Chinese EV brands make major inroads into Australia as consumers seek out high-quality and cost-effective new energy vehicles amid Canberra’s green transition push

Chinese electric vehicle (EV) manufacturers are gearing up for accelerated growth in the Australian market, as Canberra ramps up regulatory measures to smooth the country’s transition to greener transportation.

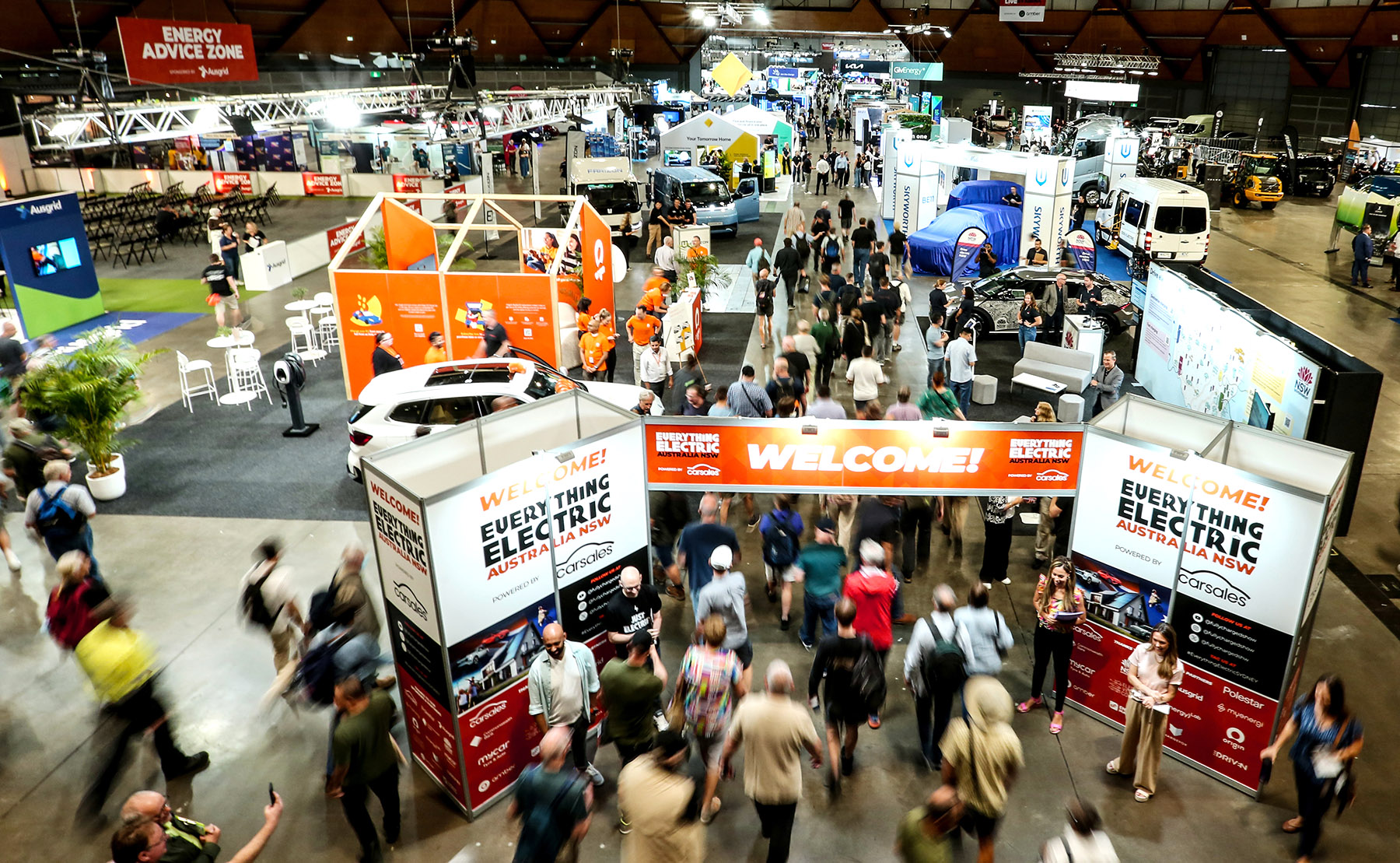

At the recent Everything Electric show in Sydney, which ran for three days starting on March 7, Chinese EV makers took center stage among the diverse range of items on display.

Ian Wilcox, a property valuer from Newcastle in New South Wales state, checked out one of the latest EV offerings on display from Chinese auto giant BYD, saying the vehicle was way ahead of its foreign competitors in many aspects.

“We already have a BYD … We’re really impressed with it, and we’ve taken some long journeys in it,” Wilcox said.

He said his current BYD electric vehicle has many features that are better than those of its non-Chinese competitors, including a long battery range that enables him and his family to use it on camping trips. “It’s amazing, the BYD is probably our favorite vehicle these days,” he said.

In 2024, the Australian government passed legislation to introduce a new vehicle efficiency standard to regulate the carbon dioxide emissions of new passenger and light commercial vehicles. The law took effect on Jan 1 this year.

The legislation has the stated dual aims of giving consumers more choices of low-emission vehicles and reducing Australia’s carbon emissions and reliance on the volatile global oil market.

Australia’s Electric Vehicle Council, the peak national body representing the EV industry, said in its 2024 report that to meet its climate targets, the country will need over 50 percent of all new car sales to be EVs by 2030.

Dan Caesar, head of the team behind the Everything Electric show, said rapid developments in technology and expertise are fueling the strong trend toward EVs, with Australian consumers’ interest in the vehicles high.

The range of EVs for sale in Australia is now “exceptional” and some models were being seen at the show for the first time. “Choice reduces costs, and China is obviously creating some of that competition … which can only be good for the consumer,” he said.

This year’s show, billed as a top industry event in the Southern Hemisphere, hosted at least 36 major exhibitors including global EV brands from China.

“Chinese-made EVs are rapidly gaining popularity in Australia, with BYD leading the charge as one of the most popular brands,” said Julie Delvecchio, CEO of the Electric Vehicle Council, or EVC.

“Other Chinese EV manufacturers including Zeekr and Geely are also emerging in the Australian market. What draws Australians to Chinese-made EVs is their affordable price points, modern features, and diverse range of models. These factors are driving healthy competition in the Australian market, making Chinese EVs an increasingly appealing choice for a wide variety of consumers,” she said.

More than 300,000 Australians are driving EVs and nearly one in 10 new cars sold in Australia are now EVs, said Delvecchio.

A total of 1.22 million new vehicle sales were recorded last year in Australia, with a rising number of motorists turning to greener choices like plug-in hybrid models, according to industry figures.

At the Sydney show, Chinese EV manufacturers expressed optimism about the Australian market. David Smitherman, CEO of Chinese auto giant BYD’s Australian distributor EVDirect, said there is “massive potential for growth”.

“Last year we sold 20,000 vehicles. This year our expectations are more than double that number,” he said.

“There’s a lot of work to be done, but with BYD’s superior technology and performance, we’re in a really good position to grow the brand here in Australia.

“Australians are very tech-savvy. We’re opening up greater choice to Australians which they are really quickly adopting,” he added.

Among the Top 10 bestselling EVs in Australia in February were Chinese vehicles including SAIC MG’s MG4, BYD’s Sealion 7 and Atto 3 along with the luxury crossover Zeekr X, a new entrant to the Australian market, according to The Driven, a leading industry news site.

Delvecchio said consumers are seeing a wider range of EVs at more affordable prices entering the Australian market, making electric vehicles a great option for everyone — from families, to trade workers such as electricians and plumbers, and to car enthusiasts.

It is estimated that battery electric vehicles can save drivers up to A$3,000 ($1,890) every year on fuel and maintenance costs — important savings for Australians currently experiencing high cost-of-living pressure, she said.

“Electric vehicles are already offering so many benefits to Australians, but there is still so much more potential. Key opportunities include the development of vehicle-to-grid, growing the used EV market, and advancing the battery recycling industry,” she said.

Hans Hendrischke, a professor of Chinese business and management at the University of Sydney’s Business School, said Australia has been more welcoming than many other countries in the EV sector.

“Australia hasn’t considered imposing any tariffs on the Chinese vehicles … because we don’t have a vehicle industry here ourselves,” he said.

He added that there is no special financial support for Chinese EVs, which compete “increasingly well” against other brands.

Hendrischke is a member of the Net Zero Institute, which supports decarbonization solutions to help the world meet its climate change goal of net-zero carbon emissions by 2050. The institute has more than 150 university researchers and industry collaborators across a range of disciplines.

“The Chinese EV market is certainly moving into markets like Australia,” Hendrischke said. “I think it (the market) hasn’t had the full impact yet; this is just starting. The Chinese have much better cars than they had in the beginning, with the EV market already very developed in China.”

Jason Clarke is the CEO of TrueEV, a company specializing in EV distribution and services that has formed a strategic partnership with leading Chinese EV manufacturer, Xpeng.

He cited Xpeng’s “smart” EVs as a big plus due to the Chinese startup’s appeal to consumers.

Xpeng’s vehicles have been available in Australia for a year, and already “people are really warming to the brand and feeling very connected with it”, Clarke said at the Sydney show.

The startup promotes itself as a technology company focused on artificial intelligence and the possibilities of how good future travel and transport mobility can be, Clarke noted.

Many Australian car buyers had initial concerns about the quality of Chinese imports, but quickly changed their minds when they saw the models on offer, he said.

“Literally thousands of people have now sat in these (EVs) and they’re quite surprised by the quality, refinement and the comfort as well as how desirable they are,” he said.

For Zeekr, another popular Chinese EV manufacturer, innovation is one of its key attractions for potential buyers.

William Zhou, Zeekr’s general manager for Australia and New Zealand, said the company is very confident about the prospects for its vehicles, not just in Australia, but also in other international markets.

“There are huge opportunities for us. On top of the mainstream market, people are also looking for premium EVs with innovation and technology. In terms of battery (range), an intelligent cockpit and charging technology, the network and services … we position ourselves as premium,” Zhou said.

Scott Maynard, managing director in Australia of Polestar, a Sweden-based EV manufacturer, said the company markets itself as a premium brand, and taps considerable Chinese know-how in the sector.

“We’re seeing a groundswell of interest in electric vehicles here. Chinese technology finds its way into so many vehicles operating in Australia, and you’ll see it in these (Polestar) cars too,” Maynard said, adding that the brand does its research and development in Europe and draws heavily on European influence and Scandinavian design.

“But, definitely, the hallmarks of technology founded in China find their way through,” he added.

Gino Casha, head of Segway-Ninebot Australia, said China’s lead in EV tech is reflected in his company’s products, such as e-scooters.

“We’re also moving into e-bikes and related products. The e-motorcycles are far more technologically advanced compared to others,” he said, pointing out their inbuilt global positioning and traction-control features.

Segway-Ninebot recently topped global electric kick-scooter sales with more than 13 million units sold.

“EV technology in China is probably second to none,” Casha said. “In terms of the smart connectivity for all of our products, some of the stuff you see in the electric cars are in these scooters, that’s pretty cool technology in such a small package.”

Many of the automakers at the Sydney event said the infrastructure and network required for the EV sector to cover Australia’s large distances still need to be improved.

“Australia is geographically a large place, similar in size to China, not quite as big but just about. But of course we have a very small population base,” said Smitherman of BYD distributor EVDirect.

Many motorists needing to travel long distances are now overcoming “range anxiety” by first opting for a plug-in hybrid vehicle before transitioning to a fully electric one, he said.

During a panel discussion at the Sydney show, Australia’s Climate Change and Energy Minister Chris Bowen said the transportation sector remains a major challenge in the country’s move toward lower carbon emissions.

“People are driving around more, flying more, that’s a big reason why — as we’re getting emissions down so quickly in electricity and industry — transport is going up, and that’s keeping up the national average,” he said.

“So we have a lot more work to do on transport. We’ve got our new vehicle efficiency standards … that will make a difference, but they’re not yet seeing huge reductions in emissions,” Bowen said.

However, he said a real impact is already being seen in the expansion of the EV sector, as evidenced by the Sydney show. “In the last three years, the range of EVs has tripled. The choice of models has tripled,” he said.

Delvecchio from the EVC said while Australia has made progress in embracing electric vehicles, there is still a long road ahead.

“We are pleased that the new vehicle efficiency standard has been introduced to further improve choice and affordability — a policy we’ve been advocating for years.

“However, there are still a range of challenges Australia must overcome including building more charging infrastructure, harmonizing and reforming regulations, countering misinformation and introducing more purchase incentives to accelerate the transition,” she said.

Professor Hendrischke, from the University of Sydney’s Business School, said Australia should look at the possible long-term benefits of China’s EV industry as well as cooperation in other energy areas.

“What of course would be a potential consideration over the long term is when China starts to have more smaller-scale production units — high-tech, but smaller scale — there would be all kinds of good reasons to set up car manufacturers in smaller markets like Australia,” he said.

While Chinese automakers are now introducing electric vehicles to the Australian market, there are other aspects of broader energy cooperation that both sides could benefit from.

“There is certainly big potential for future cooperation. But it goes beyond electric vehicles,” Hendrischke said.

“It goes to smart energy, to clean energy, where Australia could, with Chinese partners, build up energy cooperation or manufacturing. These are the next few steps the business community is looking at, and is interested in.”

Contact the writers at xinxin@chinadaily.com.cn