Visitors look at an electronic ticker at the Tokyo Stock Exchange (TSE), operated by Japan Exchange Group Inc. (JPX), in Tokyo, Japan, on Oct 29, 2020. (KIYOSHI OTA/BLOOMBERG)

Visitors look at an electronic ticker at the Tokyo Stock Exchange (TSE), operated by Japan Exchange Group Inc. (JPX), in Tokyo, Japan, on Oct 29, 2020. (KIYOSHI OTA/BLOOMBERG)

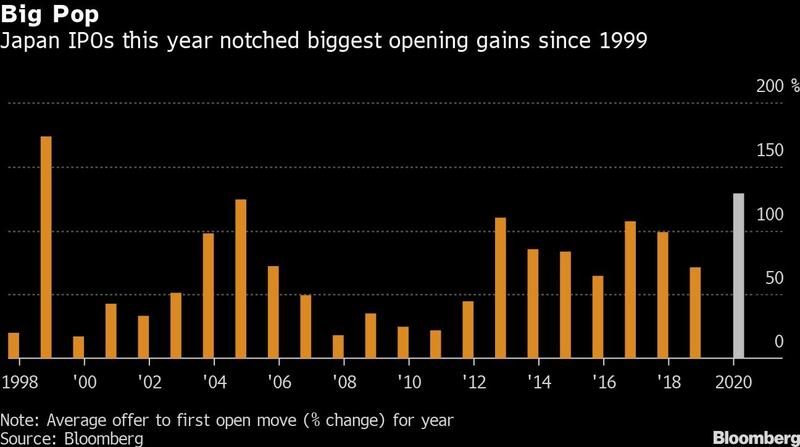

In a surprisingly strong year for initial public offerings globally, Japan’s 2020 market debutantes enjoyed their best opening share performances since the dot-com bubble era, helped by a groundswell of retail investors hungry for tech issues.

The average initial pop for IPOs in the Japanese market this year was nearly 130 percent, the most since 1999. The best performer was artificial-intelligence systems firm Headwaters Co, which jumped 1,090 percent in its first trade. Image-recognition software maker Ficha Inc came second with an 806 percent gain, followed by internet-of-things developer Tasuki Corp, which rose 655 percent.

READ MORE: World IPO duel – Can HK remain the oasis it is?

Backed by easy-money policies and growth in individual investing, new listing markets have been frothy this year despite the coronavirus market turmoil, as seen in the dramatic gains of Airbnb Inc and DoorDash Inc. in US debuts earlier this month. Stay-at-home tech plays and cloud computing upstarts especially found 2020 to be the perfect time to tap the public markets.

“The reason for the large opening gains is that there were many IPOs of stocks that were relevant to the times,” such as Japan’s digitalization push, said Hideyuki Suzuki, a general manager at SBI Securities Co. With low interest rates expected to continue for some time, the IPO market should continue to attract funds, he said.

Japanese stocks overall lagged in the pandemic recovery, with the Topix not erasing its year-to-date loss until November, months after US and Asian peers. The Tokyo Stock Exchange’s Mothers Index of startups was a notable exception, with a gain of around 30 percent on the year, thanks to its heavy weightings of biotech and Internet names, as well as the surge in retail investing.

The average initial pop for IPOs in the Japanese market this year was nearly 130 percent, the most since 1999. The best performer was artificial-intelligence systems firm Headwaters Co, which jumped 1,090 percent in its first trade

A total of 94 companies went public in Japan in 2020, up by four from the previous year, even with a pandemic-driven drought from early April to late June. About 70 percent were listed on Mothers. The overall value was small, with firms raising a total of US$3.3 billion, and no single deal worth more than half a billion dollars. That compares with US$181 billion raised in the US and US$51 billion in Hong Kong.

Toshiba Corp-affiliated chipmaker Kioxia Holdings Corp in September decided to postpone what would have been Japan’s largest offering of the year, at up to US$2.9 billion, due to market uncertainty amid US-China trade friction. That made mushroom cultivator Yukiguni Maitake Co, which raised US$409 million, the biggest Tokyo IPO of 2020, followed by musical instruments maker Roland Corp and business consulting provider Direct Marketing MiX Inc.

ALSO READ: Tokyo Stock Exchange CEO to quit over system failure

In the absence of blockbuster deals with international appeal, local retail traders helped pick up the slack. Individuals accounted for 20 percent of total trading value on the Tokyo Stock Exchange this year, up from about 16 percent in 2019.

“IPOs have helped drive retail investor turnover,” said Shoichi Arisawa, an analyst at Iwai Cosmo Securities Co. “It’s helped money come back to growth stocks and given life to the startup market.”

In 2021, investors will be watching whether Kioxia decides to try its luck again. So far one company has announced IPO plans for next year, with laser-based chip solutions firm QD Laser Co planning to list in February.