The actual and potential risks associated with stablecoin development in Hong Kong could be properly managed in line with international standards with the relevant licensing, supervisory and enforcement parameters in place, according to the secretary for financial services and the treasury.

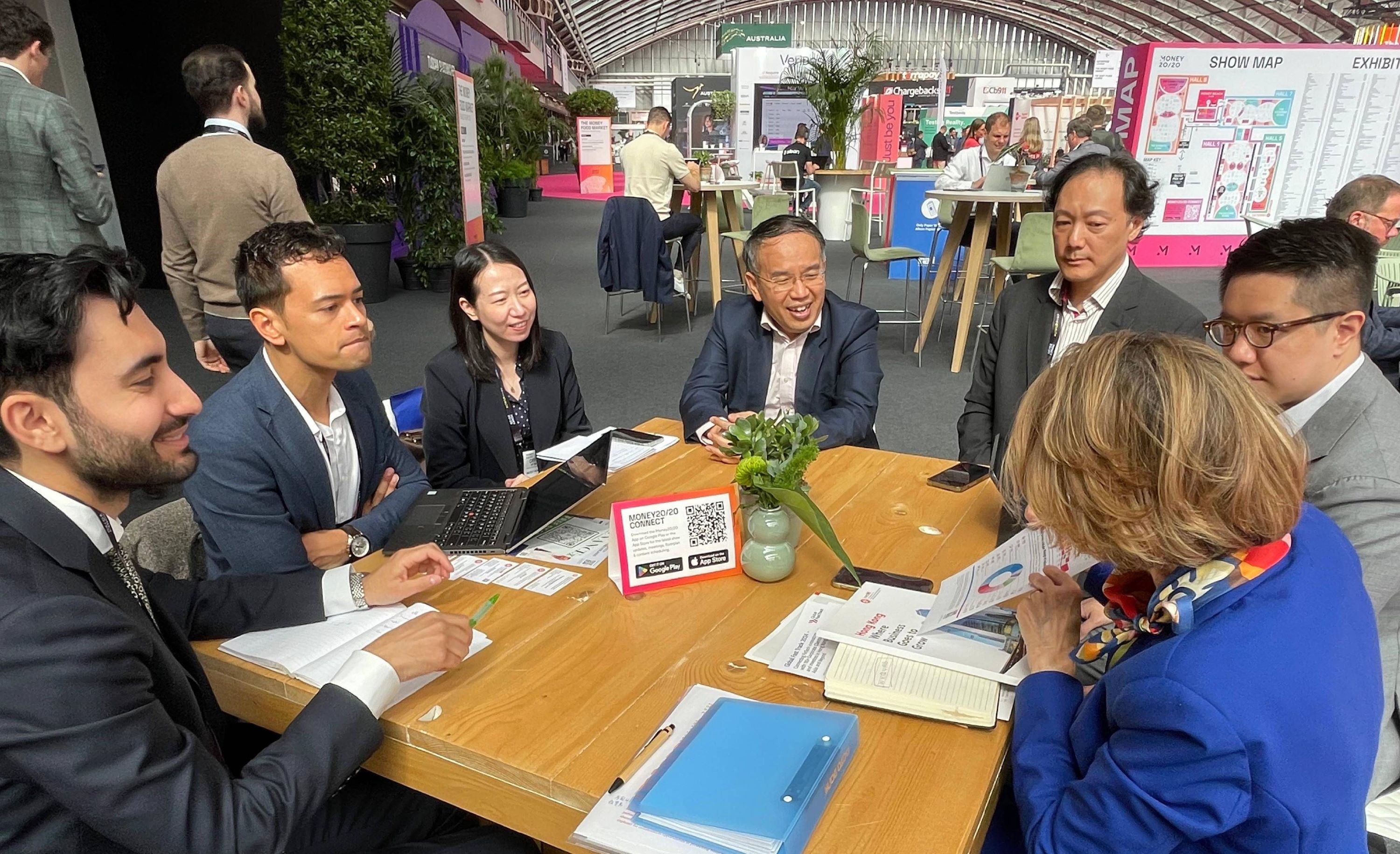

Christopher Hui Ching-yu said this on Tuesday as he promoted the city’s Web3 ecosystem in Netherlands at Money 20/20 Europe, the largest fintech event in Europe for pioneers and companies from the arenas of payments, fintech and financial services.

The public consultation in Hong Kong on the legislative proposal – an important measure facilitating Web3 ecosystem development in the city – to regulate issuers of stablecoin has been completed recently, he said during the fireside chat "Regulating the Next Wave of Financial Innovation: Lessons from the East".

READ MORE: HK eyes stablecoin regulatory regime by end of 2024

Hui, who started his visit to the Netherlands on Monday, focused on Hong Kong's initiatives including tokenization of real world assets and payment, and how they could be applied to companies and institutions around the world.

He also encouraged fintech, digital assets and Web3 companies to visit Hong Kong for first-hand experience of the city's vibrant ecosystem and opportunities of mutually beneficial collaborations.

The Hong Kong Special Administrative Region government took the global lead in issuing two batches of tokenized green bonds – the first batch, issued in February 2023, being the first government green bond issued by tokenization in the world.

Hui pointed out that the second batch – a $770-million multi-currency (Hong Kong dollar, renminbi, euro, and US dollar) bond issued in early 2024 – was the first multi-currency government green bond issued in a digitally native format globally.

The second issuance included multiple innovations that broadened investor access, supported interoperability, and improved transparency and efficiency, attracting subscription by a wide spectrum of institutional investors globally, from financial institutions to non-financial institutions, he added.

On sustainable development, Hui said the government and financial regulators aim for Hong Kong to be among the first jurisdictions to align the local sustainability disclosure requirements with the International Financial Reporting Standards - Sustainability Disclosure Standards (ISSB Standards).

ALSO READ: HK to hold blockchain conference Consensus in 2025

On the sidelines of Money 20/20 Europe, he met the top management of Netherlands Foreign Investment Agency and a partner of a venture capital firm. During the meetings, they shared their experiences in building a sustainable Web3 ecosystem, and explored the collaboration opportunities in promoting fintech, according to a government notification.

Earlier on Monday, the treasury chief met Deputy Treasurer-General and Director Financial Markets of the Dutch Ministry of Finance, Joost Smits, in the Hague and Chair of Dutch Authority for the Financial Markets, Laura van Geest, in Amsterdam.

He also paid a courtesy call on Chinese Ambassador to the Netherlands, Tan Jian, in the Hague.

Hui told Tan that Hong Kong can make good use of the unique advantage of "one country, two systems" principle to play its bridging role and leverage the development of the Guangdong-Hong Kong-Macao Greater Bay Area as the entry point to promote cooperation between the Netherlands and the Chinese mainland.

READ MORE: World of Web3 Summit wows HK again

The secretary also had a dinner gathering with heads of fintech, wealth management, and IT companies and relevant trade associations in Amsterdam, exchanging with them Hong Kong's latest financial innovations for a sustainable Web3 ecosystem, as well as the strengths in providing diverse channels for asset allocation, particularly the initiatives in developing family office business.