(From left) MUFG Bank, Ltd Advisor to the President Hiroshi Watanabe, Saudi Arabia Assistant Minister of Investment Ibrahim Almubarak, United Arab Emirates Undersecretary of Ministry of Finance Younis Haji Al Khoori, Mashreq Group Group Chief Executive Officer Ahmed Abdelaal, President Director of Bank Mandiri Darmawan Junaidi, and Bank of Finland Institute for Emerging Economies Senior Advisor Laura Solanko attend a session titled "Global Spectrum – Opportunities from New Markets" during the Asian Financial Forum at the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

(From left) MUFG Bank, Ltd Advisor to the President Hiroshi Watanabe, Saudi Arabia Assistant Minister of Investment Ibrahim Almubarak, United Arab Emirates Undersecretary of Ministry of Finance Younis Haji Al Khoori, Mashreq Group Group Chief Executive Officer Ahmed Abdelaal, President Director of Bank Mandiri Darmawan Junaidi, and Bank of Finland Institute for Emerging Economies Senior Advisor Laura Solanko attend a session titled "Global Spectrum – Opportunities from New Markets" during the Asian Financial Forum at the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

Global financial industry leaders agree that better understanding of the regulatory environment, the adoption of new financial technologies and digitalization, and the partnership between the public and the private sector will be the three key strategies to harvest opportunities in new emerging markets.

They made their remarks at a panel discussion themed “Global Spectrum-Opportunities from New Markets” at the 17th Asian Financial Forum 2024 on Thursday.

Japanese bank MUFG Bank Advisor to the President Hiroshi Watanabe said in the last 20 to 30 years, banking and financial institutions from the United States and Europe have been active, but the situation has changed.

MUFG Bank, Ltd Advisor to the President Hiroshi Watanabe delivers a speech during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

MUFG Bank, Ltd Advisor to the President Hiroshi Watanabe delivers a speech during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

“We are going to have much more active operation of the banks and financial institutions in emerging markets and developing economies. We will have a much wider range of operation in the coming years,” the advisor noted.

ALSO READ: AFF: Investment in Chinese mainland market seen to rebound in '24

Laura Solanko, senior advisor at Bank of Finland Institute for Emerging Economies, highlighted the potential realignment of global trade flows, the link of labor markets to digitalization, and openness of economies, are leading to the growing importance of new emerging markets in the financial services segment.

“This process of diversifying or de-risking of trade relations actually opens up significant new opportunities for many emerging markets. These markets see the opening of new possibilities of joining the global trade and enhancing their positions, in particular the ASEAN countries, India, Middle East and Central and Eastern European countries,” Solanko said.

Bank of Finland Institute for Emerging Economies Senior Advisor Laura Solanko speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

Bank of Finland Institute for Emerging Economies Senior Advisor Laura Solanko speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

Ahmed Abdelaal, group CEO at Mashreq Group — a financial institution based in United Arab Emirates — said understanding the regulatory environment is very important.

“The key ingredient for any international expansion or growth is the regulatory environment, and working with regulators that are open to investment makes a huge difference. We are working with regulators especially when we are tapping into new markets in areas such as understanding market dynamics and building infrastructures,” the group CEO explained.

ALSO READ: AFF: HK, mainland to bolster financial regulatory cooperation

Representatives of the public sector highlighted the importance of public-private sector cooperation.

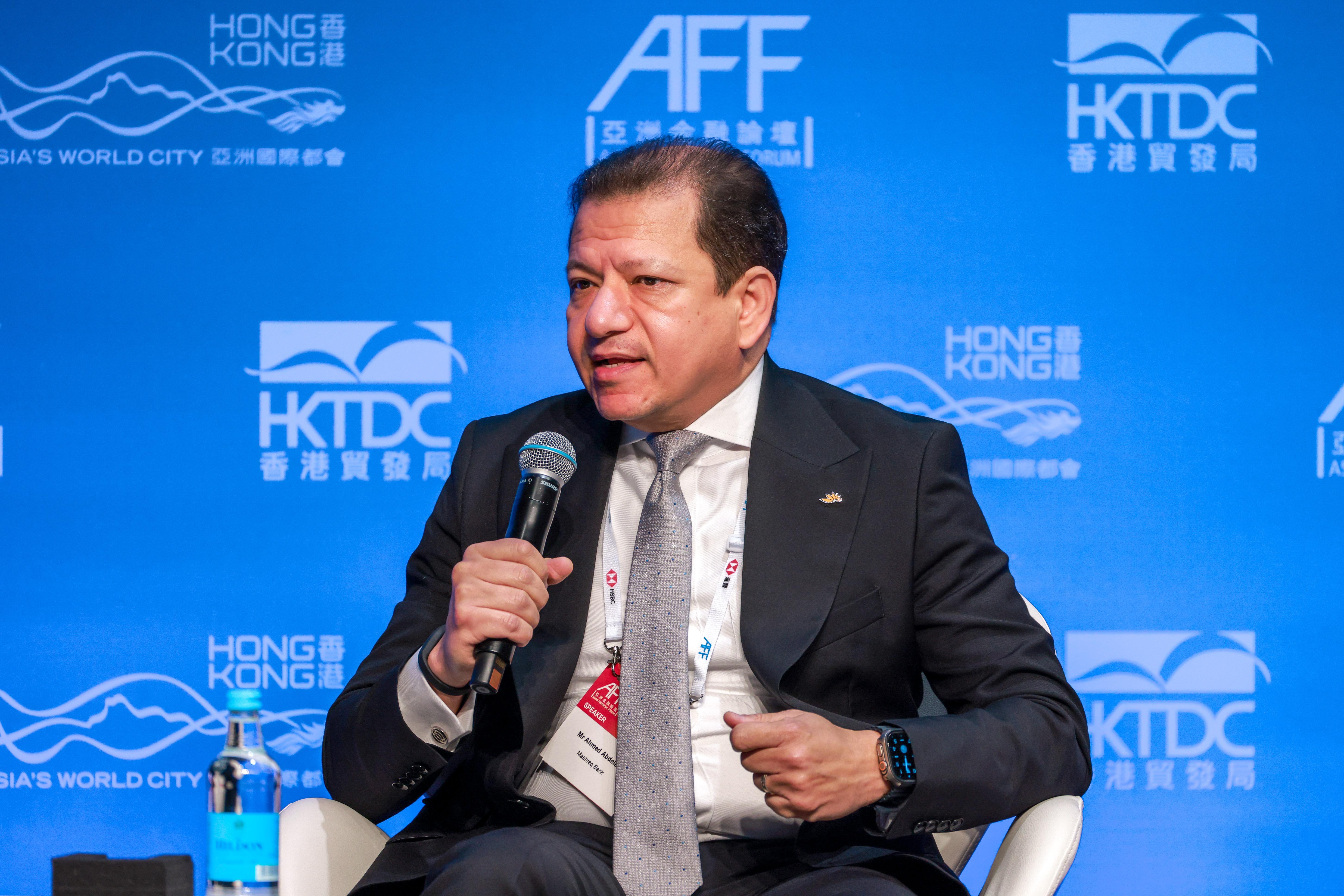

Mashreq Group Group Chief Executive Officer Ahmed Abdelaal speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

Mashreq Group Group Chief Executive Officer Ahmed Abdelaal speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

United Arab Emirates Undersecretary of Ministry of Finance Younis Haji Al Khoori added, “The success we have seen in the UAE is due to government regulations and adaptation of the concept of private sector-led initiatives. When there are more regulations and more assurances that will protect the interests of the private sector, the sector then will jump into the government initiatives.”

United Arab Emirates Undersecretary of Ministry of Finance Younis Haji Al Khoori speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

United Arab Emirates Undersecretary of Ministry of Finance Younis Haji Al Khoori speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

“We play a key role in bringing the voice of the private sector’s financial institutions into the center of government, explaining to them the regulations and potentially advocating on their behalf any regulatory reform that might be required. We have been progressing fast on regulatory reforms in fintech and sandboxes,” Saudi Arabia Assistant Minister of Investment Ibrahim Almubarak added.

Even with good understanding of the regulatory regime and public-private partnership, financial institutions have to apply technologies to real market potential.

Saudi Arabia Assistant Minister of Investment Ibrahim Almubarak speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

Saudi Arabia Assistant Minister of Investment Ibrahim Almubarak speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

Darmawan Junaidi, president director at Indonesia-based Bank Mandiri, said the digitalization journey is very important for Indonesia as a country with a massive population but still very low penetration of banking services.

READ MORE: AFF panellists highlight rule change for sustainable growth

“We have the sustainable financial inclusion problem. If you see from the penetration, the underbanked population is still huge. We see the opportunity with this supported by the technology as our clients at least can be served by our digital platforms,” the president director said.

President Director of Bank Mandiri Darmawan Junaidi speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

President Director of Bank Mandiri Darmawan Junaidi speaks during a session titled "Global Spectrum – Opportunities from New Markets" at the Asian Financial Forum held in the Hong Kong Convention and Exhibition Centre in Wan Chai on Jan 25, 2024. (ANDY CHONG / CHINA DAILY)

“We plan to transform the banking landscape in Indonesia with support by technology and digital innovation,” he said.