WASHINGTON - The US Federal Reserve on Wednesday left the target range for the federal funds rate unchanged at 4.25 percent to 4.5 percent, as recent data showed inflation is picking up.

"The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate," the Federal Open Market Committee (FOMC), the central bank's policy-setting body, said in a statement after a two-day meeting.

"In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent," the statement said.

At a press conference Wednesday afternoon, Fed Chair Jerome Powell noted that inflation "has eased significantly" over the past two years but "remains somewhat elevated" relative to the central bank's 2-percent longer-run goal.

The Personal Consumption Expenditures (PCE) price index -- the Fed's preferred inflation gauge - rose 2.1 percent in September from a year ago, then increased 2.3 percent in October and 2.4 percent in November, indicating continued inflationary pressures.

Powell said that estimates based on the Consumer Price Index and other data indicate that total PCE prices rose 2.6 percent over the 12 months ending in December. Excluding the volatile food and energy categories, core PCE prices rose 2.8 percent from a year earlier, consistent with the previous two months.

ALSO READ: Fed minutes indicate 2% inflation mark farther than thought

"If the economy remains strong and inflation does not continue to move sustainably toward 2 percent, we can maintain policy restraint for longer. If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we can ease policy accordingly," said Powell.

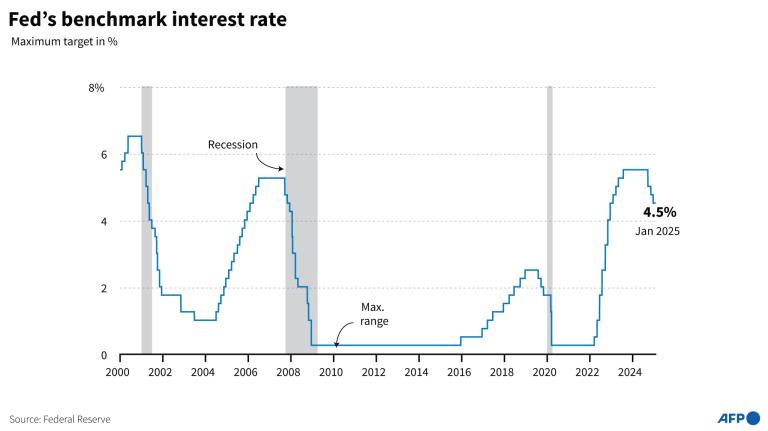

After its Sept 17-18 meeting, the central bank slashed the target range for the federal funds rate by 50 basis points amid cooling inflation and a weakening labor market, marking the first rate cut in over four years and signaled the start of an easing cycle.

After its Nov 6-7 meeting, it lowered the target range for the federal funds rate by 25 basis points. After its Dec 17-18 meeting, it further reduced rates by 25 basis points, while indicating there would be fewer rate cuts in 2025, as it braces for uncertainty stemming from the Donald Trump administration's policies.

"Over the course of our three previous meetings, we lowered our policy rate by a full percentage point from its peak. That recalibration or policy stance was appropriate in light of the progress on inflation and the rebalancing in the labor market," Powell told reporters.

"With our policy stance significantly less restrictive than it had been, and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance," he said.

When asked about Trump administration's new policies, the Fed chair said the Committee is "very much in the mode of waiting to see" what policies are enacted. "We don't know what will happen with tariffs, with immigration, with fiscal policy, and with regulatory policy," said Powell.

At the press conference, the Fed chair also said that the central bank's five-year review of its monetary policy framework is taking place this year, noting that it intends to wrap up the review by late summer.

READ MORE: Fed lowers rates but sees fewer cuts next year due to high inflation

"I would note that the Committee's 2 percent longer-run inflation goal will be retained and will not be a focus of the review," said Powell.