BEIJING - China's State Council Information Office on Wednesday released a white paper titled "China's Position on Some Issues Concerning China-US Economic and Trade Relations".

China’s Position on Some Issues Concerning China-US Economic and Trade Relations

The State Council Information Office of the People’s Republic of China

April 2025

Contents

Preface

I. China-US Economic and Trade Relations Are Mutually Beneficial and Win-Win in Nature

II. The Chinese Side Has Scrupulously Honored the Phase One Economic and Trade Agreement

III. The US Side Has Failed to Meet Its Obligations Under the Phase One Economic and Trade Agreement

IV. China Upholds the Principle of Free Trade and Strictly Complies with WTO Rules

V. Unilateralism and Protectionism Undermine China-US Economic and Trade Relations

VI. China and the US Can Resolve Differences in Economic and Trade Areas Through Equal-Footed Dialogue and Mutually Beneficial Cooperation

Conclusion

Preface

As the world’s largest developing country, China is also the largest contributor to annual global economic growth. As the largest developed country, the United States boasts the largest economy in the world. The China-US economic and trade relations hold profound significance for both countries and exert a substantial influence on global stability and development.

Over the 46 years since the establishment of diplomatic relations between China and the US, bilateral trade and economic ties have developed steadily. The volume of trade between the two countries has surged from less than US$2.5 billion in 1979 to nearly US$688.3 billion in 2024. The China-US economic and trade cooperation has continued to expand and improve, making significant contribution to the economic and social development, and wellbeing of the peoples of both countries.

However, in recent years, the rise of unilateralism and protectionism in the US has significantly impeded the course of normal economic and trade cooperation between the two countries. Since the beginning of trade friction between China and the US in 2018, the US side has imposed tariffs on Chinese exports worth more than US$500 billion. Furthermore, it has continuously implemented policies aimed at containing and suppressing China. The Chinese side has to take forceful countermeasures to defend its national interests. At the same time, committed to resolving disputes through dialogue and consultation, the Chinese side has engaged in multiple rounds of economic and trade consultations with the US side to stabilize bilateral economic and trade relations.

On January 15, 2020, China and the US signed the Economic and Trade Agreement Between the Government of the People’s Republic of China and the Government of the United States of America (also known as the Phase One Economic and Trade Agreement). Following its entry into force, the Chinese side upheld the spirit of contract and endeavored to overcome multiple adverse factors, including the unexpected impact of the pandemic, subsequent supply chain disruptions, and global economic recession, to ensure implementation of the Agreement. The US side issued several statements affirming the effectiveness of the Chinese side’s efforts. In contrast, the US side has continuously tightened export control, escalated sanctions against Chinese enterprises, and repeatedly violated its obligations under the Agreement.

Recently, the US side issued the America First Trade Policy Memorandum, the America First Investment Policy Memorandum and the Report on the America First Trade Policy Executive Summary, imposed comprehensive additional tariffs on Chinese products, including tariffs citing the fentanyl issue as the pretext, announced “reciprocal tariffs”, levied an additional 50 percent on existing tariffs, and proposed Section 301 investigation restrictions, such as charging port fees, targeting China’s maritime, logistics, and shipbuilding industries. These restrictive measures have escalated the problem, and again reveal the isolationist and coercive nature of US conduct. They are in conflict with the principles of the market economy, run counter to multilateralism, and will have serious repercussions for China-US economic and trade relations. In accordance with the fundamental principles of international law and relevant laws and regulations, the Chinese side has taken necessary countermeasures.

The US imposition of tariffs and other restrictive trade measures on its trading partners has artificially disrupted established global supply and industrial chains, undermined market-oriented free trade rules, severely hindered the economic development of various countries, harmed the wellbeing of both the American people and those of other countries, and negatively impacted economic globalization.

The Chinese side has always maintained that China-US economic and trade relations are mutually beneficial and win-win in nature. As two major countries at different stages of development with distinct economic systems, it is natural for China and the US to have differences and frictions in their economic and trade cooperation. It is crucial to respect each other’s core interests and major concerns, and find proper solutions to resolve the issues through dialogue and consultation.

The Chinese government is issuing this white paper to clarify the facts about China-US economic and trade relations, and elaborate the position of the Chinese side on relevant issues.

I. China-US Economic and Trade Relations Are Mutually Beneficial and Win-Win in Nature

Since the establishment of diplomatic relations between China and the US, the two sides have achieved fruitful outcomes in bilateral trade and investment cooperation, realizing complementarity and mutual benefits. China and the US share extensive common interests and vast potential for cooperation. Maintaining the stable development of China-US economic and trade relations is in the fundamental interest of both nations and peoples, which is also conducive to global economic development. The fact shows that cooperation between China and the US benefits both sides, while confrontation harms both. Cooperation is essential to mutual benefits and win-win outcomes.

1. China and the US Are Important Partners of Trade in Goods

China-US two-way trade in goods has grown rapidly. Statistics from the United Nations (UN) show that in 2024, the volume of trade in goods between China and the US reached US$688.28 billion, which was 275 times the volume of the trade in 1979, when diplomatic relations were established between the two countries, and more than eight times the volume of the trade in 2001, when China joined the World Trade Organization (WTO). Currently, the US is China’s largest goods export destination and the second-largest source of imports. In 2024, China’s exports to the US and imports from the US accounted for 14.7 percent and 6.3 percent of China’s total exports and imports for the year. China is the US’s third-largest export destination and second-largest source of imports. In 2024, US exports to China and imports from China accounted for 7.0 percent and 13.8 percent of the US total exports and imports for the year respectively.

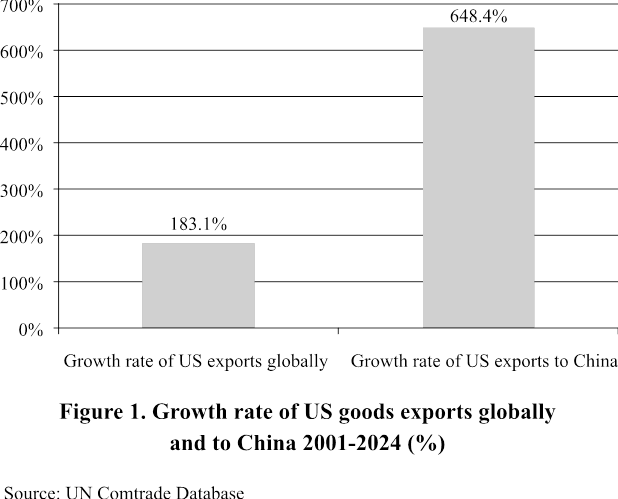

US exports to China have grown much faster than its exports to the rest of the world. Since China’s entry into the WTO, US exports to China have grown rapidly, making China an important export market for the US. According to UN statistics, in 2024, US goods exports to China reached US$143.55 billion, representing a 648.4 percent increase from US$19.18 billion in 2001, which far exceeded its overall export growth of 183.1 percent during the same period (Figure 1).

China is an important export market for US agricultural products, integrated circuits, coal, liquefied petroleum gas, pharmaceuticals, and automobiles. China is the largest export market for US soybeans and cotton, the second-largest export market for integrated circuits and coal, and the third-largest export market for medical devices, liquefied petroleum gas, and automobiles. UN data shows that in 2024, China was the destination for 51.7 percent of US soybean exports, 29.7 percent of its cotton exports, 17.2 percent of its integrated circuit exports, 10.7 percent of its coal exports, 10.0 percent of its liquefied petroleum gas exports, 9.4 percent of its medical equipment exports, and 8.3 percent of its passenger motor vehicle exports.

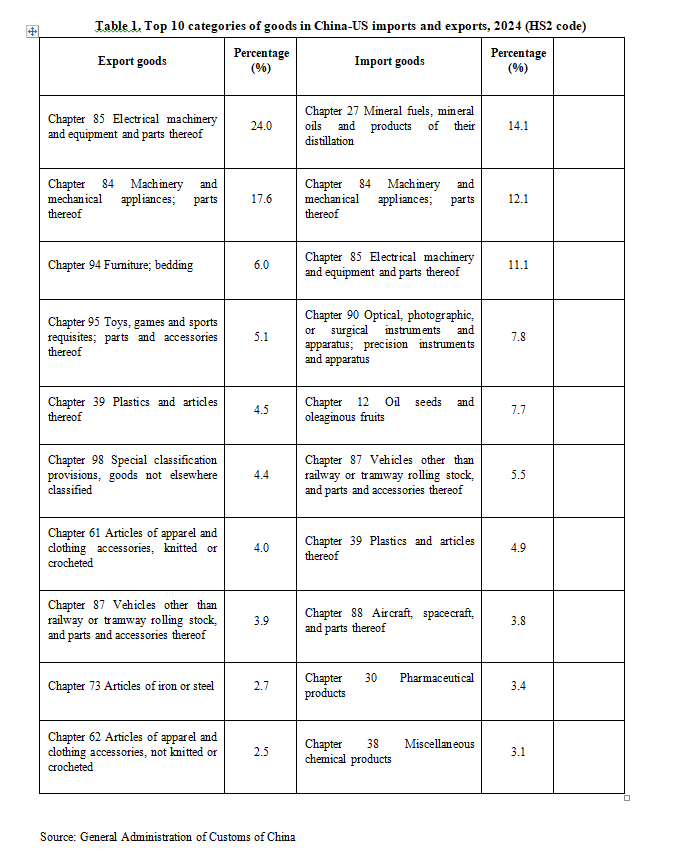

China-US bilateral trade is highly complementary as the two countries play to their comparative strengths (Table 1). Chinese customs data shows that in 2024, China’s top five export categories to the US were electrical machinery and equipment and parts thereof, mechanical appliances and parts thereof, furniture, toys, and plastics, accounting for 57.2 percent of its total exports to the US. China’s top five import categories from the US were mineral fuels, mechanical appliances and parts, electrical machinery and equipment and parts, optical instruments and apparatus, and oil seeds including soybeans, accounting for 52.8 percent of its total imports from the US. Machinery and electrical products are particularly important in China-US bilateral trade, exhibiting an evident characteristic of intra-industry trade.

2. China-US Trade in Services Maintains Rapid Growth

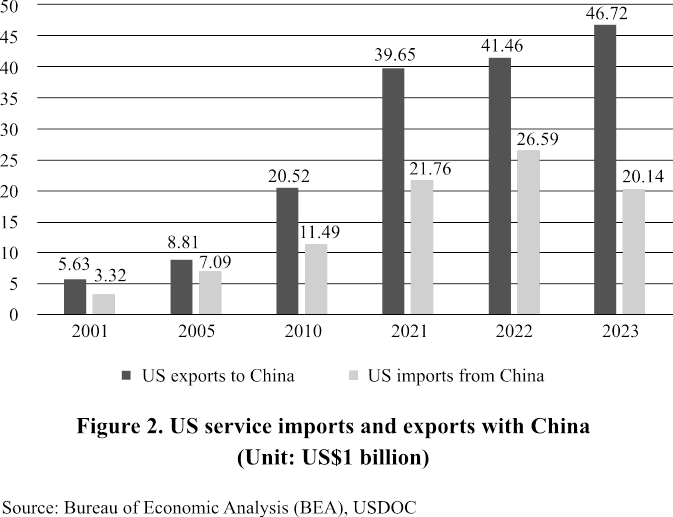

The US service industry is well developed with a complete range of sectors and strong international competitiveness. Overall, as the economy continues to develop and the standard of living rises, the demand for services in China is expanding significantly, leading to rapid growth in service trade between China and the US. According to the US Department of Commerce (USDOC), between 2001 and 2023, two-way trade in services between China and the US expanded from US$8.95 billion to US$66.86 billion, representing a seven-fold increase (Figure 2). China’s statistics show the US as its second-largest trade partner in services in 2023, while US data lists China as its fifth-largest services export market.

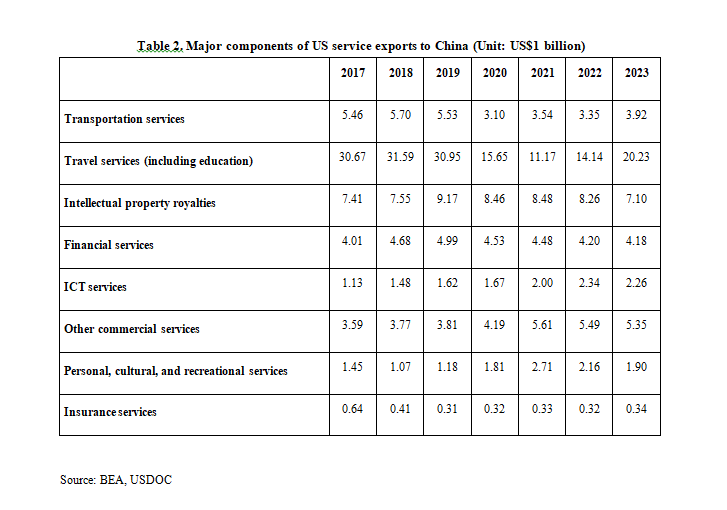

The US stands as the largest source of China’s deficit in service trade, with the deficit generally exhibiting an upward trend. According to the USDOC, from 2001 to 2023, US service exports to China expanded from US$5.63 billion to US$46.71 billion, an 8.3-fold increase. The US annual service trade surplus with China expanded 11.5 times to US$26.57 billion (Figure 2). In 2019, the number soared to US$39.7 billion. In 2023, China continued to be the biggest contributor to the US service trade surplus, representing roughly 9.5 percent of the total. China’s service trade deficit with the US is primarily concentrated in three areas: travel (including education), intellectual property royalties, and transportation (Table 2).

China’s trade deficit with the US in travel services has expanded continuously. Data from the USDOC shows that in 2023, Chinese tourists made approximately 1.1 million visits to the US, with their spending accounting for 14 percent of US service exports to China. Tourism, medical treatment, and studying abroad remain the primary categories of service trade consumption for those travelling from China to the US. According to the USDOC, US exports of travel services (including education) to China grew from US$2.31 billion in 2001 to US$20.23 billion in 2023, representing an 8.8-fold increase.

China’s payments of intellectual property royalties to the US have increased steadily. In 2023, intellectual property royalties remain a primary source of revenues for US service trade, accounting for 13.1 percent of its service trade revenues. The intellectual property royalties the US receives from China represent one-fifth of the total royalties obtained from the Asia-Pacific region and account for 5 percent of US global intellectual property royalty revenue.

3. China Never Deliberately Pursues a Trade Surplus

The trade balance in goods between China and the US is both an inevitable result of the structural issues in the US economy and a consequence of the comparative advantages and international division of labor between the two countries. China does not deliberately pursue a trade surplus. As a matter of fact, the ratio of China’s current account surplus to GDP has decreased from 9.9 percent in 2007 to 2.2 percent in 2024.

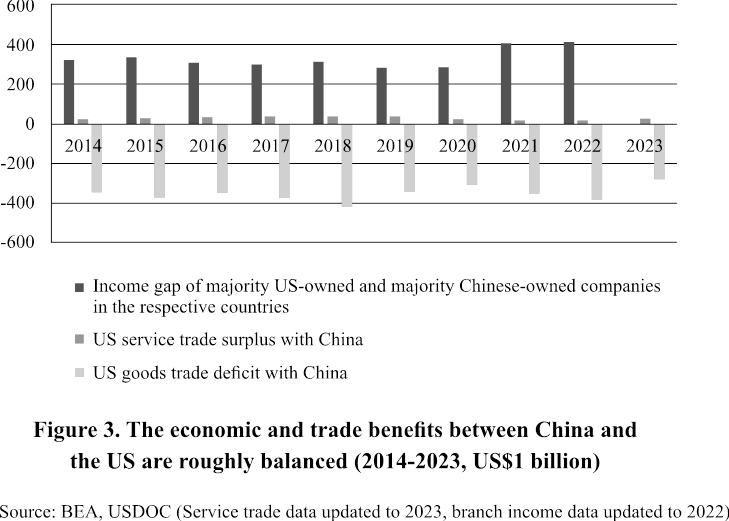

Gains from economic and trade relations between China and the US are generally balanced. A comprehensive and in-depth assessment is required to objectively evaluate whether China-US bilateral trade is balanced, as it cannot be based solely on trade in goods. In today’s context of expanding economic globalization and the prevalence of internationalized production, the scope of bilateral economic and trade relations has long since extended beyond trade in goods. Services and the local sales of domestic enterprises’ branches in the other country (local sales generated by two-way investment) should also be included. When the three factors of trade in goods, trade in services, and the local sales of domestic enterprises’ branches in the other country are taken into full account, it can be seen that the economic and trade benefits gained by China and the US are roughly balanced (Figure 3).

Data from the USDOC shows that in 2023, the US registered a surplus of US$26.57 billion in service trade – a notable advantage for the US. Furthermore, in 2022, the sales revenue of the US-owned enterprises in China reached US$490.52 billion, significantly exceeding the US$78.64 billion in sales revenue generated by Chinese-owned enterprises in the US. The gap of US$411.88 billion underscores the more pronounced advantage of American enterprises in multinational operations.

The US trade deficit has increased globally, while the proportion attributable to China has decreased. According to the data of the BEA, USDOC, China’s share of the total US deficit of trade in goods has fallen in each of the past six years, from 47.5 percent in 2018 to 24.6 percent in 2024, while the US trade deficit with other countries and regions has increased substantially in the same period. In 2024, the US international deficit of trade in goods reached US$1.2 trillion, an increase of 13 percent year on year, the fourth consecutive year that had exceeded US$1 trillion.

China’s foreign trade is characterized by large volumes of both imports and exports, a pattern mirrored in China-US trade. The value-added accrued by China from much of the export of processed manufactured goods represents only a minor fraction of the total value of all commodities. However, current trade statistics methods calculate China’s exports based on their gross value (the full value of goods exported by China to the US). Calculated by the trade in value-added method, the US trade deficit with China would significantly decrease.

China is proactively adopting various measures to expand imports. Actively expanding imports demonstrates China’s proactive commitment as a responsible major country and constitutes a significant contribution to global economic development. Since November 2018, the China International Import Expo (CIIE) has been held annually in Shanghai. Both the number of participating countries and the intended transaction value have shown year-on-year growth, with cumulative intended transaction value exceeding US$500 billion. In 2024, China’s imports totaled RMB18.4 trillion, up 2.3 percent year on year, with the value of imports reaching a record high. China has maintained its position as the world’s second-largest import market for the 16th consecutive year.

China has systematically expanded voluntary opening up and unilateral opening up, continuing to unleash the potential of its vast market and providing increased opportunities for countries worldwide. In 2024, China imported RMB9.86 trillion of goods from the Belt and Road Initiative partner countries, up 2.7 percent, which accounted for 53.6 percent of the country’s total import value. Since December 1, 2024, China has implemented a policy granting zero-tariff treatment for 100 percent of tariff lines to all least developed countries with which it has diplomatic relations, which led to an 18.1 percent growth in imports from relevant countries in the first month. In the current period and for some time to come, China possesses substantial potential for import growth. It is projected that by 2030, the cumulative value of imports from developing countries alone is expected to exceed US$8 trillion.

Actively expanding imports is also a key part of China’s strategy for high-level opening up. China will systematically expand market access for goods and fully implement zero tariffs on all tariff lines for the least developed countries with which it has diplomatic relations. It will continue to use the major platforms such as the CIIE, China Import and Export Fair, China International Fair for Trade in Services, and China International Consumer Products Expo to boost imports. China will also develop national-level demonstration zones for the creative promotion of imports, steadily facilitate growth in imports, and explore more potential. The goal is to transform China’s vast market into a shared global market, injecting new impetus into the world economy.

4. China and the US Are Important Two-Way Investment Partners

The US is a major source of foreign investment for China. According to the statistics of the Chinese Ministry of Commerce (MOFCOM), by the end of 2023, the actual accumulated amount of US investment in China was US$98.23 billion. In 2023, the US set up 1,920 new enterprises in China, with an actual investment of US$3.36 billion, up 52 percent from the previous year.

The US is also an important investment destination for China, and Chinese companies’ direct investment in the US has grown rapidly and significantly. The statistics released by MOFCOM show that by the end of 2023, China’s direct investment in the US had reached roughly US$83.69 billion, covering 18 sectors of the national economy. Chinese companies have established over 5,100 overseas enterprises in the US, with more than 85,000 local employees. China has also made a significant financial investment in the US. According to the US Department of the Treasury, as of the end of December 2024, China owned US$759 billion of US treasury bonds, as the second-largest foreign creditor of the US.

5. China and the US Both Benefit from Bilateral Economic and Trade Cooperation

In international trade relations, countries exchange products based on their comparative advantages to realize their own value, meet each other’s needs, and achieve common development. As the two largest economies in the world, the economic and trade cooperation between China and the US has generated substantial benefits for both sides, with enterprises and consumers in both countries reaping tangible benefits through bilateral trade and investment.

China-US economic and trade cooperation has created a large number of employment opportunities for the US. According to a report released by the US-China Business Council in April, 2024, China is a key market for US exports of goods and services. In terms of combined goods and services exports in 2022, China was the largest export market for three US states, in the top three for 32 US states, and in the top five for 43 US states.

According to an estimate by the US-China Business Council, the number of American jobs supported by exports to China was 931,000 in 2022, ranking third among all countries, behind only Canada and Mexico. This figure was more than the sum of US jobs supported by the two Asian markets of Japan and the Republic of Korea (ROK).

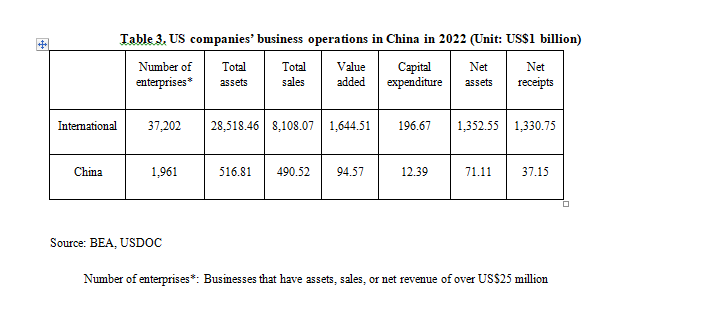

China-US economic and trade cooperation has created a large quantity of business opportunities and profits for American enterprises (Table 3). China has a vast market and continuously growing consumer demand. For example, Tesla’s sales in China have continued to grow, surpassing 657,000 units in 2024, up 8.8 percent year on year to a new historical high. More than 10 American insurance companies have subsidiaries in China. American financial institutions, such as Goldman Sachs, American Express, Bank of America, and MetLife, have achieved substantial investment returns as strategic investors in Chinese financial institutions.

Data from the USDOC in August 2024 shows that in 2022, there were a total of 1,961 American enterprises (businesses holding a majority equity stake and having assets, sales, or net revenue of above US$25 million) operating in China, with a combined total sales of US$490.52 billion, up 4.3 percent year on year.

China-US economic and trade cooperation has facilitated the upgrading of American industries. Through cooperation with China, American multinational corporations have boosted their international competitiveness by integrating the strengths of resources from both countries. Apple designs and develops mobile phones in the US, assembles and manufactures them in China, and sells them in global markets. Tesla has established wholly-owned mega factories in China, expanded production capacity, and exported to global markets. China has taken on certain production processes for American enterprises, which enabled the US to allocate resources such as capital to innovation and management, and focus on the development of high-end manufacturing and modern services. It has driven US industry towards higher value-added and more technologically advanced sectors, reducing US domestic pressure for energy consumption and environmental protection.

China-US economic and trade cooperation has brought tangible benefits to American consumers. The US has imported from China a large quantity of consumer goods, intermediate goods, and capital goods, which has supported the development of the supply and industrial chains of the US manufacturing industry, provided US consumers with more choices, lowered their cost of living, and increased the real purchasing power of the American people – especially the low and middle-income groups.

China-US economic and trade cooperation has generated substantial business opportunities and profits for Chinese companies. By investing in the US, which is the world’s largest consumer market and the most mature capital market, Chinese firms can expand their sales channels, increase the impact of their international brands, attract global clients and partners, and access financing more easily, thereby supporting rapid business growth.

US companies in China have provided experience for their Chinese counterparts in technical innovation, market management, and institutional innovation, driving Chinese companies to accelerate their transformation and upgrading and improve industry efficiency and product quality.

II. The Chinese Side Has Scrupulously Honored the Phase One Economic and Trade Agreement

As a major country that takes its responsibilities seriously, China has scrupulously fulfilled its obligations in the Phase One Economic and Trade Agreement (hereinafter referred to as the Agreement) by protecting intellectual property, increasing imports, and providing greater market access, which has created a favorable business environment geared to investors of all countries including US companies, for them to share the benefits of China’s economic development.

1. China Has Continued to Strengthen Intellectual Property Protection

Innovation is the number one driving force behind development. To protect intellectual property is to protect innovation. As part of its efforts to honor its obligations in the Agreement, China has adopted multiple measures to protect business secrets and pharmaceutical intellectual property, punish cyber infringement, and strengthen intellectual property law enforcement.

Strengthening the protection of business secrets. In September 2020, the Supreme People’s Court issued the Regulations on the Application of Laws on Civil Cases of Infringement of Business Secrets; the Supreme People’s Court and the Supreme People’s Procuratorate issued the Interpretations to the Application of Laws on Criminal Cases of Intellectual Property Infringement (III); and the Supreme People’s Procuratorate and the Ministry of Public Security issued the Decision on Revising the Regulations on the Registration and Prosecution of Criminal Cases Under the Jurisdiction of Public Security Organs. In December 2020, the National People’s Congress (NPC) passed the amendments to the Criminal Law. These documents defined the scope of prohibited acts that constitute infringement of business secrets, the act of theft of business secrets, the application of temporary bans involving theft of business secrets, and the adjustment of the rules on starting criminal investigations.

Improving the system for protection of pharmaceutical-related intellectual property. In October 2020, the NPC Standing Committee deliberated and passed a decision to amend the Patent Law, with additional stipulations as to the mechanism for early resolution of pharmaceutical patent disputes, and patent term extension (PTE) for inventions. In July 2021, the National Medical Products Administration and the China National Intellectual Property Administration (CNIPA) jointly issued the Implementation Measures for the Early Resolution Mechanism for Pharmaceutical Patent Disputes (Trial), the CNIPA released the Administrative Adjudication Measures for the Early Resolution Mechanism for Pharmaceutical Patent Disputes, and the Supreme People’s Court issued the Regulations on the Application of Laws on Civil Cases of Patent Disputes Involving Pharmaceuticals Applying for Registration, which help establish the early resolution mechanism for pharmaceutical patent disputes and ensure the effective implementation of relevant measures. In December 2023, the State Council issued the decision to amend the Rules for the Implementation of the Patent Law. In conjunction with this, the CNIPA completed changes to the Patent Review Guide. They further detailed the provisions for PTE for inventions. In addition, the CNIPA also refined provisions for late submission of laboratory data in the 2021 amendments to the Patent Review Guide.

Improving the protection of trademarks and geographical indications. In April 2019, the NPC Standing Committee passed a decision to amend the Trademark Law, which added provisions to regulate malicious trademark registration, and increased the penalties for infringement of exclusive trademark rights, thereby substantially raising the legal penalties for those who counterfeit registered trademarks. Subsequently, the CNIPA formulated and issued the Provisions on Regulating Applications for Trademark Registration, the Criteria for Determining Trademark Infringement, and the Criteria for Judging Trademark General Violations. These measures aimed to combat vexatious trademark registration applications. In December 2023, the CNIPA formulated and released the Measures for the Protection of Geographical Indication Products, and the Regulations on the Registration and Management of Collective Trademarks and Certification Trademarks, further refining the legal framework for protecting geographical indications.

Actively promoting intellectual property exchanges and cooperation with the US. Efforts have been made to expand mutually beneficial and pragmatic cooperation with the US intellectual property authorities in various technical areas including intellectual property reviews, expert exchanges, and public awareness through mechanisms such as consultative work plans and the signing of MoUs. A proactive and open approach has been maintained in communication with American enterprises, with attentive consideration given to their opinions and suggestions regarding China’s intellectual property system, and great coordination made to address their reasonable concerns about intellectual property in China.

Launching a stronger fight against cyber infringement. In September 2020, the Supreme People’s Court issued the Decision on the Trial of Civil Intellectual Property Cases Involving E-commerce Platforms and the Reply to the Application of Laws on Cyber Intellectual Property Infringement Disputes, which provided provisions on the effectiveness of instant takedown, notice, and counter-notice. In November 2020, the NPC Standing Committee adopted the amendments to the Copyright Law, with additional provisions on civil assistance to copyright infringement. In August 2021, the State Administration for Market Regulation published the draft Decision on Revising the Electronic Commerce Law of the People’s Republic of China to solicit public feedback, which carried articles related to the procedures for notice and takedown and relevant penalties.

Strengthening intellectual property-related law enforcement. In August 2020, the State Administration for Market Regulation and some other government departments issued the Decision on Strengthening the Destruction of Infringed and Counterfeit Goods, and the State Council revised the Provisions on Reference of Suspected Criminal Cases by Administrative Law-enforcement Bodies. Both documents required that administrative law-enforcement bodies transfer suspected criminal cases involving intellectual property rights to the public security bodies.

China has strengthened law enforcement against intellectual property infringement and counterfeit goods. In 2024, its market supervision departments launched special initiatives dedicated to intellectual property protection involving key fields, key products, and key markets. They investigated nearly 675,000 cases, including 43,900 cases of trademark infringement and counterfeit patent, and conducted about 88,000 law enforcement activities targeting key markets prone to frequent infringement and counterfeit goods. The General Administration of Customs of China has reinforced its law enforcement on intellectual property protection, utilizing targeted campaigns to maintain a robust stance against infringements in import and export. In 2024, this resulted in the detention of 41,600 shipments suspected of intellectual property violations, totaling 81.6 million items.

2. China Has Prohibited Forced Technology Transfer

China opposes forced technology transfer in any form. It considers mutually beneficial cooperation to be a basic value in international technological cooperation, encourages and respects transfer and licensing of technology by Chinese and foreign enterprises on voluntary terms and under market principles, provides an enabling market environment for Chinese and foreign technology holders to receive benefits from transfer and licensing of technology, and provides support for global scientific and technological progress and international economic and trade development.

The US side has described it as “forced technology transfer” when foreign-invested ventures and Chinese enterprises contract voluntarily to seek technological cooperation and share commercial returns from the Chinese market. That does not tally with reality on the ground.

Imposing legal prohibitions on forced technology transfer. The Foreign Investment Law, promulgated in March 2019, states, “No administrative department or its staff member shall force any transfer of technology by administrative means.” The Administrative License Law, promulgated with revisions in April 2019, states, “An administrative agency and its staff shall not directly or indirectly require transfer of technology in the process of issuance of an administrative license.” The Regulations for the Implementation of the Foreign Investment Law, promulgated in December 2019, specifies that forced technology transfer in any form must be prohibited.

Strengthening confidentiality obligations for administrative departments and staff. Chinese laws have definite stipulations that administrative departments and their staff must keep confidential any business secrets of foreign investors or foreign-funded enterprises that they get to know while performing their duties.

The Foreign Investment Law states, “Administrative departments and their staff shall keep confidential any business secrets of foreign investors or foreign-funded enterprises that they get to know during the performance of their duties and shall not divulge or illegally provide to others the secrets.” It also states that when a staff member of an administrative department “divulges or illegally provides to others any business secret he or she gets to know during the performance of duties, a penalty will be imposed upon him or her in accordance with the law; if a crime is constituted, he or she will be held criminally liable”. Similar stipulations are found in the Administrative License Law.

Opening the market wider with greater investment access. China has continued to improve its market environment, granted foreign investment greater access, and offered greater options and freedom for foreign enterprises to invest in China, which has created favorable conditions for foreign enterprises to conduct technological cooperation with Chinese partners on a voluntary basis and under market principles.

China has introduced a management system based on pre-establishment national treatment and a negative list and replaced the old practice of case by case approval for the establishment and modification of foreign-invested businesses with the new practice of convenient and efficient information reporting. It has rolled out a series of measures to encourage foreign investment and improve the environment for foreign investment.

In 2024, the General Office of the CPC Central Committee and the General Office of the State Council issued the Decision on Improving the Market Access System, requiring coordination and alignment of policies on domestic and foreign investment access and granting national treatment while not reducing the access opportunities of existing business entities. China has refined the market access system, optimized the market access environment, and improved the efficiency of market access.

3. China Has Granted Greater Access to Food and Agricultural Products

Agricultural products constitute an important part of bilateral trade and involve extensive market entities on both sides. China honored the Agreement and increased its purchase of agricultural products despite the difficulties brought by Covid-19. In November 2020, the US government released a report, confirming that US exports of agricultural products to China had returned to normal. The 2020 evaluation report published by the US Department of Agriculture (USDA) and Office of the United States Trade Representative also hailed the Agreement as a historic step for American agriculture.

In line with the Agreement, since February 2020, China has removed import restrictions for specific US agricultural products, and conditionally resumed trade in US beef, poultry, and dairy products. In accordance with specified conditions, China has:

• conditionally lifted the ban on beef and beef products from cattle 30 months of age and older and allowed more than 600 US enterprises to export beef products to China;

• removed the import limits on US pet food containing ruminant ingredients, poultry, and poultry products and allowed the import of US pet food containing ruminant ingredients and poultry products that meet China’s legal and regulatory requirements;

• allowed more than 300 US enterprises to export infant formula, pasteurized milk, and other dairy products to China;

• completed the approval process for US dairy permeate powder and allowed the import of US dairy permeate powder;

• permitted, through the signing of inspection and quarantine agreements, the import of eight US products – processing potatoes, avocados, nectarines, blueberries, barley, alfalfa pellets and hay blocks, almond kernel pellets, and timothy hay.

4. China Has Expanded Market Access to Financial Services

China’s voluntary opening policies have benefited financial institutions from all countries including the US, and a number of US financial institutions have obtained access and commenced operations in China. JPMorgan and Goldman Sachs have established wholly foreign-funded securities companies in China, and Morgan Stanley has gained 94 percent of its joint-venture securities company in China. JPMorgan Futures and Morgan Stanley Futures are both wholly foreign-owned futures companies. BlackRock, Fidelity, Neuberger Berman, JPMorgan, Morgan Stanley, and Alliance Bernstein have been allowed to establish wholly foreign-owned fund management companies in China. Standard & Poor’s, Fitch, and other international rating companies have commenced operations in China. American Express and MasterCard have both set up joint ventures in China, which started operation upon receiving their bank card clearing license.

China has so far adopted more than 50 measures on voluntary opening up of the financial sector and greatly eased the market access limits on foreign investment in financial services.

– Removing all equity shareholding limits on foreign investment. In 2018, China removed the foreign equity caps in Chinese-funded banks and financial asset management companies, giving equal treatment to domestic investment and foreign investment regarding equity shareholdings.

The Methods for Management of Foreign-funded Securities Companies, Methods for Management of Foreign-funded Futures Companies, and Methods for Management of Foreign-funded Insurance Companies have been amended, allowing as much as 51 percent ownership to foreign investment in the sectors of securities, fund management, futures, and life insurance, and no cap was set from the year 2020 on. Foreign investments are allowed to supply credit checking, credit rating, and payment services, and enjoy national treatment.

– Greatly expanding the business scope of foreign investment. Foreign banks are allowed to provide RMB business upon their inauguration in China. There is no separate limit on the business scope of foreign-funded securities companies and insurance agencies, with equal treatment for domestic and foreign companies. Foreign-funded enterprises are allowed to provide insurance agency and insurance appraisal services. The requirements for professional qualifications of foreign-funded agencies have been relaxed when they apply to become main underwriters of the debt financing instruments for non-financial enterprises and to provide fund custody services.

– Relaxing the requirements for the qualifications of foreign shareholders. China has eliminated the previous requirements that foreign banks must have US$10 billion of total assets if they are to open legal person banks in China and have US$20 billion of total assets if they are to set up branches in China, and the requirements that foreign insurance agencies must have two years of representative office presence in China and 30 years of insurance business operations if they are to enter the Chinese market. It no longer demands that joint venture securities firms must have at least one securities company as their shareholder in China.

5. China Has Maintained Basic Stability in the RMB Exchange Rate at an Adaptive, Balanced Level

China safeguards multilateralism and respects multilateral consensus. It has honored its multilateral commitments and refrained from competitive devaluation. It has also honored the Agreement and put in place a managed floating exchange rate regime based on market supply and demand with reference to a basket of currencies.

Carrying out market-based exchange rate reform. China has constantly improved the market-based RMB exchange rate formation regime. China holds that the exchange rate should be mainly determined by market demand and supply, and refrains from routine intervention in foreign exchange.

It has expanded the exchange rate band in an orderly manner to increase the flexibility of the RMB exchange rate. The daily floating exchange range of RMB to US dollar in the inter-bank spot foreign exchange market gradually grew from 0.3 percent in 2007 to 2 percent.

It has worked to make the central parity rate regular and market-based. It takes the major participating banks in the foreign exchange market as the quoting banks, and gives full consideration to the closing price of the previous day in the inter-bank foreign exchange market before offering its quotation, to the demand and supply conditions in the foreign exchange market, and to the exchange rate movement of the major currencies.

Promoting the growth of the foreign exchange market. China has adopted a number of measures to facilitate the investment and financing of foreign-related enterprises and individuals in cross-border trade, provided more products in the foreign exchange market, increased participating entities in the market, advanced the opening of the foreign exchange market, and improved relevant infrastructure. A multi-tiered foreign exchange market with comprehensive functions is therefore taking shape, and the diverse foreign exchange needs of the market entities can be satisfied.

China’s inter-bank foreign exchange market now has more than 40 tradable currencies, involving forwards, foreign exchange swaps, currency swaps, options, and other mainstream products in the international foreign exchange market. The inter-bank foreign exchange market reported a trading volume of US$41.14 trillion in 2024. The foreign exchange market has more resilience, and the market players have greater adaptability to the two-way fluctuation in the RMB exchange rate. In 2024, the proportion of enterprises using forward exchanges, options, and other foreign exchange derivatives to hedge exchange rate risks reached 27 percent.

Maintaining a clear and transparent policy stance on the exchange rate. Through holding press conferences and releasing minutes of regular meetings of the monetary policy committee and the Implementation Report of the Monetary Policies, China has made public its monetary policy stance. It has followed good international practice and regularly publicized the balance sheet of its central bank, foreign exchange reserves, balance sheet of international receipts and payments, and international investment positions to increase the transparency of its exchange rate policy.

Making notable progress in market-based RMB exchange rate reform. The RMB exchange rate has become more market-based, the exchange rate has greater flexibility, and two-way fluctuation has become a norm. The RMB exchange rate has remained generally stable at an adaptive, balanced level, and China has kept a basic balance of international payment.

Since 2020, the China Foreign Exchange Trade System, which is responsible for measuring the exchange rate of the RMB to a basket of currencies, has reported an RMB exchange rate index of around 100, which is quite strong among the major currencies in the world and shows no competitive devaluation. The annual fluctuation of the RMB exchange rate remains at 3 percent to 4 percent, similar to the fluctuation changes of major global currencies. This plays a sound role of an automatic stabilizer to the macro economy and the international balance of payments. In 2024, China’s current account surplus represented 2.2 percent of its GDP, which is within the range generally recognized as reasonable.

6. China Has Actively Expanded the Scale of Trade

China has proactively addressed issues in the implementation of the Agreement based on domestic market needs, commercial principles, and WTO rules. It supports Chinese enterprises in expanding imports from the US. The procurement obligations under the Agreement expired naturally at the end of 2021.

Exempting eligible US products from additional tariffs. On application from domestic enterprises, for a certain period China has exempted eligible US imports from additional tariffs imposed in response to US Section 301 measures, based on market and commercial principles. These measures have facilitated imports from the US for relevant enterprises. For instance, by incorporating oil, gas, and coal into the eligible commodity exemption application range, China has enabled companies to import these energy products from the US. In 2020 and 2021, China’s imports of American energy-related products, denominated in US dollars, increased by 144.5 percent and 114.7 percent.

Making significant progress in expanding imports from the US. According to Chinese statistics, while China’s overall imports of goods denominated in US dollars decreased by 0.6 percent year on year in 2020, imports from the US saw an increase of 10.1 percent. In 2021, imports of goods from the US rose by 31.9 percent year on year, outpacing the overall import growth of 30 percent. The proportion of US goods in China’s total imports increased from 5.9 percent in 2019 to 6.7 percent in 2021. According to US statistics, while US overall exports of goods declined by 13.4 percent in 2020, exports to China grew by 15.9 percent. In 2021, exports of goods to China also achieved a strong growth rate of 21.9 percent. The proportion of US goods exports to China increased from 6.5 percent in 2019 to 8.6 percent in 2021.

China’s performance of its obligations under the Agreement has encountered multiple obstacles caused by the US. Limited US production capacity hindered exports to China. In 2020, Boeing’s aircraft production was only about 40 percent of its 2019 output, which significantly impacted deliveries to China. In 2019, adverse weather conditions during the growing and harvesting seasons in the US led to significant issues with excessive levels of ergot and vomitoxin in wheat. As a result, the quantity of wheat meeting Chinese food safety and quarantine standards was limited, which negatively impacted US wheat exports to China in 2020.

Inadequate infrastructure has contributed to elevated transport costs. For instance, most US ports in the Gulf of Mexico cannot directly accommodate very large crude carriers of 300,000 tonnes and need medium-sized oil tankers (100,000 to 200,000 tonnes) for transshipment and refueling. This results in US crude oil transport costs to China tripling those from the Middle East, weakening its international price competitiveness.

The limited competitiveness of certain US products in terms of price and safety reduced the willingness of China’s enterprises to import them on a market-driven basis. US soybeans are at a price disadvantage compared to South American soybeans; US beef is significantly more expensive (roughly 50 percent higher than South American beef); US rice can hardly compete with Southeast Asian rice in terms of quality, appearance, taste, and price. In February 2020, the import price of US rice was about RMB3,000 higher than Thai rice per tonne, and RMB3,500 higher than Vietnamese rice per tonne. In another example, in 2018 and 2019, Boeing’s main aircraft model, the 737 MAX, was involved in multiple major accidents. In response, most countries worldwide, including China and the US, grounded the aircraft model, dealing a significant blow to the aviation trade.

The US side has caused the disruption of China-US international logistics. Ports and other infrastructure in the US were already in a tight balance. With the impact of Covid-19, various supply chain links such as railways, ports and container trucks struggled to adapt, leading to severe congestion at major US ports and blockages in the inland transport network, resulting in a significant buildup of goods. According to the global major container port operation data released by the Shanghai Shipping Exchange, in 2021, the average duration of container vessel port stays at the Ports of Los Angeles and Long Beach (including both anchorage dwell time and quay operations) was 11.1 days and 10.6 days, (compared with 4.3 days and 4.7 days before the pandemic), while the average duration at Shanghai Port and Shenzhen Port in China during the same period was only 2.96 days and 2.33 days.

7. China Has Maintained Pragmatic Communication with the US Regarding Agreement Issues

In 2020 and 2021, China maintained close communication with the US at all levels on bilateral economic and trade relations and specific issues regarding the implementation of the Agreement, and efficiently advanced implementation work, fully demonstrating China’s commitment to fulfilling the Agreement. During this period, neither side initiated the dispute resolution mechanism. In accordance with the stipulations of the Agreement, in terms of high-level communication, six phone calls were conducted between China and the US to exchange views on macroeconomic issues, bilateral economic and trade relations, and multilateral and bilateral cooperation, with the aim of assessing the overall implementation of the Agreement. In terms of daily work, the two sides held five vice-ministerial quarterly meetings and 14 monthly meetings and consultations at the director-general level, dealing with implementation of the Agreement, particularly related to matters such as expanding trade, trade of food and agricultural products, intellectual property rights, and financial services. They also maintained regular communication through working-level talks and email exchanges to address issues of mutual concern.

In line with its provisions, the Agreement officially came into effect on February 15, 2020. Meanwhile, China provided a public comment period of over 45 days for all the proposed measures, fully accommodating both domestic and international feedback, and appropriately addressing the reasonable concerns and requests of all parties.

III. The US Side Has Failed to Meet Its Obligations Under the Phase One Economic and Trade Agreement

Since signing the Phase One Economic and Trade Agreement (hereinafter referred to as the Agreement), the US has systematically escalated economic and other forms of pressure against China, implementing a series of restrictive measures such as export controls and investment restrictions that repudiate the spirit of the Agreement. Concurrently, the US has promoted false narratives related to human rights, Hong Kong, Taiwan, Xinjiang and the pandemic. These actions have done serious damage to China-US ties as well as economic and trade relations, and disrupted normal trade and investment activities, and significantly undermined the conditions necessary for the implementation of the Agreement.

1. The US Has Failed to Implement Agreement Commitments on Technology Transfer

On technology transfer, the Agreement stipulated, “Neither Party shall require or pressure persons of the other Party to transfer technology to its persons in relation to acquisitions, joint ventures, or other investment transactions.” The US adopted the Protecting Americans from Foreign Adversary Controlled Applications Act. Under the pretext of protecting US national security, the US has tried to force TikTok to sell off or divest its business. It has interfered with its normal operation and threatened the technological security and commercial interests of the investors. The US has disregarded and undermined the just and legitimate interests of enterprises and violated the basic principles of the market economy.

At the same time, in the name of protecting national security, the US has released rules to control outbound investment restricting US enterprises from investing abroad, which has obstructed investment cooperation between Chinese and US enterprises in semiconductors and microelectronics, quantum information technology, artificial intelligence (AI), and other fields. In February 2025, the US unveiled a Memorandum on America First Investment Policy and announced that it would adjust its investment policies, with the focus on further limiting two-way investment with China, which will create serious disruption to China-US investment cooperation.

2. The US Has Failed to Fully Implement Agreement Commitments on Trade in Food and Agricultural Products

The Agreement stipulated, “Within 30 days following receipt from China of a formal request for an evaluation of a region of China for avian disease free recognition and a completed information package to support such a request, the USDA’s Animal and Plant Health Inspection Service shall initiate such an evaluation.” However, the US side has refused to recognize Shandong’s status as free from highly pathogenic avian influenza (HPAI), citing non-compliance with its own recognition requirements. On November 2, 2020, China submitted materials to the US to qualify Jiaodong Peninsula as a region free from HPAI. According to Chapter 10.4 of the World Organization for Animal Health (WOAH) Terrestrial Animal Health Code, a country or zone may demonstrate freedom from avian influenza through either immune-based strategies or non-immune measures. By August 2022, China’s Shandong Province as a whole had become a region free of HPAI, with all development and management complying with the regulations in the Terrestrial Animal Health Code. Since then, China has conducted continuous monitoring including pathogenic monitoring that can prove that the province has remained free of avian disease.

China has also scrupulously honored the Agreement and recognized the US as avian disease free. It has eased the overall trade ban on US export of poultry and poultry products to China since the Covid-19 outbreak. But the US side has refused to conduct disease-free status certification on the grounds that a HPAI-vaccinated avian influenza free zone is not considered a disease-free zone. This constitutes a failure to reciprocally fulfill the Agreement and is also inconsistent with the WOAH principles regarding avian influenza-free status.

The Agreement stipulated, “The two sides intend to conduct technical consultations with each other on areas of potential cooperation related to pesticides for agricultural use. These consultations may include discussion of the Parties’ pesticide registration data and pesticide trial data, and discussion on the setting of maximum residue levels.” However, the US side has given no positive response to China’s request for cooperation in this field.

China is the largest source of pesticide imports to the US, and the US is China’s second-largest export market of pesticides. Realizing mutual recognition of pesticide registration data and pesticide trial data as early as possible will facilitate trade, reduce unnecessary repeated tests, and cut registration costs. It is the shared aspiration of pesticide producers in both countries, and it is favorable to innovation of pesticides in both countries.

China has maintained communication with the US in the hope of starting bilateral technical consultations in relation to pesticides as early as possible. Since December 2020, China has expressed, through the US Embassy in China, its hope that the US side will agree as soon as possible to build a mechanism with the Chinese side for communication and advancing cooperation on pesticides. But the US side has so far not given any reply.

In the Agreement, the US side agreed to complete as early as possible its regulatory notice process for the import of poultry, citrus, jujube, fragrant pear, and other agricultural products from China. However, the US side did not take reciprocal tariff exclusion measures for the agricultural products involved in the Agreement, hindering the substantive export of Chinese agricultural products to the US. Relevant products are not in the tariff exclusion list. In 2025, using the fentanyl issue as the pretext, the US decided to levy an additional 20 percent tariff on all Chinese products to be exported to the US, then a 34 percent “reciprocal tariff”, and an additional 50 percent tariff, which would further limit the export of relevant products to the US.

After Chinese aquatic and dairy products for export to the US were detained by the US side, the General Administration of Customs of China has more than once requested the US Food and Drug Administration to clarify as soon as possible how these detainments would cease so that the two sides could advance relevant work. But the US side has not put forward any concrete proposals in response.

3. The US Has Failed to Fully Implement Agreement Commitments on Financial Services and Exchange Rate Matters

In recent years, the US has generalized the concept of national security and adopted a series of measures to restrict China-related investment and financing, which has caused tension in bilateral economic and trade relations, interrupted normal bilateral cooperation, and seriously impaired the plans of Chinese financial institutions to invest and operate in the US. At the same time, some Chinese financial institutions have faced discriminatory treatment in the US. The US practice is in violation of the rules of fair competition.

According to the Agreement, if the two sides have a dispute over issues related to the exchange rate, the People’s Bank of China and the US Department of the Treasury shall seek a resolution under the Bilateral Evaluation and Dispute Resolution Arrangement established through consultations. If they fail to resolve the dispute this way, they may request help from the IMF, consistent with its mandate. These articles provide sensible pathways for resolving disputes.

But after the Agreement was signed, the USDOC laid down new rules that included exchange rate undervaluation in anti-subsidy investigations and introduced “RMB exchange rate undervaluation” in the anti-subsidy cases of some products, which contravenes both WTO rules and the Agreement.

4. The US Has Failed to Provide Adequate Measures to Facilitate China’s Efforts to Expand Procurement and Imports

Unjustifiable measures such as export controls and sanctions against China seriously affected the implementation of the Agreement. Since 2020, the US has violated the principles of the Agreement and introduced multiple unreasonable economic and trade restrictions against China, implemented a series of inappropriate export control measures, and repeatedly imposed unjustified sanctions against a large number of Chinese enterprises through the US Entity List. These actions have severely undermined China-US economic and trade relations, resulting in a negative impact on China’s imports of goods and services from the US. For example, in October 2022, the US introduced measures to comprehensively upgrade export controls on chips and semiconductors to China. As a result, China’s imports of semiconductors and semiconductor manufacturing equipment from the US (denominated in US dollars) decreased by 23 percent and 17.9 percent in that year. The US fabricated the “forced labor” issue and adopted the Uygur Forced Labor Prevention Act, smearing and defaming Chinese enterprises and products, restricting the import of cotton products from China, which indirectly affected Chinese enterprises’ imports of cotton from the US.

Considering the ongoing US efforts to contain and suppress China in recent years, coupled with the detrimental impact of the Covid-19 pandemic on the global economy and trade activities, China would have been justified in withdrawing from the Agreement pursuant to the fourth item of the Article 7.4 by providing written notice to the US. China might also, pursuant to the first item of the Article 7.6, have initiated consultations on the force majeure clause with the US side. However, with the goal of preserving order in China-US ties and China-US economic and trade relations, and safeguarding the vital interests of enterprises and the people in both countries, China has not initiated any actions. Instead, it has demonstrated its sincerity by honoring its commitments and overcoming various difficulties to fulfill the Agreement arrangements. Since the Agreement was signed, the US has not to date initiated any dispute settlement proceedings against China.

IV. China Upholds the Principle of Free Trade and Strictly Complies with WTO Rules

Since joining the WTO in 2001, China has played an active role in economic globalization, launching a new phase in its reform and opening-up efforts. Committed to the principle of free trade, China has made its trade policies more stable, transparent, and predictable, substantially opened its markets, and made a positive contribution to upholding the effectiveness and authority of the multilateral trading system.

1. China Has Comprehensively Strengthened Trade Policy Compliance

Since joining the WTO, China has fully honored its accession commitments, abided by and implemented WTO rules, strengthened its rule-based market economy laws and regulations, and established a legal framework aligned with multilateral trade principles. Following its accession, China launched major efforts to review and revise over 2,300 laws, regulations and departmental rules at central government level, and over 190,000 local regulations at sub-central government levels. These efforts spanned key areas such as trade, investment, and intellectual property protection, among others.

To implement the requirements of the Third Plenary Session of the 18th CPC Central Committee in 2013 on adhering to the rules of the world trading system and building new systems for an open economy, the General Office of the State Council issued an official document on furthering trade policy compliance with WTO rules in 2014, and the MOFCOM issued the Measures for the Implementation of the Compliance Work of Trade Policies (Trial), requiring governments at all levels to conduct compliance assessments in accordance with WTO agreements and China’s accession commitments when formulating trade policies. The Third Plenary Session of the 20th CPC Central Committee proposed in 2024 to establish compliance mechanisms that are aligned with prevailing international rules, and optimize the environment for opening up and cooperation.

In March 2025, the General Office of the State Council issued the Guideline on Further Strengthening Trade Policy Compliance, which suggested that compliance assessment should be a compulsory precondition for the release of trade policies. In the process of decision-making on trade policies, the State Council departments, the people’s governments at the county level and above, and the relevant departments should adhere to the principle of “who formulates, who evaluates”, conducting compliance assessment of the trade policies, to ensure that they comply with the WTO rules and China’s accession commitments.

2. China Has Rigorously Fulfilled the Commitments on Tax Reduction upon Accession to the WTO

Upon acceding to the WTO, China made extensive and substantial tariff reduction commitments. The Chinese government has honored its commitments, and all the tariff reduction commitments for goods were fulfilled by 2010. The overall tariff level has been reduced from 15.3 percent in 2001 to 9.8 percent. In terms of WTO-bound tariff rates, China’s overall tariff level is approaching the average bound tariff rate of developed members (9.4 percent).

China pursues an opening-up strategy that emphasizes mutual benefit and win-win outcomes. In recent years, it has actively expanded imports and taken repeated and substantial steps to reduce import tariff rates at its own initiative. In July 2023, with the eighth reduction in tariffs on products under the expanded Information Technology Agreement, China’s overall tariff level saw a further drop to 7.3 percent. In 2024, China further announced that it would grant zero-tariff treatment for 100 percent tariff lines to all the least developed countries that have diplomatic relations with China. This fully demonstrates China’s firm commitment to promoting opening up and integrating into the global economy. China’s comparatively low tariff levels create extensive market opportunities for high-quality global products, while providing a diverse range of choices for domestic consumers. Moreover, these efforts contribute to the development of global industrial and supply chains while driving progress in trade and investment liberalization as well as economic globalization.

3. China Has Provided Subsidies Within a Reasonable Range in Compliance with WTO Rules

Subsidies are significant policy instruments for developing members to advance the United Nations’ Sustainable Development Goals and achieve the WTO’s overarching objectives of fostering inclusive development and improving living standards. A joint report released by the WTO Secretariat and other international institutions in April 2022 pointed out that subsidies are common in all sectors, used by countries at all stages of development.

Upon joining the WTO, China pledged to refrain from maintaining or granting export subsidies for agricultural products and made commitments regarding agricultural domestic support and industrial subsidies that surpass those of the average developing members. Since its accession, China has strictly adhered to all WTO subsidy discipline and promptly submitted subsidy notifications to the WTO. In June 2023, China submitted the 2021-2022 subsidy policy notification, involving 69 central and 385 local government subsidy policies, covering all provincial-level administrative regions. In July 2024, China submitted its notifications regarding domestic support for agriculture for the year 2022, aligning its notification year with those of major developed members such as the US (market year 2022/2023) and the EU (market year 2021/2022).

China is committed to establishing and improving a fiscal subsidy system in line with international practice, and promoting the transformation of industrial policies from differentiated and selective to inclusive and functional. The Chinese government prioritizes market-oriented and indirect guiding measures, such as public services, technical standards, and skills training to support areas of market failure, including technological research and innovation, the development of small and medium-sized enterprises, green energy efficiency, and the establishment of public service systems. By offering inclusive support across industries, these measures aim to stimulate the vitality of market entities, promote fair competition, and reinforce the socialist market economy system. For instance, it implements preferential policies in personal income tax, corporate income tax, resource tax, property tax, and urban land use tax for eligible self-employed businesses and small enterprises with slim profit margins.

To better leverage the role of subsidies in promoting development, China is open to discussions on industrial subsidies within the framework of the WTO. However, such discussions should define their focus, objectives, format, and boundaries in order to prevent them from devolving into sweeping discussions on state intervention or industrial policy, and, most importantly, to ensure they respect the economic systems and development paradigms of member states.

Some persons have accused China of abusing its “overcapacity”, asserting that macroeconomic imbalances and “non-market economic behaviors” such as subsidies have resulted in “overcapacity” in China, thereby disrupting international markets and undermining employment and supply chain resilience in other countries. China maintains that such accusations are both unreasonable and factually incorrect. From the perspective of market economy principles, supply and demand are fundamental and intrinsically linked components of market dynamics. While equilibrium between supply and demand is a transient and relative state, disequilibrium is pervasive and dynamic. International trade emerges and progresses based on the comparative advantages of countries, fostering international specialization and cooperation and thereby increasing global economic efficiency and benefits. The imposition of restrictions on Chinese goods exports and investment cooperation, citing “overcapacity” and other pretexts, constitutes overt trade protectionism. This artificial intervention and fragmentation of the global market will inevitably destabilize global industrial and supply chains, leading to redundant development and genuine overcapacity. The employment of restrictive measures predicated on unsubstantiated allegations and labeling will only impede cooperation, and it will ultimately prove ineffectual.

4. China Has Continued to Improve the Business Environment

The Third Plenary Session of the 20th CPC Central Committee emphasized that the market plays the decisive role in resource allocation and the government better fulfills its role, that economic entities under all forms of ownership have equal access to factors of production as required by law, that they compete in the market on an equal footing, that they are protected by the law as equals, thus enabling them to complement each other and develop side by side, and that the regulations and practices impeding the development of a unified national market and fair competition will be reviewed and abolished. The Chinese government has aligned itself with international rules through a series of systematic reforms and progressively optimized the business environment, providing a more transparent, fair, and predictable environment for global enterprises.

Continuously expanding access for foreign investment. In July 2017, the negative list management system for foreign investment was implemented nationwide. In 2019, the Foreign Investment Law was enacted, introducing a system of pre-establishment national treatment plus negative list for foreign investment. This legislation formally established the principle of “equal treatment for domestic and foreign investment”, prohibited forced technology transfer, and strengthened intellectual property protection, providing legal certainty for foreign-funded enterprises. To attract more foreign investment, China has further improved the business environment by ensuring foreign-funded enterprises’ participation in government procurement activities, supporting their equal involvement in the formation of standards, and granting them equal access to support policies, to provide a further boost to foreign investment confidence. From 2017 to 2024, China reduced the number of items on the national negative list for foreign investment from 93 to 29, and all restrictions on foreign investment in the manufacturing sector were lifted. In 2024, China launched more pilot programs to expand opening up in the value-added telecommunications and medical sectors, further expanding foreign investment access to the service industry. The Action Plan for Stabilizing Foreign Investment came into effect in 2025, sending a strong signal of further opening up. Meanwhile, efforts were actively made to promote foreign investment and effectively address the concerns of foreign-funded enterprises.

Fostering a level playing field in the market. In 2022, China released the Guideline on Accelerating the Construction of a Unified National Market, explicitly requiring the comprehensive removal of preferential policies that discriminate against foreign-funded enterprises and enterprises from other regions, as well as those that enforce local protectionism. In June 2024, the State Council released the Regulations on Fair Competition Review, stipulating that policy measures shall not contain provisions affecting production and operational costs without prior authorization, which includes the prohibition of granting to specific operators tax preferences, special fiscal rewards or subsidies, or preferential treatment in terms of factor acquisition, administrative and public service charges, government-managed funds, and social insurance fees. The Chinese government is working on the cleanup of relevant preferential policies, such as special fiscal rewards or subsidies, while accelerating the establishment of a system aligned with international rules to promote high-quality economic and social development.

Treating domestic and foreign-funded enterprises equally in taxation. In recent years, China has implemented orderly reforms of its tax system. It has optimized the tax structure and accelerated the implementation of the principle of statutory taxation, with the aim of capitalizing on taxation’s crucial role in boosting high-quality development and promoting social fairness and justice.

– Equal treatment for domestic and foreign-funded companies in tax policy. Regardless of ownership type, all enterprises within China’s territory now operate under the same tax laws and tax rates. Meanwhile, eligible foreign-invested companies and projects can all enjoy tax incentive policies in accordance with relevant regulations.

– Equal treatment for domestic and imported goods. China imposes tariffs on imported goods in accordance with relevant WTO rules as well as domestic laws and regulations. In addition, as a move to embody the principle of tax fairness, imported goods are subject to value-added tax (VAT), and consumption tax is imposed on specific consumer goods. However, VAT can be credited in subsequent transactions, with the tax burden being passed down the supply chains. For domestically produced goods, VAT is levied at production, circulation, and other stages, while consumption tax applies to certain goods at the specific stage of production and circulation. Both the scope of taxation and applicable tax rates are entirely consistent for imported and domestic goods, ensuring no discriminatory treatment.

Many economies, including China, Japan, the ROK, and the EU, implement a turnover tax system and levy VAT or consumption tax at the import stage. This practice is a conventional approach widely implemented in many countries, which aligns with both taxation principles and international norms. In contrast to economies with turnover taxes, the US employs a direct tax system such as sales tax, which is imposed directly on end consumers rather than importers. This distinction stems from the contrasting tax systems of different countries, and VAT or consumption tax should not be misinterpreted as an additional “discriminatory” or “extraterritorial” tax on imported goods imposed by economies with a turnover tax system such as China, Japan, the ROK, the EU, and others. Therefore, there are no grounds for the US to cite such distinctions as justification for imposing additional tariffs on imports from such countries.

– Equal treatment for Chinese and foreign nationals in terms of individual income tax. It is a common international practice for a country to levy individual income tax on foreign nationals working within its territory. According to China’s individual income tax law, resident individuals are required to pay tax on their income earned from both within and outside China, while non-resident individuals only need to pay tax on their income earned within China. Regardless of nationality, the distinction between resident and non-resident individuals is whether they have a residence in China or whether they have resided in China for 183 days or more in a tax year. Meanwhile, foreign nationals working in China can enjoy preferential policies, such as tax-exempt fringe benefits.

Actively promoting the development of digital trade. China has established 12 national digital service export bases nationwide, and introduced policies and measures to support the innovative development of these bases. Since 2015, China has set up 165 cross-border e-commerce comprehensive pilot zones in 31 provincial-level administrative units, achieving integrated development of industrial digitalization and trade digitalization. In addition, China upholds law-based cyberspace governance and welcomes international internet companies to develop in China, provided they comply with China’s laws and regulations and offer secure, reliable products and services.

In 2024, China issued the Guideline on the Reform and Innovative Development of Digital Trade, further advancing institutional opening up in digital trade. Key measures include relaxing market access in the digital sector, facilitating and regulating cross-border flows of data, and building platforms for the high-standard opening up of digital trade.

Regarding data cross-border transfer, China, in 2024, based on the realities of cross-border data transfer security management, issued the Provisions on Facilitating and Regulating Cross-border Data Flow, which further optimizes the regulatory environment for cross-border data flows while authorizing pilot free trade zones around the country to formulate their own negative lists for cross-border data flows. The pilot free trade zones in Tianjin, Shanghai and Beijing have taken the lead in piloting the formulation of negative lists for cross-border data flows, which clarifies the boundaries of restricted data, reduces corporate compliance costs, and strengthens policy predictability.

V. Unilateralism and Protectionism Undermine China-US Economic and Trade Relations

As a key builder and participant of the international economic order and multilateral trading regime after World War II, the US should take the lead in observing multilateral trade rules and properly handle trade friction with other WTO members through the dispute settlement mechanism within the WTO framework. However, in recent years, the US has resorted to unilateralism and economic hegemony, adopted approaches of “small yard, high fence” and decoupling and severing supply chains, and provoked international trade friction around the world. This has not only undermined the interests of China and other WTO members, but also jeopardized the international reputation of the US itself. And above all, the US has shaken the foundations of the global multilateral trading regime, which will ultimately damage the long-term interests of the US.

1. Rescinding China’s Permanent Normal Trade Relations (PNTR) Status Undermines the Foundation of China-US Economic and Trade Relations

In April 2025, the White House issued the Report on the America First Trade Policy Executive Summary, which carefully reviewed legislative proposals related to China’s PNTR status and advised the president accordingly. The PNTR status, or granting the Most Favored Nation (MFN) treatment permanently, is the ballast of China-US economic and trade relations. The US push to revoke China’s PNTR status represents a clear instance of unilateralism and trade protectionist practices, which violates WTO rules and undermines China-US relations and the global economic order.