China's AIGC products shine at home and abroad, and narrow gap with US rivals

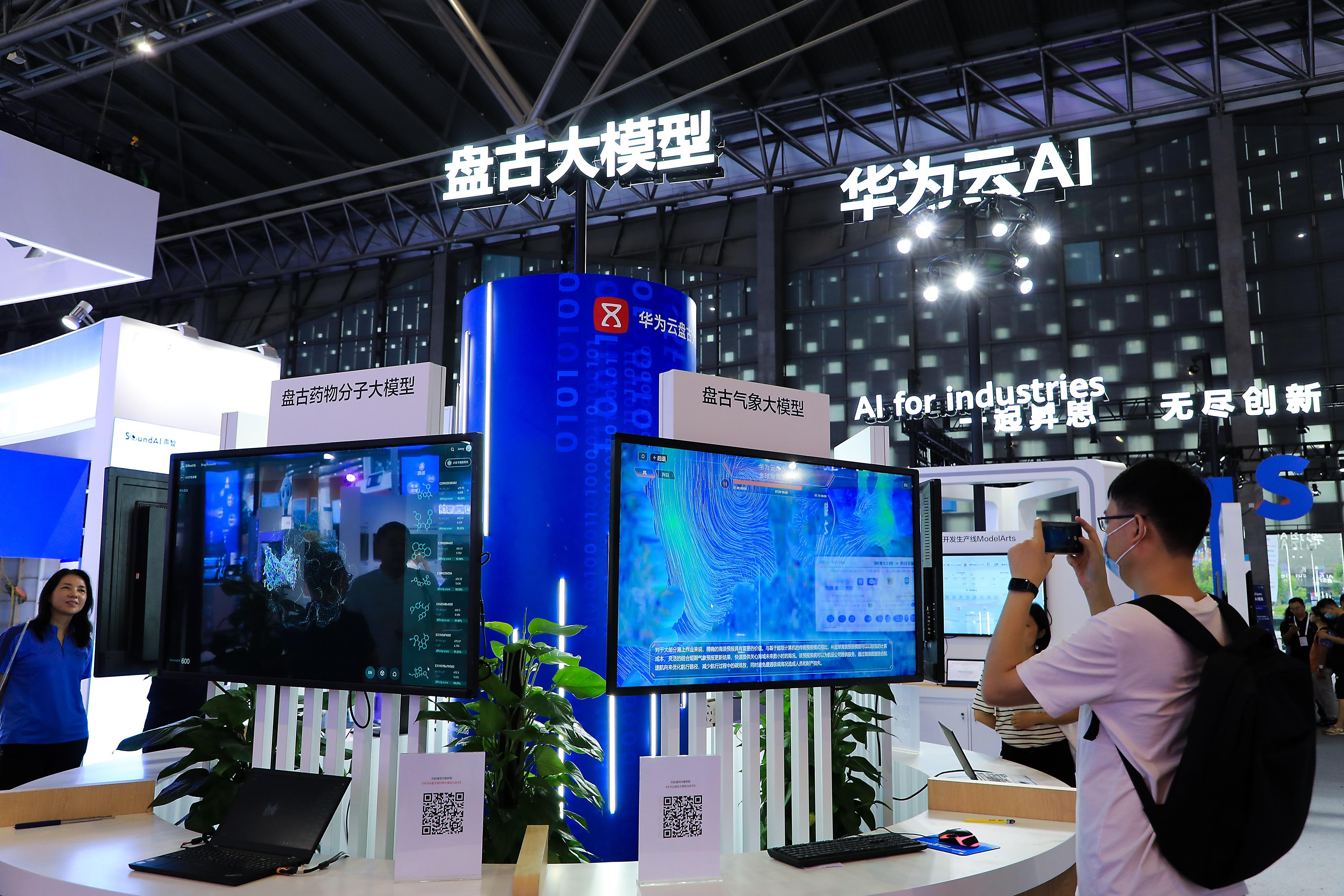

Visitors check out and take pictures of Huawei Pangu meteorological model during the 2023 World Artificial Intelligence Conference in Shanghai on July 8. (PHOTO PROVIDED TO CHINA DAILY)

Visitors check out and take pictures of Huawei Pangu meteorological model during the 2023 World Artificial Intelligence Conference in Shanghai on July 8. (PHOTO PROVIDED TO CHINA DAILY)

Miaoya Camera, an artificial intelligence-powered digital product for generating self-portraits online with a twist, was launched as a mini program on China's all-in-one killer app WeChat on July 17, just five months after a founding team of six Chinese software professionals conceptualized and developed the product. In contrast, top-end talent at OpenAI, a startup backed by, among others, Microsoft, took several years to develop ChatGPT.

During peak times, when over 6,000 people could line up online at the same time for their turn, some users wait for more than 15 hours to get their digital clone from Miaoya Camera.

China ... focuses more on applications. And Chinese companies are better at adapting technology to various industries and commercializing its various applications.

Zhou Yu, chairman of natural language processing products and services provider Beijing Fanyu Technology Co Ltd

Within a month of its launch, the market declared Miaoya Camera to be a potential disruptor of the niche AIGC market.

Zhang Yueguang, product manager of Miaoya Camera, said, "The market performance (of the portrait generator) is definitely far beyond our expectation."

Wang Peng, a senior researcher at the Beijing Academy of Social Sciences, said though Miaoya Camera and ChatGPT are different types of digital products, the former's success shows China has an edge in developing AI-generated content or AIGC.

"The US may have wrested lead with ChatGPT in the AIGC race, but Miaoya Camera offers a glimpse of China's potential to catch up with the US," Wang said.

The product's success, industry experts said, shows China can not only catch up with the United States in mobile apps and enterprise applications, but create its own edge in certain niches of generative AI, besides hoping to lead the market that consultancy IDC expects will be worth $26 billion by 2026.

That figure refers to just the China market. A Goldman Sachs Research report stated that breakthroughs in generative AI have the potential to bring about sweeping changes to the global economy, and could drive a 7 percent, or almost $7 trillion, increase in global GDP, lifting productivity growth by 1.5 percentage points over the next 10 years.

Given that the stakes are high, China and the US appear to be using different approaches to the development of large language models that drive generative AI, said Zhou Yu, chairman of Beijing Fanyu Technology Co Ltd, a leading provider of natural language processing products and services.

Zhou said: "The US puts more emphasis on the research and development of underlying technology and its groundbreaking innovations. The US is a world leader in both hardware and deep learning frameworks.

"China, on the other hand, focuses more on applications. And Chinese companies are better at adapting technology to various industries and commercializing its various applications. They are more flexible in creating personalized products and innovations, especially in niche sectors."

Visitors check out the display screens of the AI-generated content solution from Ant Group during the 2023 World Artificial Intelligence Conference in Shanghai on July 7. (CHEN MENGZE / FOR CHINA DAILY)

Visitors check out the display screens of the AI-generated content solution from Ant Group during the 2023 World Artificial Intelligence Conference in Shanghai on July 7. (CHEN MENGZE / FOR CHINA DAILY)

Proof of the emerging trend is that Chinese tech heavyweights such as Baidu Inc, Alibaba Group Holding Ltd, Tencent Holdings Ltd and JD have all forayed into this field already. Data from the Internet Society of China showed the country has already developed more than 80 LLMs, all potential rivals to ChatGPT.

Besides supportive policies, what is driving the trend in China is "a well-rounded mobile internet market and ecosystem, where a large number of users are willing to try new technologies and can be easily attracted via social media like WeChat", said Wang.

Sensing the potential for high growth, Tencent Cloud, a subsidiary of WeChat owner Tencent, launched its industry-specific LLM in June. The next month, Chinese e-commerce giant JD unveiled its own industry-specific LLM called Chat-Rhino that is said to be capable of serving a wide range of fields, including retail, logistics, finance and health.

Compared with universal LLMs like ChatGPT, industry-specific LLMs refer to industrial versions of ChatGPT focused on niche sectors. They can better leverage industry data to offer more targeted solutions.

"General or universal LLMs are mostly trained using information in the public domain that may contain errors, rumors and biases, and lack the professional know-how and industry data," said Dowson Tong, Tencent's senior executive vice-president and CEO of the company's cloud and smart industries group.

Data from such models contain too much "noise" and are likely to cause huge legal liabilities or public relations crises. Thus, companies need more industry-specific models, Tong said.

He said Tencent's LLM has covered 10 major areas, including finance, culture, tourism, government affairs, media and education, and is able to offer 50 different kinds of solutions.

"In addition, the larger the model, the higher its cost of training. Companies also tend to choose a suitable model at a reasonable cost," Tong said.

In China, efforts to develop rivals to ChatGPT receive support from even local governments. According to Dai Qionghai, an academician at the Chinese Academy of Engineering, recent months have seen real money, in the form of investments by local governments, flow into AIGC, LLMs and related sectors.

This aspect is a potential game-changer that could deepen the tech competition between China and the US, Dai said.

According to a report by the Institute of Scientific and Technical Information of China, which is affiliated with the Ministry of Technology, more than 14 provincial regions have contributed to the R&D of LLMs. And 38 LLMs are from Beijing, followed by 20 from Guangdong province.

An employee from Tencent introduces the 10 trends of the age of large model during the 2023 World Artificial Intelligence Conference in Shanghai on July 7. (PHOTO PROVIDED TO CHINA DAILY)

An employee from Tencent introduces the 10 trends of the age of large model during the 2023 World Artificial Intelligence Conference in Shanghai on July 7. (PHOTO PROVIDED TO CHINA DAILY)

Beijing has launched a package of supportive policies to drive the innovative development of AIGC.The municipal government has also encouraged local companies and government departments to "purchase and use safe LLMs and related services", Dai said.

For their part, Shanghai, Shenzhen, Hangzhou, Nanjing, Suzhou and Chengdu have all unveiled supportive policies to drive LLM development, in terms of computing power, data and ecosystem.

Shanghai, for instance, will provide support for the companies' computer power investment to drive the R&D of LLMs. Shenzhen plans to launch a guideline for open-source apps and sharing of public data by the end of this year.

There is a good reason, or concern, behind such policymaking. "The US continues to move forward. If China can't make its own universal LLM in the second half of this year, we might not even be able to see the 'taillights of cars' in the future," said Yu Linwei, deputy head of Shanghai's Xuhui district, at the World Artificial Intelligence Conference held in Shanghai in July.

The China Electronics Standardization Institute, which is part of the Ministry of Industry and Information Technology, the country's top regulator of industries, said a national standard for LLMs would be implemented soon.

It has enlisted internet search leader Baidu Inc, telecom giant Huawei Technologies Co, cybersecurity firm 360 Security Technology and e-commerce company Alibaba Group, to lead in the development of the LLM standard.

"More efforts are needed from the government to increase investment so that China can truly stand at the forefront," Dai said.

Chinese tech heavyweights' chatbots launched to rival ChatGPT have higher requirements for computing capacity for LLM training, he said.

In a report, HSBC analysts said a model at the level of OpenAI's GPT-3 requires at least 1,000 AI chips of Nvidia to complete one 23-day round of training; so, demand for AI graphics processing units, which can process many pieces of data simultaneously, will likely grow by more than 40 percent in China this year.

But high-performance computer chips, or semiconductors, are now at the center of tension between Washington and Beijing. The US government in October announced export bans aimed at restricting China's access to high-end chips.

"US companies like Nvidia currently have the lead in developing AI chips and few Chinese companies can compete against ChatGPT given the export restrictions," said Pascale Fung, director of the Center for Artificial Intelligence Research at the Hong Kong University of Science and Technology, in an interview.

Given the complex scenario, what will the future LLM landscape look like? At the annual conference of the Beijing Academy of Artificial Intelligence in June, OpenAI CEO Sam Altman emphasized the importance of collaboration between US and Chinese researchers.

Such collaboration, Altman said, can help mitigate the risks of AI systems, against a backdrop of escalating competition between Washington and Beijing in technology. "China has some of the best AI talent in the world and, fundamentally, given the difficulties in solving alignment for advanced AI systems, this requires the best minds, from around the world."