Experts call for consumption boost, more expansionary fiscal policy next year amid solid rebound

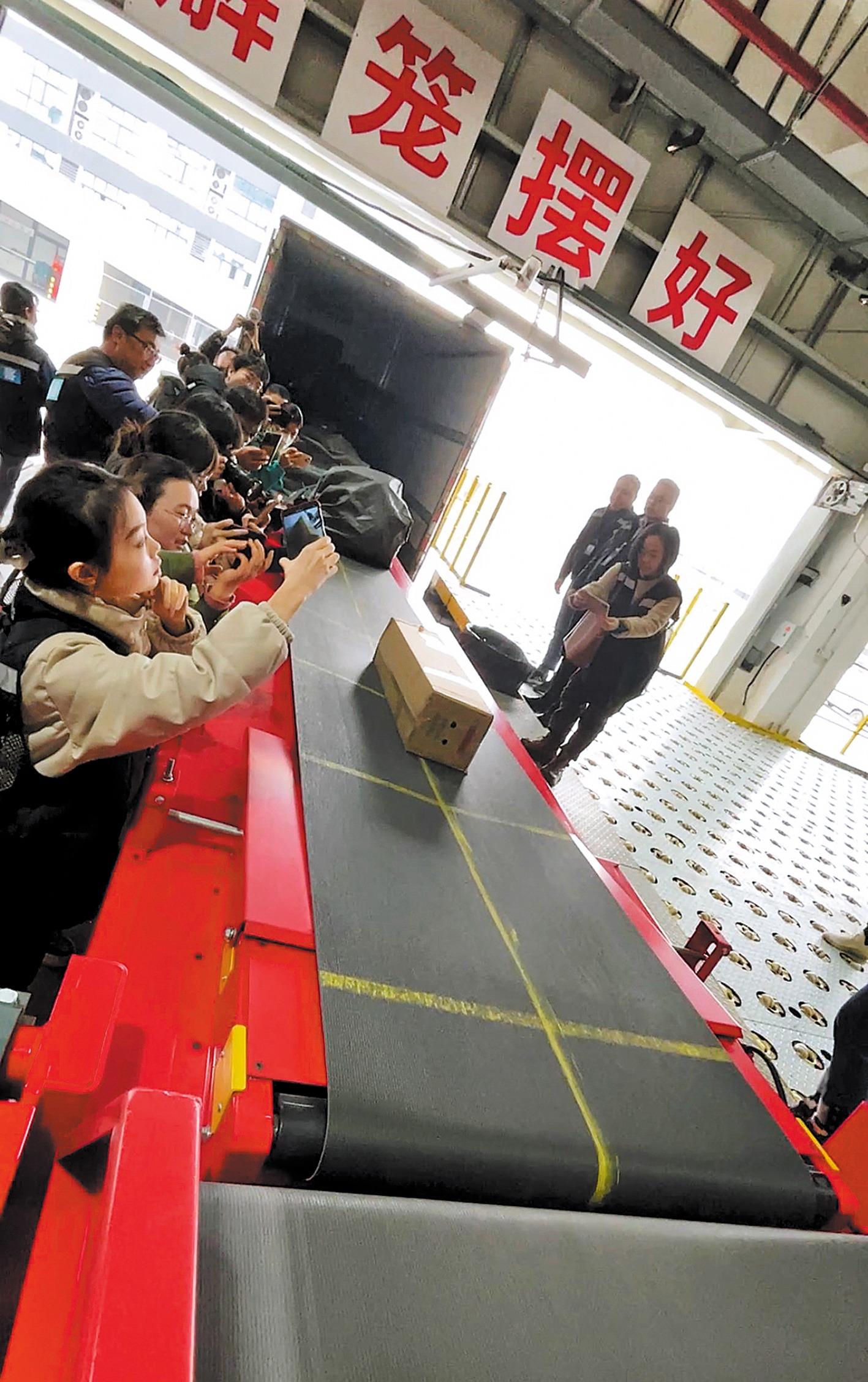

The 120 billionth parcel in China this year, containing flowers, is unloaded from a truck at a distribution center in Chengdu, Sichuan province, on Dec 5. The parcel delivery sector’s resilience reflects the nation’s stable and positive economic momentum. (LUO WANGSHU / CHINA DAILY)

The 120 billionth parcel in China this year, containing flowers, is unloaded from a truck at a distribution center in Chengdu, Sichuan province, on Dec 5. The parcel delivery sector’s resilience reflects the nation’s stable and positive economic momentum. (LUO WANGSHU / CHINA DAILY)

The better-than-expected rebounds in China’s services and manufacturing sectors in November, as shown by a private-sector index, solidify the positive trajectory of the country’s economic recovery, suggesting that government support is taking effect and that business activities are picking up steam, experts said.

That said, as challenges and uncertainties remain, they called for continued efforts to further shore up domestic consumption and scale up effective investment, thus boosting market expectations and sustaining stable economic growth.

The Caixin services purchasing managers’ index (PMI) rose to 51.5 in November from October’s 50.4, registering a three-month high, according to a report released on Dec 5 by media group Caixin and information provider IHS Markit. The 50-point mark separates expansion from contraction in activity.

Citing the previously released Caixin manufacturing PMI for last month, which rose by 1.2 percentage points to 50.7 and bounced back to expansionary territory, the report noted that the rebounds in both sectors have propelled the Caixin composite PMI for November to 51.6 from 50 in October, reaching a new high for the past three months.

The twin expansions in November signal a positive outlook for China’s macroeconomy, which is attributable to steady consumer spending, solid industrial production, and improved market expectations, said Wang Zhe, a senior economist at Caixin Insight Group.

Although the growth in new orders for services in November remained modest, it recorded the highest level since September, which surveyed businesses attributed to improved market fundamentals, the report said, adding that insufficient clients, however, would still put a drag on its overall growth.

Additionally, the services sector in China is showing signs of increased market confidence, as some enterprises anticipate improvements in the economic landscape and a rise in customer numbers, according to the report.

The pressures still linger in the services sector as the reading for employment fell into the contraction zone for the first time since February and prices charged by services grew at a slower pace, the report stated.

The foundation of recovery needs further consolidation to ensure sustained growth, Wang said.

Temporary measures such as discounts, promotions, and the distribution of consumption vouchers are good, but equally important is the task of ensuring stable job creation and income expectations. Such a fundamental step can foster a robust and enduring consumer base and unleash the potential of domestic demand, said Cai Hanpian, a researcher at the National Economy Research Center under Peking University.

The anticipated improvement in economic indicators for December, fueled by the lower base effect, indicates that the annual growth objective of roughly 5 percent is likely to be met, notwithstanding the seasonal downward pressures facing the PMI for December, said Xiong Yuan, chief economist at Guosheng Securities.

Further rate cuts and a reduction in the reserve requirement ratio could be expected later this month, and China will likely pursue expansionary policies to bolster its economy next year, Xiong said.

Other experts agreed that China can adopt a more expansionary fiscal policy to underpin economic recovery amid multiple challenges including the downturn in the property market and stress from local government debts.

They suggested that the budgeted fiscal deficit rate next year should exceed the so-called red line of 3 percent, which China has retained for years, and could even reach 4 percent, while speaking on Dec 4 at the Central Economic Work Conference, usually convened every December to map out economic development priorities and set the tone for macroeconomic policy.

“After disruptions caused by COVID-19 in the past three years, lack of funds has become a problem for households, enterprises, and the government,” said Zhang Yansheng, chief researcher at the China Center for International Economic Exchanges.

“Even if the debt-to-GDP ratio next year reaches 3.8 percent, we can hardly view that as ‘stimulus’, because that’s what we need minimally to let households, enterprises, and local governments have adequate funds and boost market confidence,” Zhang added.

Experts have also called for better management of risks stemming from hidden debts of local governments raised by their funding vehicles and the real estate downturn.

Louise Loo, lead economist at Oxford Economics, said that the housing market correction process is much needed and probably still has two to three years more to run.

“China is fully confident and capable of properly responding to various financial risks and challenges by increasing vitality through reform and solving problems through development,” Li Yunze, head of the National Financial Regulatory Administration, said in an interview with Xinhua News Agency published on Dec 3.

Pan Gongsheng, governor of the People’s Bank of China, the country’s central bank, said the central bank will strengthen coordination with fiscal policy and continuously beef up support for major national strategies, key areas, and weak links.

It will provide low-cost medium-to-long-term funding to affordable housing projects and make full use of structural monetary policy tools to beef up support for small and micro businesses, green development, and technological innovation, Pan said on Dec 2 in an interview with Xinhua News Agency.

Pan also said that the central bank will provide medium- to long-term low-cost funding support to “three major projects”, including affordable housing.

The “three major projects” refer to the development of affordable housing projects, the redevelopment of shantytowns, and the construction of recreational facilities that can be easily converted into emergency structures (like makeshift hospitals during epidemics).

Following Pan’s interview, experts said pledged supplementary lending (PSL) is likely to be used in China to extend funding to affordable housing and shantytown redevelopment projects as the country’s policymakers ramp up support for the economy and seek to stabilize the troubled real estate market, experts said.

PSL is a monetary policy tool to provide policy banks with low-cost and long-term funding.

The PBOC may seek to support the real economy by further reducing interest rate levels, making better use of outstanding loans to facilitate economic restructuring, and easing local governments’ debt stress, experts noted.

The tone-setting Central Financial Work Conference in late October had urged quicker steps on the “three major projects” to build a new development model for the debt-laden real estate sector.

“Given that PSL has functioned well in driving credit expansion in specific areas, it is necessary to use the tool to expand the financing channels for ‘three major projects’,” said Lou Feipeng, a researcher at the Postal Savings Bank of China.

Elsewhere, China’s parcel delivery sector has set a record by handling more than 120 billion items this year, demonstrating its strong resilience and showcasing the country’s improving consumer market, the State Post Bureau said on Dec 5.

It is also a reflection of the nation’s stable and positive economic momentum, the bureau added.

“China has become the most dynamic express delivery market in the world, and the parcel delivery business in China has become a calling card of the country,” said Bian Zuodong, deputy head of the bureau’s market inspection department.

China’s parcel delivery sector continued to grow rapidly this year. Since March, the number of parcels handled each month has reached a record 10 billion. In 2013, the annual figure was under 9.2 billion.

Luo Wangshu in Chengdu contributed to this story.

Contact the writers at wangkeju@chinadaily.com.cn