HONG KONG - Full Truck Alliance (FTA), the Chinese mainland's "Uber for trucks", could revisit plans for a second listing in the Hong Kong Special Administrative Region in the wake of a rebound in investor sentiment and an escalation in geopolitical tensions, a company executive said.

The company, also known as Manbang in the mainland, had initially planned a dual primary listing in Hong Kong in 2022 but later scrapped the plan.

"Regarding a (second) listing in Hong Kong, whether it was then or now, the most important consideration for us has always been to hedge against US risks," said Chief Financial Officer Simon Cai.

"This is our primary objective. Beyond this, if there are any additional benefits, such as improvements in valuation and liquidity, these would be bonus points," Cai told Reuters in an interview.

ALSO READ: Truck app company's NYSE IPO makes a big splash

FTA, backed by big-name investors including SoftBank's Vision Fund and Tencent Holding, went public in New York in 2021 and is among the few US-listed mainland companies that have not yet pursued a second listing in the Asian financial hub.

Stock prices of mainland tech firms listed in the SAR have rallied in recent months, boosting their liquidity and valuation, as investors' appetite for tech stocks has been whetted by hopes of Beijing's support for private firms and optimism about the mainland's artificial intelligence sector.

The Hang Seng Tech Index has risen over 30 percent so far this year.

"Against this broader backdrop, we will actively re-examine and consider a listing in Hong Kong again. However, no specific plans have been decided yet," Cai added.

ALSO READ: HK's stock market sees daily average turnover exceed HK$200b in 2025

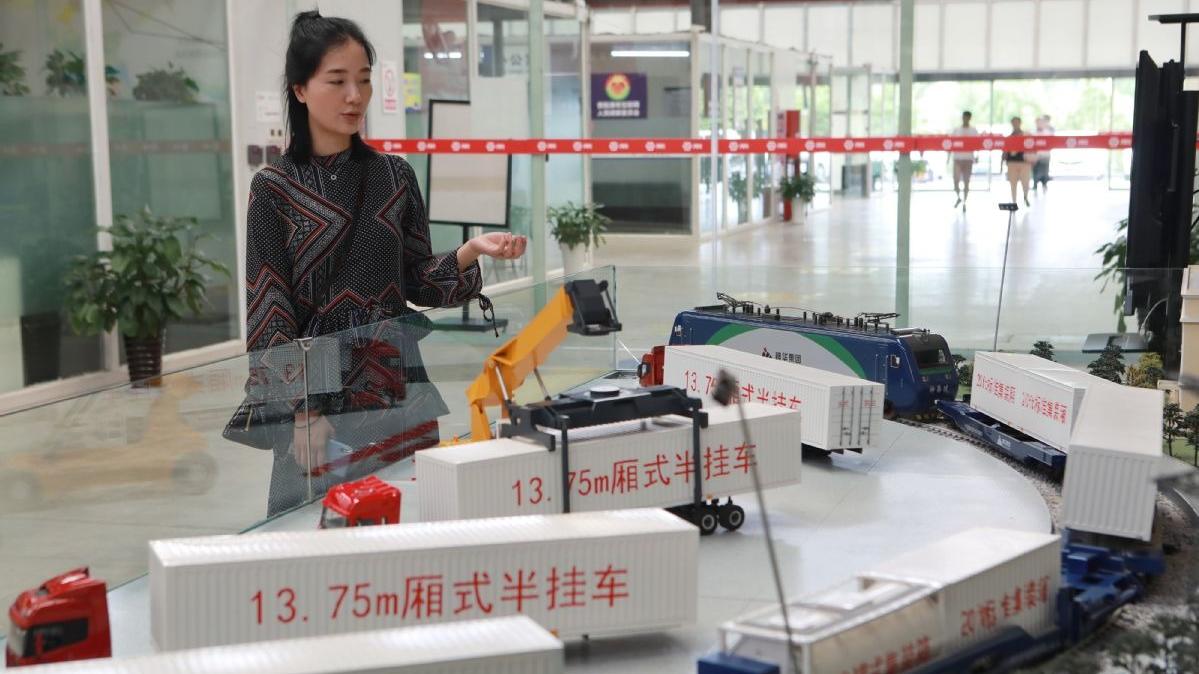

Formed in 2017 out of a merger between two digital freight platforms Yunmanman and Huochebang, FTA runs a mobile app that connects truck drivers with people who need to ship items within the mainland. The company reported nearly 200 million fulfilled orders on its platform in 2024, a 24 percent year-on-year increase.

FTA on Wednesday posted strong earnings for 2024, with annual total revenue rising by 33 percent year-on-year to 11.2 billion yuan ($1.55 billion) and net income up by 40 percent to 3.1 billion yuan. The growth was primarily driven by increasing digital adoption, penetration rate and order volume.

Cai expects another strong performance for the company in 2025, tipping record revenue of over 12 billion yuan with an order growth of 15 percent-20 percent.

"We've clearly observed significant capital inflows (into FTA) over the past quarter," Cai said, noting that major investors such as Norway's Norges Bank Investment Management, BlackRock and Fidelity have increased positions in the company in recent months.

READ MORE: China's 'Uber' for trucks looking to boost focus on big data technologies

FTA is boosting its investment in AI and plans to deploy a nationwide AI-led system to increase the order fulfillment rate by the end of the year, Cai said.

In 2023, FTA spun off its cold chain business, which is close to finalizing its latest fundraising round, raising about 200 million yuan at a post-investment valuation of over 30 billion yuan, Cai said.

The unit which yielded over 100 million yuan in net profit last year plans to expand and potentially go public either in Hong Kong or the mainland, he added.

"Small-cap stocks don't get much attention in Hong Kong. We would prefer a market cap of at least $1 billion or even bigger at the time of its listing," Cai said. He estimated the earliest the unit could go public would be in 2026 or 2027.