COLOMBO - Sri Lanka has reached agreements in principle on restructuring approximately $17.5 billion of external commercial debt, the President's Media Division (PMD) said in a press release on Thursday.

These agreements have been reached with holders of its international sovereign bonds, following negotiations with the Ad Hoc Group of Bondholders, a representative group of international investors, and the Local Consortium of Sri Lanka, a representative group of domestic financial institutions, according to the PMD.

Collectively, the two groups hold in excess of 50 percent of the bonds, said the PMD.

ALSO READ: Sri Lanka tourism rebound to gain traction

Under the agreements, holders of the bonds will be consenting to a present value concession of 40.3 percent in the baseline scenario, calculated with a discount factor of 11 percent.

The agreements provide Sri Lanka with enhanced debt relief compared to a joint working framework agreed in July 2024, including a further reduction in interest payments provided in the new agreement, according to the PMD.

Sri Lanka's Ministry of Finance said this provided significant debt relief and reduced interest payments, strengthening the country's financial stability.

The country defaulted on its foreign debt for the first time ever in May 2022, engulfed in a severe crisis and buckling under its high debt burden and dwindling foreign exchange reserves.

ALSO READ: Sri Lanka grants Starlink license to provide nationwide satellite broadband services

The agreement comes after Sri Lanka began a third round of formal debt restructuring talks with bondholders last week. The country had to renegotiate parts of a previous draft deal, which it announced in July, after objections from the International Monetary Fund and official creditors. Getting sign off from both is a prerequisite to executing the deal.

"Sri Lanka now expects to receive formal confirmation from IMF staff that the Agreement in Principle and the Local Option, taken together, are fully consistent with the parameters of Sri Lanka's IMF-supported Program," the Sri Lankan government said in a statement.

"Sri Lanka will continue to work with the OCC and its secretariat to secure confirmation of compliance of the Agreement in Principle and the Local Option with the Comparability of Treatment principle," it added, referring to the Official Creditor Committee.

READ MORE: Sri Lanka pushes new industrial policy

Once Sri Lanka gets the formal sign-off from both parties, it said it would commit "its best efforts to expedite the implementation of the restructuring in respect of the bonds".

President Ranil Wickremesinghe said the IMF is likely to visit Sri Lanka two weeks after the election.

READ MORE: Sri Lanka presidential contenders wrap up campaigning

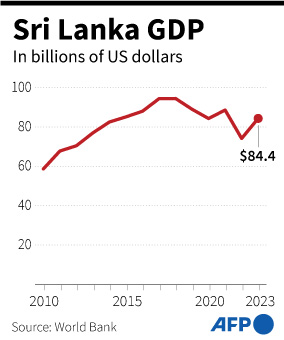

The latest draft agreement raised the GDP thresholds under which bondholders would get bigger payments under so-called macro-linked bonds. The previous agreement would have triggered at a GDP of $92 billion-$100 billion, while Thursday's agreement increased those targets to $94 billion-$107 billion.

It also lowered some of the coupon payments. But the haircut on the nominal amount of existing bonds is 27 percent under the new deal, from 28 percent under the agreement announced in July.