The Hong Kong Special Administrative Region is trying to further diversify and internationalize the city’s talent pool while exploring new products and funding channels at the commercial and financial levels, said Financial Secretary Paul Chan Mo-po.

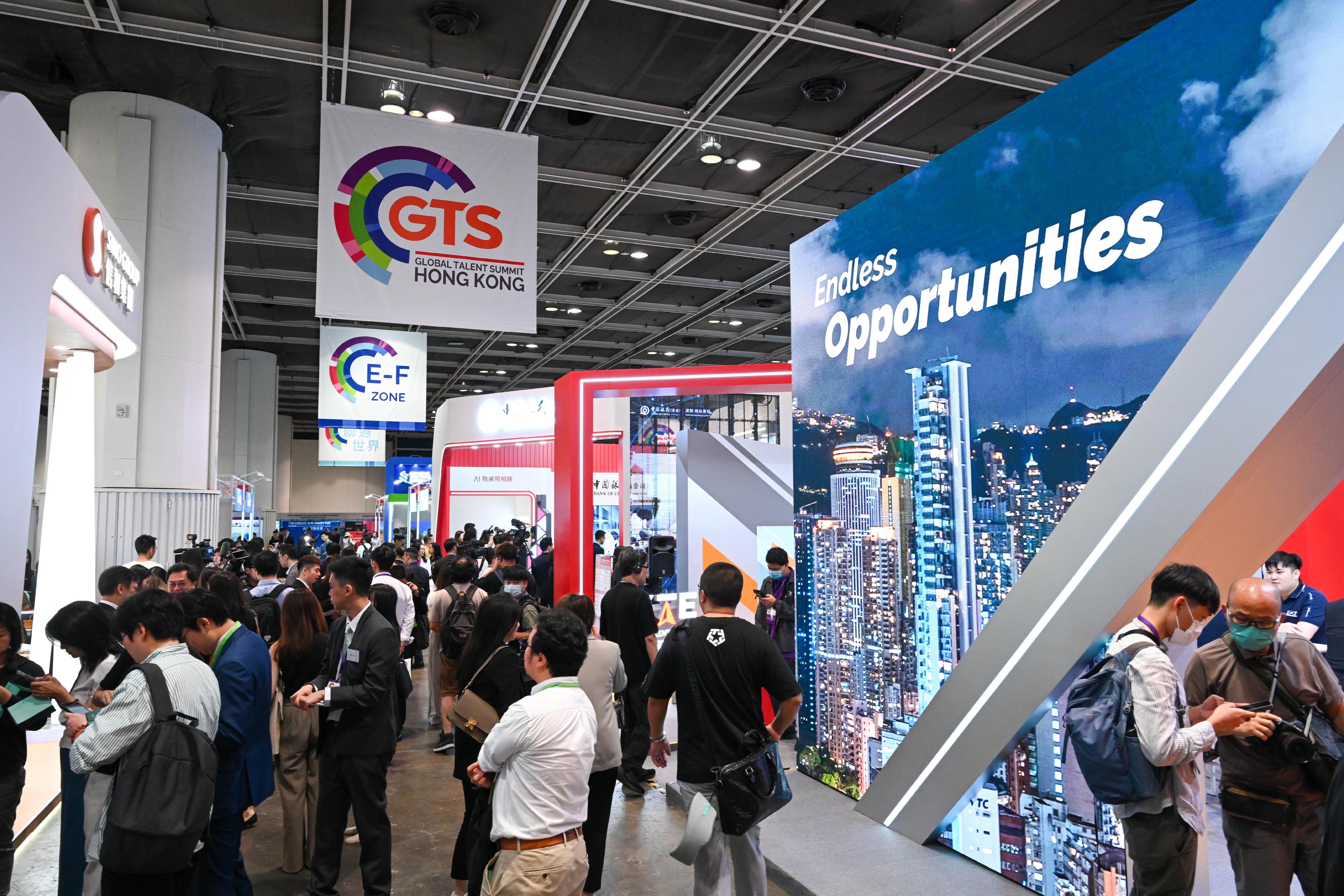

Writing in his Sunday blog, he noted that the Global Talent Summit and the second Guangdong-Hong Kong-Macao Greater Bay Area Talent High-Quality Development Conference held in Hong Kong last week was attended by about 4,900 representatives, and the number of online live broadcasts exceeded 130,000. The two-day CareerConnect Expo drew more than 8,600 visitors, reflecting Hong Kong’s allure for talents.

“By the end of last month, our various talent programs had received up to 290,000 applications, of which about 180,000 have been approved and about 120,000 professionals have arrived in Hong Kong,” Chan said.

Since February last year, various Hong Kong government departments, chambers of commerce and local enterprises have signed agreements with Middle Eastern countries on 60 projects, ranging from strengthening cooperation, mediation and arbitration to artificial intelligence

According to a survey conducted late last year, the average median age of professionals whose applications were given the nod under the Top Talent Pass Scheme was 35 years. About 60 percent of them were married and, generally, brought their families along to Hong Kong. More than half of them who have been in the city for six months or more have been hired, and their median monthly income is about HK$50,000 ($6,410).

ALSO READ: Hui: Hong Kong remains a magnet for global biz, talent

The main factors applicants took into consideration under the Top Talent Pass Scheme are the city’s low tax rate, safety, freedom, diversity, good employment and development prospects, as well as medical services and their children’s education, Chan said.

In attracting overseas funds following the first “PRIORITY Asia Summit” organized by Saudi Arabia’s Future Investment Initiative Institute in Hong Kong last year, the Saudi Stock Exchange moved its flagship “Capital Market Forum” overseas for the first time last week and held it in Hong Kong. The forum attracted about 650 participants, about 30 percent of whom were from the Middle East.

The Hong Kong Stock Exchange also organized some 300 matchmaking meetings with enterprises and investors from the Middle East, the SAR and the Chinese mainland, highlighting the city’s role and function as a “super connector” linking the mainland and the world.

“Cooperation between Hong Kong and Saudi Arabia in finance, the economy, trade and people-to-people and cultural exchanges continues to deepen. The SAR government is working with several financial institutions to promote exchange-traded funds listed in Saudi Arabia that track the Hong Kong stock index, promoting two-way flow of funds between the two places,” the finance chief said.

ALSO READ: Hong Kong goes all-out to secure talent, boost arts

In September last year, the Hong Kong Stock Exchange added the Saudi Stock Exchange to its list of recognized stock exchanges to facilitate secondary listings of Saudi-listed companies in Hong Kong. After two months, Asia’s first Saudi ETF was listed in Hong Kong, with the largest ETF-related assets among similar products worldwide.

In attracting enterprises, besides the second batch of partner enterprises announced earlier by the Office for Attracting Strategic Enterprises, Invest Hong Kong had helped 150 overseas companies to expand their operations in Hong Kong in the first quarter of this year – up 46 percent from the same period last year

Since February last year, various Hong Kong government departments, chambers of commerce and local enterprises have signed agreements with Middle Eastern countries on 60 projects, ranging from strengthening cooperation, mediation and arbitration to artificial intelligence.

“We are negotiating with Saudi Arabia on an investment promotion and protection pact and may set up an economic and trade office in Riyadh, the capital of Saudi Arabia” Chan said.

The Hong Kong Tourism Board this month organized the city’s largest industry delegation to Dubai to participate in the largest annual international travel industry exhibition in the Middle East. According to a survey conducted last year, each tourist from the Gulf region spends an average of HK$11,300 in Hong Kong -- about 85 percent higher than the overall average. The length of overnight stays is also longer than the overall average, showing that travelers from the Gulf region are in the high-spending category.

READ MORE: Hong Kong luring more venture capital, private equity funds

In the fourth quarter of this year, Cathay Pacific Airways will relaunch the direct passenger route from Hong Kong to Riyadh to make it more convenient for economic, trade and people-to-people exchanges between the two places.

In attracting enterprises, besides the second batch of partner enterprises announced earlier by the Office for Attracting Strategic Enterprises, Invest Hong Kong had helped 150 overseas companies to expand their operations in Hong Kong in the first quarter of this year – up 46 percent from the same period last year.

“These companies are mainly from the finance, innovation and technology and family office sectors, with total investments reaching HK$14.7 billion and creating more than 2,000 jobs,” Chan said.