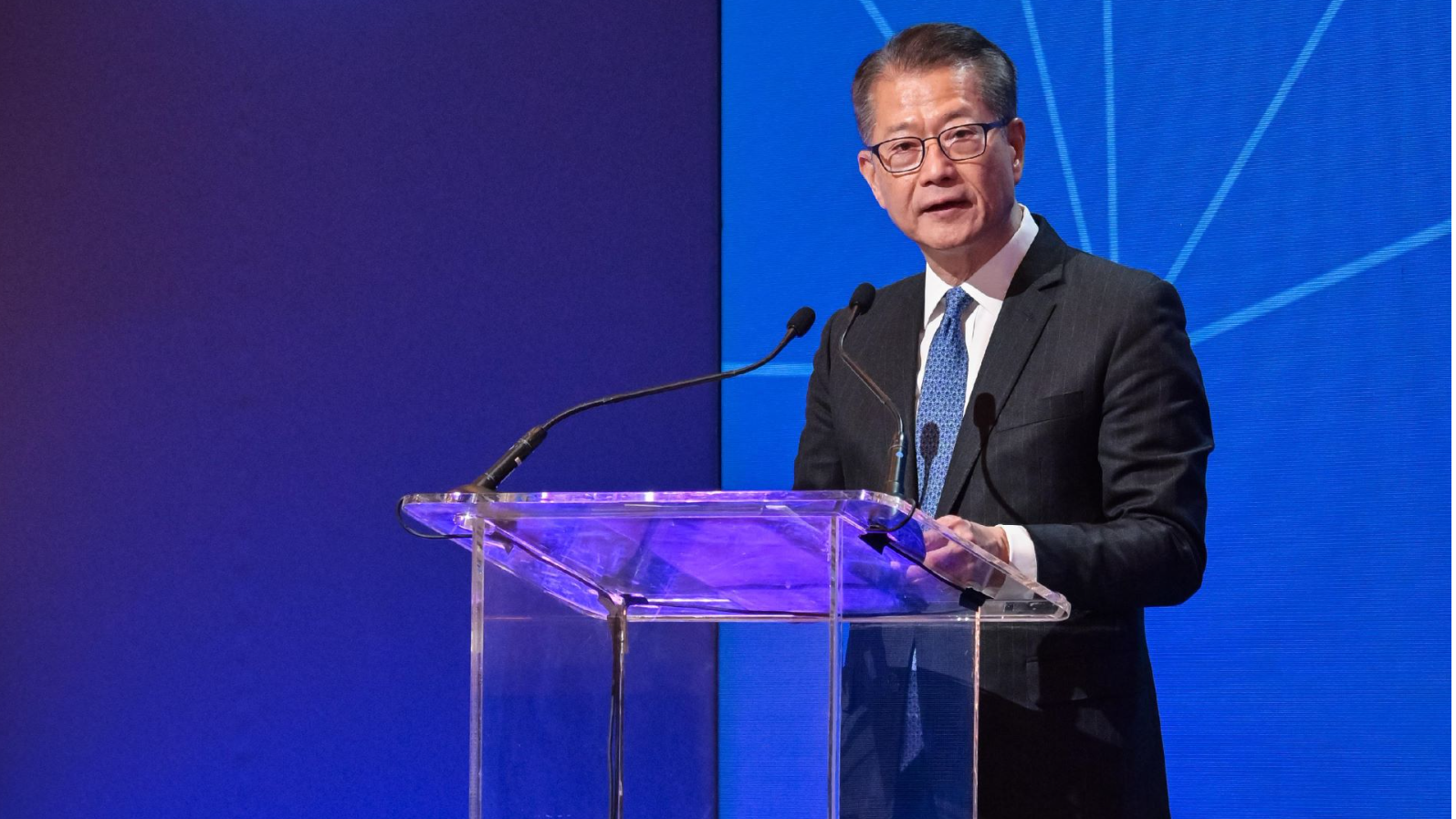

With over 400 senior executives worldwide from various fields attending the Milken Institute Global Investors’ Symposium in Hong Kong on Monday, Financial Secretary Paul Chan Mo-po said that Hong Kong can be a catalyst for global economic cooperation.

“Hong Kong remains one of the world’s most open, dynamic and globally connected financial centers,” said Chan, as the city serves as a gateway to the Chinese mainland and Asia, and strives to develop financial services and the tech sector, continuing to provide opportunities for global investors.

The Global Financial Centres Index, published in March and jointly compiled by Shenzhen-based think tank China Development Institute and London-based think tank Z/Yen, ranked Hong Kong at third place in the world again and first in the Asia-Pacific region.

ALSO READ: HK maintains third place in global financial center rankings

Oliver Weisberg, CEO of Blue Pool Capital, a firm involved in managing the assets of Alibaba Group Holding chairman Joe Tsai, agreed with that assessment, saying that he’d seen an increase in foreign investors visiting Hong Kong, including private equity, hedge funds and long-only managers. “This is the core to bringing Hong Kong to the place it should be.”

“Hong Kong offers a full range of funding options, from angel investment to private equity to IPOs. We continue to review our listing regime, enhance product offerings and attract more quality issuers and new capital,” Chan said.

ALSO READ: Hong Kong hailed as world’s freest economy once again

“As China actively enhances the momentum of its external trade, Hong Kong will continue to consolidate its relations with traditional markets such as Europe and the United States, and make every effort to explore new markets, while also mobilizing more mainland provinces and cities to jointly go overseas to attract investment,” Chan said at the China Development Forum 2025 in Beijing on Sunday.

Chan added that collaboration between Hong Kong and new markets extends well beyond finance. “Hong Kong’s ambitions for innovation and technology are more hopeful thanks to deepening collaboration with our sister cities in the Guangzhou-Hong Kong-Macao Greater Bay Area.”

READ MORE: HK simplifies entry for invited ASEAN visitors

Goodwin Gaw, the chairman of Gaw Capital Partners who also participated in the Milken Institute Global Investors’ Symposium, said he believes that integration into the Greater Bay Area will benefit Hong Kong eventually.

“Blood swapping”, he said, refers to increased labor mobility among the finance, tech and manufacturing hubs, and estimates that the region will develop into “one big whole economy.”