A subtle global reconnection is underway as economies seek alternatives and forge new ties to navigate growing uncertainties spawned by fresh trade tariffs likely to be imposed by the incoming US administration. Liu Yifan reports from Hong Kong.

Hong Kong found itself at the heart of a seismic shift as dignitaries and business leaders from the world’s two largest economies gathered in the city just days after Donald Trump scored a resounding victory in the United States presidential election in November.

Their mission was to tackle the seemingly impossible task of bridging deep-seated Sino-US misunderstandings amid heightened political fragmentation.

In the words of Craig Allen, president of the US-China Business Council, both countries are profoundly entangled economically, and pulling that apart would be very difficult and costly. “But that doesn’t mean that politics will lead us in that direction,” he told the US-China Hong Kong Forum, attended by envoys, politicians and financial pundits.

READ MORE: Forum on US-China ties set to launch

According to China’s official data, unveiled in November, the value of trade between it and the US surpassed $560 billion in the first 10 months of this year, with over 70,000 US companies operating in the world’s second-largest economy, generating $50 billion in profits annually.

However, the likelihood of increased protectionism promoted by Trump presents a “great risk”, said Stephen Roach, a senior fellow at Yale Law School. As part of Trump’s “America First” nationalist agenda, the billionaire Republican once vowed to jack up tariffs on all imports coming into the US from zero to between 10 to 20 percent, and boost those on Chinese products to 60 percent. The president-elect also announced recently he would slap 25 percent tariffs on all imports from Canada and Mexico, with an additional 10 percent on Chinese goods.

Roach warned that problems associated with the new US policy would invite retaliation from all US trading partners. The International Monetary Fund has also cautioned that the introduction of higher tariffs on a significant portion of global trade by the middle of next year could lower global growth by 0.8 percent in 2025 and by 1.3 percent in 2026.

During his first term as US president, Trump raised tariffs on Chinese imports from three percent in 2018 to 19 percent, and these are still in force. Some pundits have suggested that Trump might not be serious enough to press ahead with his renewed tariff threats, but Roach gave a heads-up at the Hong Kong forum that China and the world have to take Trump more literally this time.

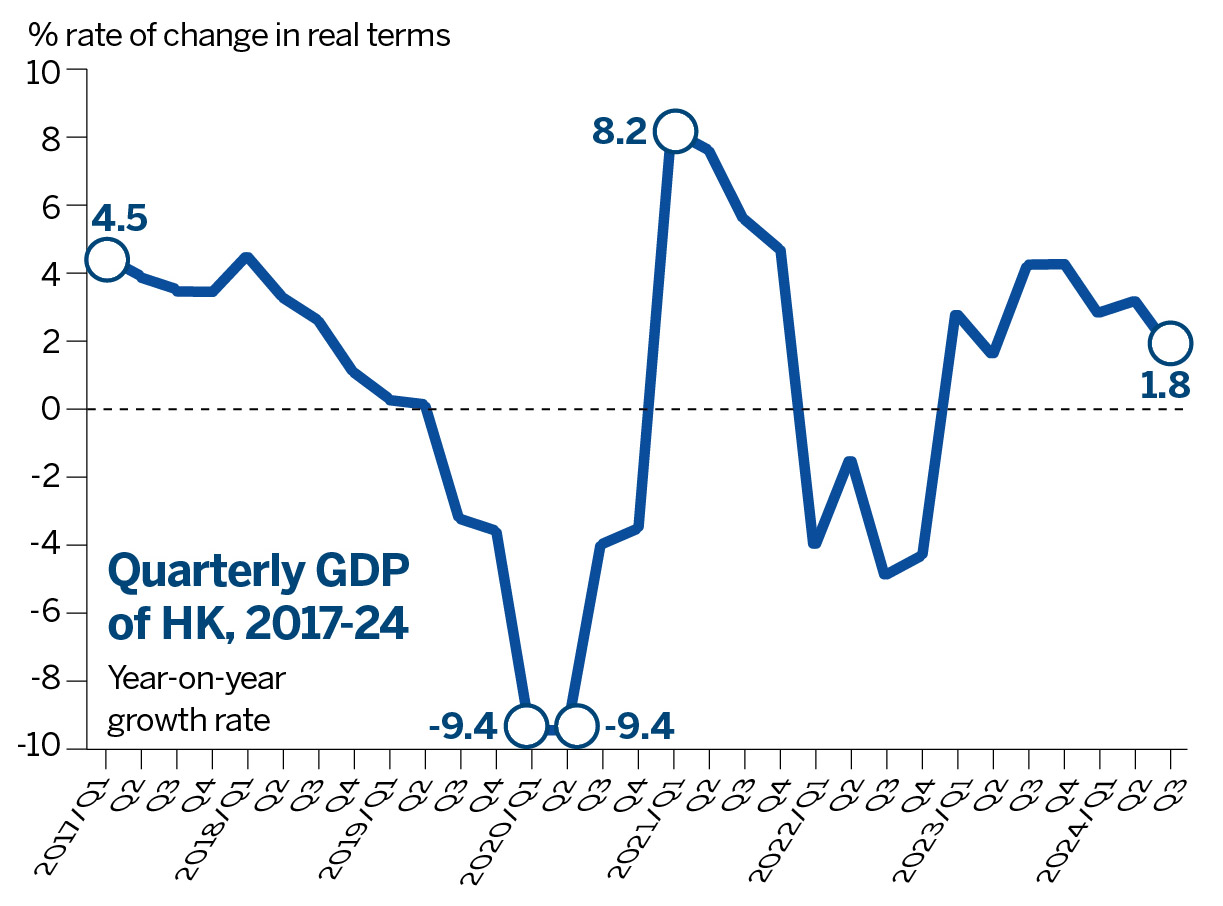

The Hong Kong Special Administrative Region, long seen as China’s entrepot and offshore financial hub, has to bear the brunt across the economic spectrum. “Trump 2.0 will affect exports from the Chinese mainland and, by extension, Hong Kong’s position as a transshipment hub,” said Chim Lee, senior analyst at the Economist Intelligence Unit. These developments will impact Hong Kong’s already weak consumer and business sentiment, and therefore consumption and investment activities, especially in the transport and logistics sector, he added. More broadly, as happened after US tariffs were enforced in 2018, the current threats could be a harbinger of fresh trade frictions. “For most economies, we can probably expect slightly increased dependence on partners, other than the US, for trade,” said Adam Ahmad Samdin, an assistant economist at Oxford Economics. “If higher tariff rates are applied on China, we can also expect more supply chain reshuffling, much to the benefit of other economies like Vietnam.”

Embracing flexibility

“We are on the edge of a changing world. I think the mindset has to change overall,” said Savana Pires, director of international business and development at Porto Business School, referring to the US presidential election.

Two weeks after Americans went to the polls, Pires led a group of 10 MBA students from the Portuguese business school to Hong Kong under one of four overseas exchange programs, others being in the US, Germany and India. During their weeklong trip, the students attended lessons at the Chinese University of Hong Kong and visited local companies to gain insights into the city’s economic landscape.

“When we first thought about coming to China in 2020 or 2021, people doubted us. They said ‘Why China? No one would want to go.’ But we decided to give it a try, and now, here we are, in our second year. I think we will keep coming for the next 10 years,” said Pires.

Flexibility has been Porto Business School’s mantra in recent years. Pires recalled a challenge they faced when a group of students from the West African nation of Ghana was unable to obtain visas to visit Portugal. Instead of allowing the setback to derail their plans, the school pivoted, taking the program to Dubai, where professors and students could meet. “Dubai offered them visas, so we found a solution,” said Pires. “Political issues might create barriers, but we have to overcome these challenges and keep facilitating global communication and learning.”

The European business school’s educational communication approach offers a glimpse into how the world is adapting to global headwinds with alternatives.

Since Hong Kong began its post-pandemic economic recovery bid in 2022, the SAR government has been ramping up efforts to promote the city and attract new investments to reboot its growth engine and restore its image as Asia’s world city. Chief Executive John Lee Ka-chiu, Financial Secretary Paul Chan Mo-po, and other government officials have led delegations to various parts of the world in recent years to develop business collaborations and forge closer ties on top of Hong Kong’s traditional partnerships with the US and Europe.

InvestHK — the SAR government’s investment promotion agency — said it helped 150 mainland and 172 overseas enterprises set up shop or expand their operations in the city in the first half of this year — up 43 percent, compared with the same period in 2023. These companies have pledged to invest HK$38.3 billion ($4.9 billion) in investments to boost the local economy and create more than 3,500 jobs.

The injection came amid prolonged geopolitical tensions, as seen in the scaling back of foreign businesses’ presence in Hong Kong, and a US bill that could potentially shut the SAR’s trade offices in the US. Data from the Census and Statistics Department shows that the number of regional headquarters in Hong Kong has seen a continuous decline from 1,541 in 2019 to 1,336 last year. The steepest drops were among companies from the US, Japan and the UK.

Establishing new links

Among the bright spots to have emerged are the large economies in Southeast Asia and the Middle East. Pinpointing where the specific opportunities lie, answers could be found at a summit held in the SAR in September featuring the Belt and Road Initiative — a China-proposed transcontinental project that aims to promote connectivity and cooperation.

At a panel discussion, Andrew Gan, an independent director of the Philippine Stock Exchange, highlighted the potential for deeper collaboration among bourses. He said the Philippines has been a “long-only” market for an extended period, and it would be interesting to work with Hong Kong to explore short-selling and derivative markets. Opportunities relating to environmental, social, and governance issues also show great potential as the Southeast Asian country “takes it very seriously”, he said.

Apart from the Philippines, Indonesia’s establishment of social enterprises is a major area where Hong Kong’s strength in professional services could play an indispensable role, said Cahyo Muzhar, director-general of legal administrative affairs at the Indonesian Ministry of Law and Human Rights.

According to Muzhar, Indonesia is in the process of laying down the legal framework for social enterprises — a type of business that combines profitability with addressing social or environmental issues. These businesses are normally micro, small or medium-sized companies that are desperate for financing. On that note, Hong Kong, as a business and financial center, is a “role model” for cooperation, he said.

Tengku Zafrul Aziz, Malaysia’s minister of investment, trade, and industry, said his country and Hong Kong ought to explore the huge potential of the Islamic compliance market together, noting that an estimated 60 percent of the world’s Muslims are in Asia. “This goes beyond just food and finance, but also tourism, beauty products and so much more,” he said.

Southeast Asian economies have performed impressively this year. According to McKinsey & Co, GDP growth was recorded across all countries in the region in the second quarter of this year, with Malaysia, the Philippines, Thailand and Vietnam achieving the highest year-on-year growth over the past four quarters.

China and the Association of Southeast Asian Nations are each other’s largest trading partners, with the 10-member regional grouping accounting for 15 percent of China’s total trade last year — an increase of 10 percent from 2010. China accounted for 20 percent of ASEAN’s total trade last year — up from 12 percent in 2010 — according to McKinsey.

For Hong Kong, ASEAN’s support is crucial in the SAR’s bid to join the Regional Comprehensive Economic Partnership — the world’s largest free trade agreement, which includes 15 economies in the Asia-Pacific, and is expected to further deepen the region’s economic interdependence.

The Middle East’s geostrategic location at the crossroads of Europe, Asia and Africa offers Hong Kong businesses access to a vast market base. There is growing potential for collaboration among investors in Hong Kong and Saudi Arabia, including opportunities to tap into each other’s stock markets through exchange-traded funds.

However, Pires warned that cultural and social differences with new friends could create significant hurdles, and misinformation would present difficulties, citing misconceptions about working conditions in China, where it is claimed that workers have to toil for up to 20 hours daily in factories.

ALSO READ: HK stocks flat as market waits for NPC major decision

Up to 80 of 125 MBA students from Porto Business School have mandatorily opted to go to the US for their studies. But, according to Pires, next year could see a big shift with annual compulsory US studies to be made optional. The change would allow students greater flexibility in choosing destinations that align with their personal and professional goals.

“The US is still important, but it’s an established way. We need to try new ways,” said Pires. She identified three regions — China, the Middle East and Africa — that will shape the future of the international business landscape. For Africa, she pointed to Angola and Mozambique as natural focal points for Portugal due to their shared history. She also highlighted the untapped potential in countries like Morocco, Tunisia, Kenya, South Africa, Ghana and Zimbabwe.

For Hong Kong, the mission is clear — adapt and seize the opportunities in this shifting global pattern.

Lawrence Li Lu-jen, chairman of Hong Kong’s Financial Services Development Council, succinctly put it: “Everyone in the world is forming new partnerships. We in Hong Kong must find our niche in this realignment.”

Contact the writer at evanliu@chinadailyhk.com