CHICAGO - US Federal Reserve Chair Jerome Powell on Friday said the "time has come" for monetary policy to adjust, noting that the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

Speaking at the Kansas City Fed's annual economic symposium in Jackson Hole, Wyoming, Powell sent a straightforward message to markets that the central bank will likely cut interest rates in its Sept 17-18 meeting.

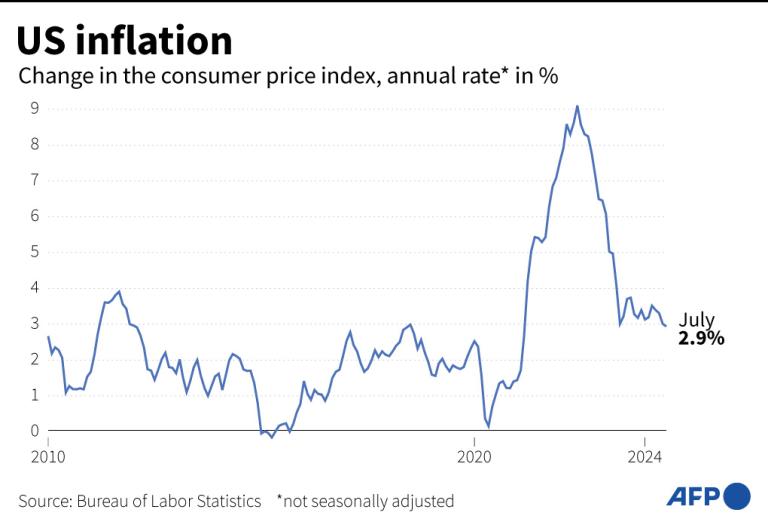

The Fed chief reflected on why inflation spiked during the COVID-19 pandemic, saying that the US Congress responded with "substantial" fiscal support, the Fed used its powers "to an unprecedented extent" to stabilize the financial system and help stave off an economic depression, and the pandemic wreaked havoc on supply conditions.

"Pent-up demand, stimulative policies, pandemic changes in work and leisure practices, and the additional savings associated with constrained services spending all contributed to a historic surge in consumer spending on goods," said the Fed chief.

Inflation spiked in March and April 2021, and for a time, the data were consistent with the "transitory hypothesis," he said. The case began to weaken around midyear, and beginning in October, "the data turned hard against the transitory hypothesis, with inflation rising and broadening out from goods into services," he noted.

In March 2022, the Fed raised rates from near zero by 0.25 percent to a level of 0.25 percent -0.50 percent. After implementing 11 interest rate increases totaling 5.25 percentage points between March 2022 and July 2023, the Fed has maintained the federal funds rate at a 23-year high of 5.25 percent -5.50 percent during the past year.

"Inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic. Supply constraints have normalized," Powell said.

"My confidence has grown that inflation is on a sustainable path back to 2 percent," he said.

ALSO READ: US Fed minutes indicate potential rate cut in September

Moreover, Powell noted, it seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. "We do not seek or welcome further cooling in labor market conditions," he said.

"The inflation and labor market data show an evolving situation. The upside risks to inflation have diminished. And the downside risks to employment have increased," said the Fed chief.

The US Labor Department reported earlier this week that monthly payroll data had overestimated job growth by approximately 818,000 over the 12 months ending in March, signaling a weaker labor market than previously reported.

More recent data, unaffected by the revisions, indicate that job growth continued to slow. The Labor Department reported in early August that US employers added 114,000 jobs in July, with the unemployment rate increasing to 4.3 percent, which marks the highest since October 2021.

"The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks," Powell said.

The Consumer Price Index (CPI) in July increased 2.9 percent from a year ago, after climbing 3.0 percent in June and 3.3 percent in May, the Labor Department reported last week.

Dean Baker, a senior economist at the Center for Economic and Policy Research, told Xinhua earlier that barring some big surprises, it can be assumed that the Fed will cut rates in September.

The only real question is whether it is 0.25 percentage point or 0.50 percentage point, he said.

READ MORE: Fed policymakers signal rate cuts ahead, but not recession

The Chicago Mercantile Exchange Group's FedWatch Tool, which acts as a barometer for the market's expectation of the Fed funds target rate, showed that the probability of the Fed cutting rates by 25 basis points at the September meeting is 67.5 percent as of Friday morning. The probability of the Fed cutting rates by 50 basis points is 32.5 percent. Enditem