Police have arrested 139 people from across Hong Kong for their alleged involvement in investment, dating and job scams and other types of fraud that have resulted in a total loss of over HK$131 million ($16.9 million).

Of the suspects, 100 are men and 39 are women. Aged between 19 and 73, they include domestic helpers, waiters, construction workers and unemployed individuals.

READ MORE: Woman held for allegedly luring HK residents to SE Asian scam farm

Believed to hold “mule accounts”, functioning as intermediaries to receive and transfer illegal money, they were detained during a crackdown on money laundering and scams between March 27 and Thursday, the police revealed at a news conference on Friday.

The largest single loss among the cases for which the individuals were arrested was suffered by a 50-year-old businesswoman who, after falling victim to an investment scam promising high returns, transferred HK$33 million to fraudsters through 40 transactions over two months.

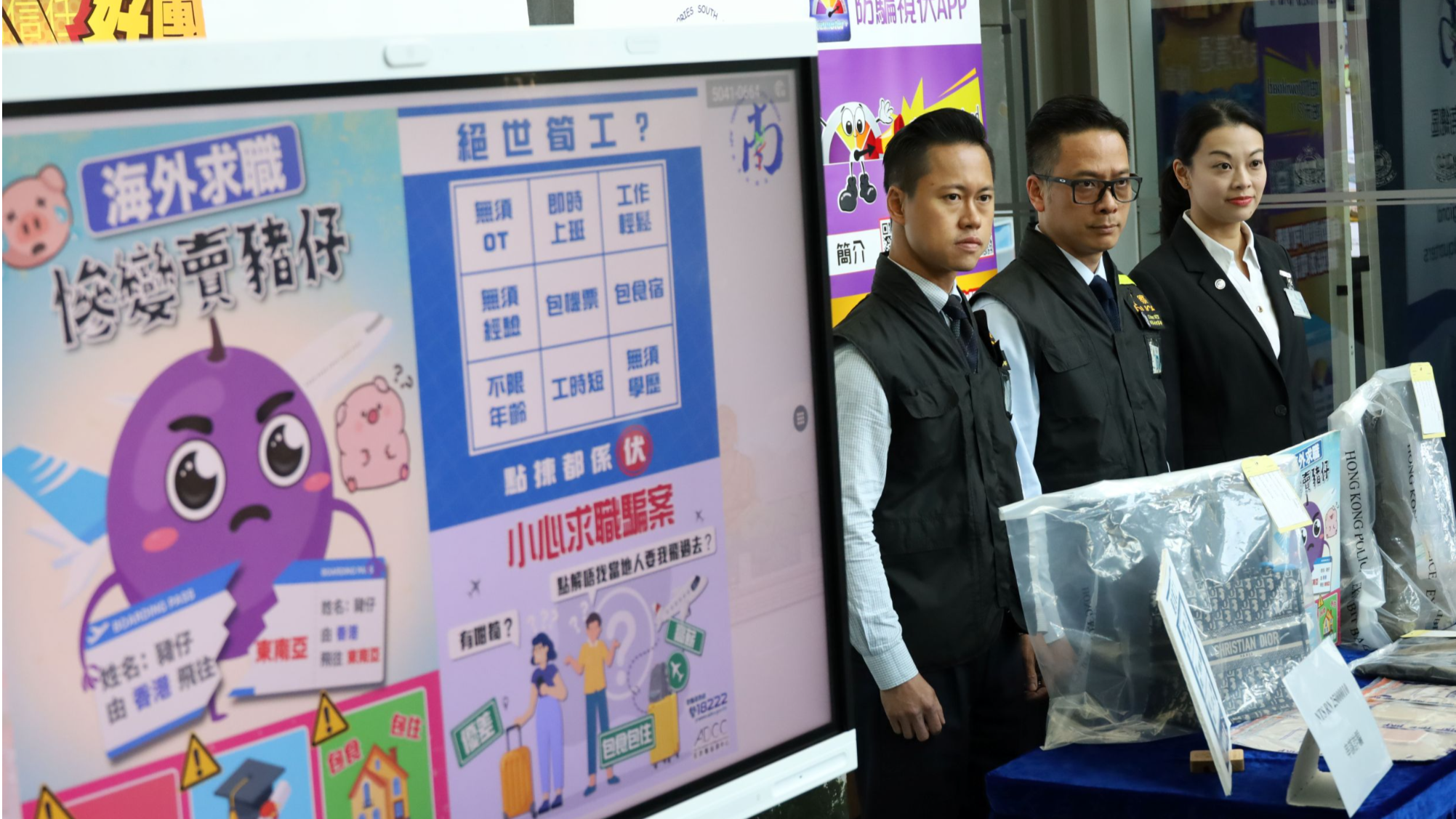

The crackdown operation, codenamed “Firetrace”, was led by the Kowloon West Regional Police. The region logged 1,742 fraud cases in the first three months of 2025, a 12 percent increase over the same period last year.

ALSO READ: HK acts to thwart scammers preying on mainland students

Apart from investment, job seeking, romance and other common types of scams, police also found that fraudsters have been impersonating well-known travel agencies or concert organizers on social platforms to sell discount hotel rooms or concert tickets, hoping to deceive people into transferring money to accounts belonging to fraud syndicates.

Police have urged the public to stay vigilant when transferring money, especially when a company asks for payments into personal accounts or multiple accounts. Members of the public are also encouraged to download police's one-stop anti-scam app, Scameter+, to identify suspicious phone numbers, bank accounts and websites.

To further curb money laundering activities, the Hong Kong authorities and local banks on Thursday announced a series of cross-sector initiatives to help lenders identify “mule accounts” through enhanced information exchanges and amendments to laws.

READ MORE: Residents need effective alerts against cyberfraud

Money laundering carries serious penalties including up to 14 years behind bars and a fine of up to HK$5 million upon conviction.

Contact the writer at stacyshi@chinadailyhk.com