People walk at Gantry Plaza State Park in Queens, New York, on July 19, 2022. (YUKI IWAMURA / AFP)

People walk at Gantry Plaza State Park in Queens, New York, on July 19, 2022. (YUKI IWAMURA / AFP)

WASHINGTON - The US economy unexpectedly contracted in the second quarter, with consumer spending growing at its slowest pace in two years and business spending declining, which could fan financial market fears that the economy was already in recession.

The second straight quarterly decline in gross domestic product reported by the Commerce Department on Thursday largely reflected a more moderate pace of inventory accumulation by businesses because of ongoing shortages of motor vehicles.

The second straight quarterly decline in GDP meets the standard definition of a recession

The second straight quarterly decline in gross domestic product reported by the Commerce Department on Thursday largely reflected a more moderate pace of inventory accumulation by businesses because of ongoing shortages of motor vehicles

Slowing consumer spending has also left retailers with little appetite to accumulate more stock. The back-to-back decline in GDP against the backdrop of aggressive monetary policy tightening by the Federal Reserve could force the US central back to scale back its massive interest rate increases.

ALSO READ: US inflation: Fed jacks rates again, Powell vows no surrender

"The economy is highly vulnerable to slipping into a recession," said Sal Guatieri, a senior economist at BMO Capital Markets in Toronto. "That might discourage the Fed from ramming through another large rate hike in September."

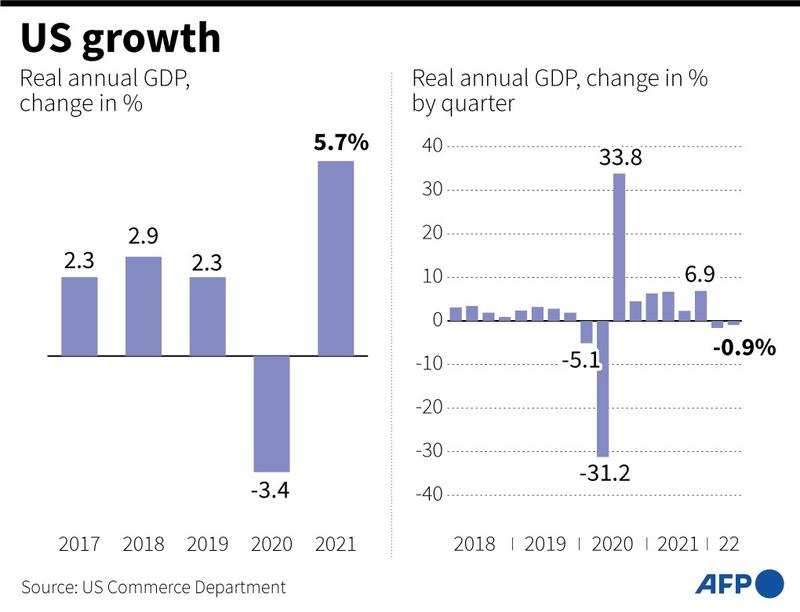

Gross domestic product fell at a 0.9 percent annualized rate last quarter, the government said in its advance estimate of GDP.

Economists polled by Reuters had forecast GDP rebounding at a 0.5 percent rate. Estimates ranged from as low as a 2.1 percent rate of contraction to as high as a 2.0 percent growth pace. The economy contracted at a 1.6 percent pace in the first quarter.

The second straight quarterly decline in GDP meets the standard definition of a recession.

ALSO READ: US recession fears darken outlook for global growth

But the National Bureau of Economic Research, the official arbiter of recessions in the United States defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators."

Job growth averaged 456,700 per month in the first half of the year, which is generating strong wage gains. Still, the risks of a downturn have increased. Homebuilding and house sales have weakened while business and consumer sentiment have softened in recent months.

US stocks were lower. The dollar was steady against a basket of currencies. US Treasury prices rose.

Demand stalls

The White House is vigorously pushing back against the recession chatter as it seeks to calm voters ahead of the Nov 8 midterm elections that will decide whether President Joe Biden's Democratic Party retains control of the US Congress.

The White House is vigorously pushing back against the recession chatter as it seeks to calm voters ahead of the Nov 8 midterm elections that will decide whether President Joe Biden's Democratic Party retains control of the US Congress

Treasury Secretary Janet Yellen is scheduled to hold a news conference on Thursday to "discuss the state of the US economy." While the labor market remains tight, there are signs it is losing steam.

A separate report from the Labor Department on Thursday showed initial claims for state unemployment benefits decreased 5,000 to a seasonally adjusted 256,000 for the week ended July 23. Economists polled by Reuters had forecast 253,000 applications for the latest week.

Jobless claims remain below the 270,000-350,000 range that economists say would signal an increase in the unemployment rate. With the economy struggling, the Fed could slow its pace of rate hikes, though much would depend on the path of inflation, which is way above the US central bank's 2 percent target.

READ MORE: Yellen: US economy slowing, but recession not inevitable

The Fed on Wednesday raised its policy rate by another three-quarters of a percentage point, bringing the total interest rate hikes since March to 225 basis points. Fed Chair Jerome Powell acknowledged the softening economic activity as a result of tighter monetary policy.

The trade deficit narrowed sharply last quarter, thanks to record exports, adding 1.43 percentage points to GDP growth. That ended seven straight quarters in which trade was a drag on growth.

While businesses continued to rebuild inventory, the pace slowed significantly from what was seen in the fourth quarter of 2021 and the first three months of this year. Inventories sliced off 2.01 percentage points from GDP.

Consumer spending, which accounts for more than two-thirds of US economic activity, grew at a 1.0 percent rate. That was the slowest since the second quarter of 2020 and a step-down from the first-quarter's moderate 1.8 percent pace.

Business spending contracted, pulled down by weak investment in equipment and nonresidential structures. Government spending was also soft, reflecting a sharp decline in non-defense outlays.

A measure of domestic demand - excluding trade, inventories and government spending - was unchanged, underscoring the significant loss of momentum in the economy. Final sales to private domestic purchasers account for roughly 85 percent of aggregate spending and increased at a 3.0 percent rate in the first quarter.

Residential investment contracted by the most since the COVID-19 recession two years ago as higher mortgage rates weighed on homebuilding as well as homes sales, which reduced brokers' commissions.