Goal unchanged at ‘around 5 percent’ amid ‘more proactive’ fiscal policy

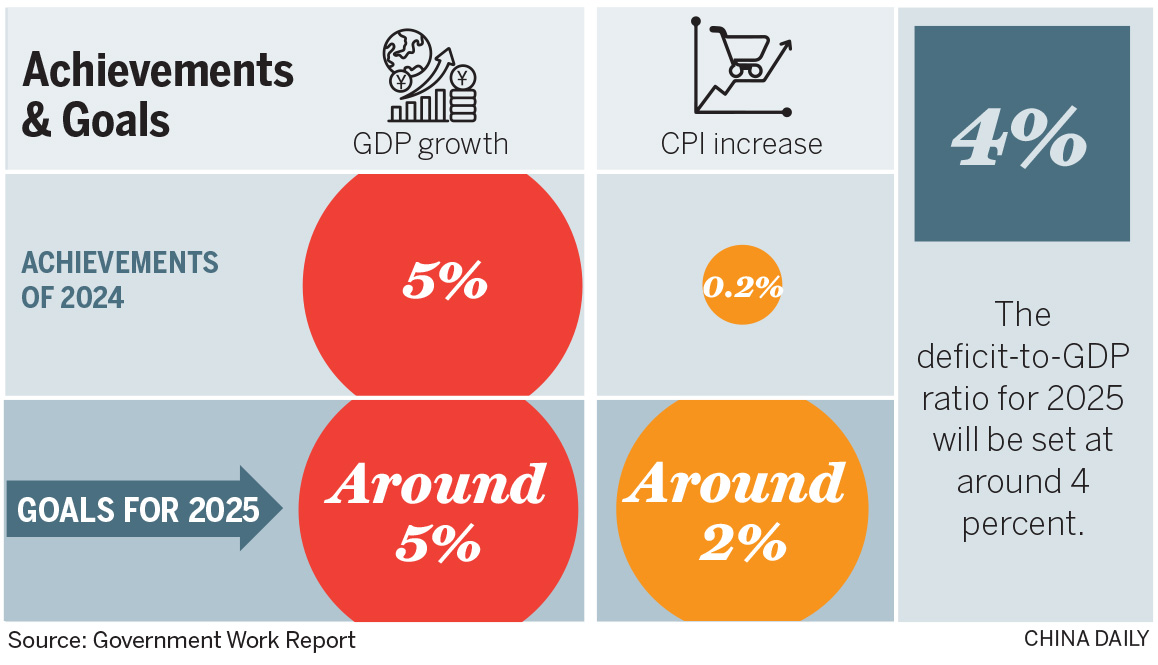

China is keeping the GDP growth target for 2025 unchanged at “around 5 percent”, the latest Government Work Report said on March 5, while launching significant steps unseen for more than a decade to broadly invigorate domestic demand amid an increasingly complex and severe external environment.

Economists and executives said the target, at around 5 percent for the third consecutive year, showcased the government’s strategic priority on maintaining a steady growth trajectory despite challenges and implied a multiyear shift toward emphasizing consumption and people’s living standards in macroeconomic policy adjustments.

Premier Li Qiang, who delivered the report at the opening meeting of the third session of the 14th National People’s Congress in Beijing, said that the annual economic growth target of around 5 percent is well aligned with the country’s mid- and long-term development goals and underscores the resolve to meet difficulties head-on and strive hard to deliver.

After adopting a “proactive” fiscal policy for 16 consecutive years, this year’s work report, which has been submitted to the country’s top legislature for deliberation, shifted to pledge a “more proactive fiscal policy”.

The report set the annual projected fiscal deficit-to-GDP ratio at around 4 percent, up from 3 percent last year and the highest since the record started in 2010, according to the financial data provider Wind Information.

Liu Jing, chief China economist at HSBC Global Research, said that the target aims to anchor market expectations and has instilled a stronger resolve to bolster domestic demand, with fiscal policy taking the lead.

The report said China will also issue 1.3 trillion yuan ($179 billion) in ultra-long-term special treasury bonds this year, up from 1 trillion yuan for 2024, and issue special local government bonds worth 4.4 trillion yuan, compared with 3.9 trillion yuan last year.

Additionally, 500 billion yuan of special treasury bonds will be issued to support large State-owned commercial banks’ replenishing of capital.

The report said this year’s new government debt will total 11.86 trillion yuan, 2.9 trillion yuan more than last year, a notably higher level of spending.

“The strength of fiscal policy has increased considerably, reflecting a significant change in fiscal philosophy,” said Luo Zhiheng, chief economist at Yuekai Securities.

Wang Qing, chief macroeconomic analyst at Golden Credit Rating International, said, assuming a fiscal multiplier of 1, the rise in the deficit-to-GDP ratio alone is estimated to contribute approximately 1.2 percentage points to GDP growth, serving as a key buffer to a slowdown in external demand. A fiscal multiplier is a ratio showing the effect that changes in fiscal policy will have on a nation’s economic output, or GDP.

On the monetary front, the work report said the country will pursue a moderately loose monetary policy for the first time in over a decade, after adhering to a “prudent” monetary stance from 2011 to 2024.

The report said the country will make timely cuts to the reserve requirement ratio and interest rates, pledging to refine and develop new structural monetary policy instruments to strengthen support for the sound development of the real estate sector and the stock market.

Chen Changsheng, a member of the report drafting group and deputy director of the Research Office of the State Council, said the report places significance on boosting consumption and improving people’s living standards.

For instance, the report called for macroeconomic policies to be “people-oriented”, vowing to provide child care subsidies, increase the minimum basic old-age benefits for rural and nonworking urban residents by 20 yuan per month, and allocating 300 billion yuan of ultralong-term special treasury bonds to consumer goods trade-in programs.

Janice Hu, China country head at UBS AG and chairperson of UBS Securities, said, “These much-anticipated measures could gradually help underpin household confidence and unleash consumption potential in the long run.”

The report outlines steps to introduce city-specific policies on adjusting or reducing property transaction restrictions and to strengthen strategic resource reserves and market stabilization mechanisms in the capital market.

In the report, China sets a consumer price index growth target of around 2 percent, marking the first inflation target below 3 percent in two decades.

Contact the writers at zhoulanxv@chinadaily.com.cn