM said.

Michael Chan, managing director of GUM, predicted that due to geopolitical tensions and dampened consumer sentiment, “it could be challenging for the Hang Seng Index – a benchmark of the Hong Kong stock market – to reach 20,000 points in 2024, but there’s a greater chance to rise to around 18,000 points”.

As of November 2023, MPF members had transferred HK$11.8 billion of their investment into equity funds, with around HK$11 billion of that being from fixed income funds and the remaining HK$800 million being from mixed asset funds.

“This investment pattern reflects a more aggressive stance adopted by the members in 2023, as they opted to redirect their capital towards equity funds, particularly in the United States, Europe, and Japan,” GUM’s report read.

Looking into 2024, Chan said, “high-risk investors may consider allocating some assets to US and European equity funds in the short term, as inflation data in Europe aligns with market expectations, and the European economy is expected to gradually recover in 2024. In the United States, inflation is under control, and the economy is expected to have a soft landing. Market expectations suggest that the Federal Reserve may consider an early interest rate cut.”

“The stock prices and valuations in the mainland and Hong Kong markets are currently at low levels, which offers potential returns to investors, but patience will be required to wait for a rebound,” Chan added.

READ MORE: MPF members in HK lose $995 on an average in August

For low-risk investors, Martin Wan, investment and strategic analyst of GUM, said, “They can continue to prioritize conservative funds as their primary asset allocation, as the United States is entering a rate-cutting cycle in 2024, which bodes well for bond funds.”