Mainland banks listed in the Hong Kong Special Administrative Region are expected to post steady net profit performance this year, thanks to easing financial conditions on the Chinese mainland and their prudent credit loan policies, financial analysts have noted.

Major mainland banks delivered their annual results this week. State-owned Bank of China’s net profit gained 2.6 percent year-on-year in 2024, which is better than expected, while China Merchants Bank, the country’s first joint-stock commercial bank wholly owned by corporate legal entities on the mainland, recorded its net profit as having increased 1.2 percent annually in the same period.

Postal Savings Bank of China Co’s net profit edged up a meager 0.2 percent, and Agricultural Bank of China’s net profit hiked 4.7 percent year-on-year in the same period.

ALSO READ: BOCHK to declare quarterly dividends starting this year

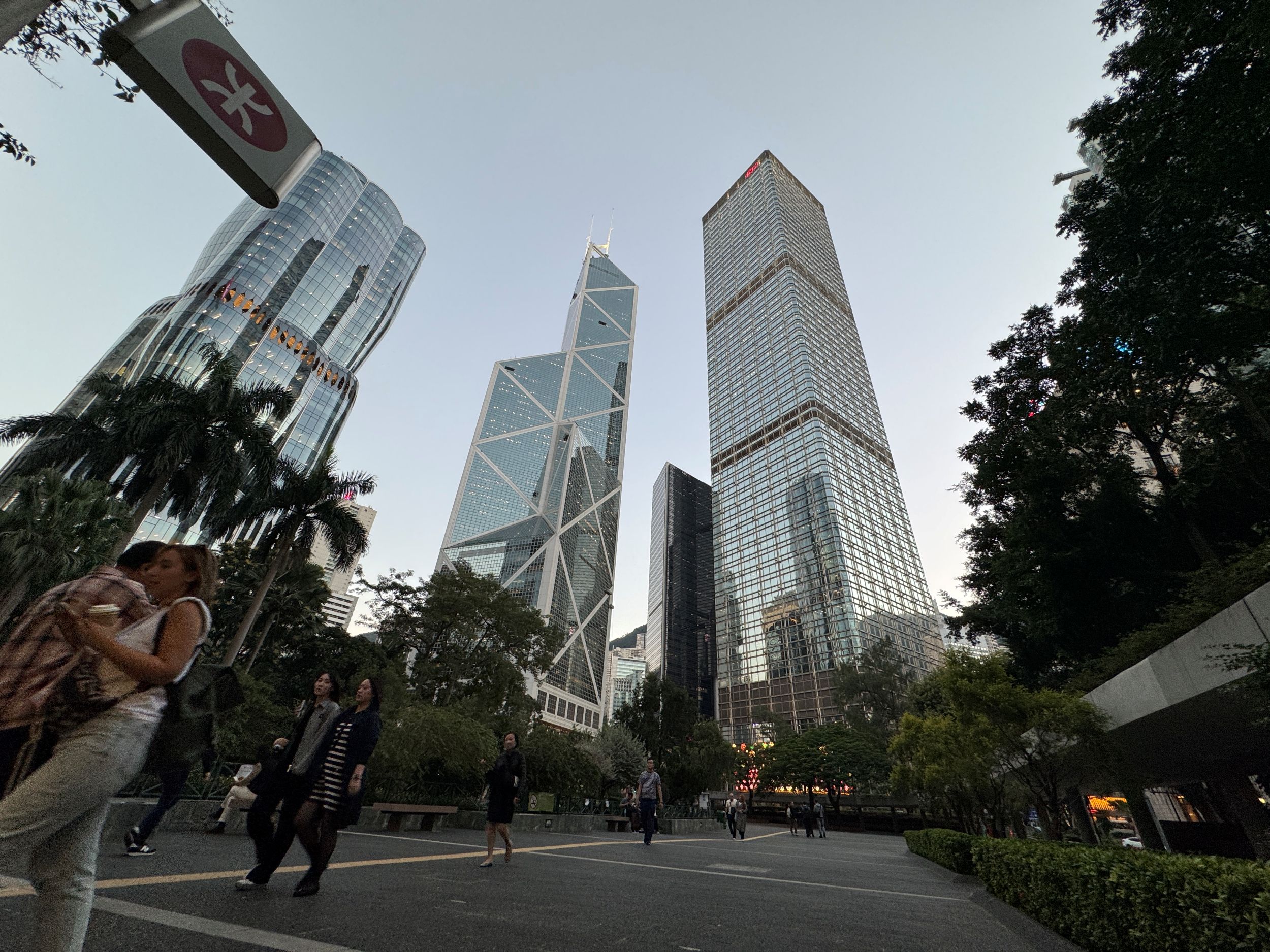

BOC Hong Kong (Holdings), a subsidiary of Bank of China, reported that its net profit has soared 16.8 percent annually and has proposed to declare dividends on a quarterly basis starting this year.

S&P Global Ratings said the proposed capital injections from the central government would boost the fund availability to the mainland’s megabanks, and enhance the megabanks’ loss absorption buffer amid profitability strains.

The six mainland megabanks are Industrial and Commercial Bank of China, China Construction Bank Co, Bank of China, Agricultural Bank of China, Postal Savings Bank of China Co, and Bank of Communications Co.

"The injection will enhance the megabanks’ capital position to fund loan expansion. It will help mitigate the pressure from weakening internal capital generation and give the banks more flexibility to grow while maintaining a sufficient capital buffer," said S&P Global Ratings credit analyst Cheng Xi. "This is important amid the mainland’s rate-cut cycle and continued strains on profitability from earnings concessions."

READ MORE: HSBC expects revamp to cost $1.8 billion over two years

At the annual "two sessions" in March, the central government announced plans to issue 500 billion yuan ($69 billion) in special government bonds in 2025 to recapitalize the mainland’s six largest commercial banks as part of the 1 trillion yuan capital injection plan announced in September 2024.

A Moody’s Ratings report said the mainland’s easing financial conditions are supportive to corporate credit. "The mainland’s monetary policy will remain moderately loose in 2025, as the government seeks to lower funding cost and support liquidity. Corporate loans will remain the key driver of loan growth."

But the US-based credit agency warned that lower rates will continue to put pressure on banks’ net interest margins (NIM) because of lower asset yields, though the NIM contraction will narrow as reduced deposit costs partially mitigate the impact.

ALSO READ: CATL's Hong Kong listing approved, sources say it could raise at least $5 billion

Regarding the Hong Kong operations of mainland banks, S&P Global Ratings said that BOCHK, along with the two other largest banks in Hong Kong — Hongkong and Shanghai Banking Co (including Hang Seng Bank) and Standard Chartered Bank (Hong Kong) — have manageable exposure to major developers and landlords.

The credit agency said Hong Kong banks’ profits and asset quality face further pressure from their exposure to commercial real estate but they have a number of defenses, including solid profitability and strong capital levels, to manage higher property-related non-performing loans and maintain resilient credit profiles.

"Hong Kong banks, particularly the largest ones, have diversified loan portfolios, adequate collateral, and reasonable underwriting standards," said S&P Global Ratings credit analyst Ryan Tsang.