Hong Kong’s stock market is turning into one of the biggest winners of Donald Trump’s first 50 days in office.

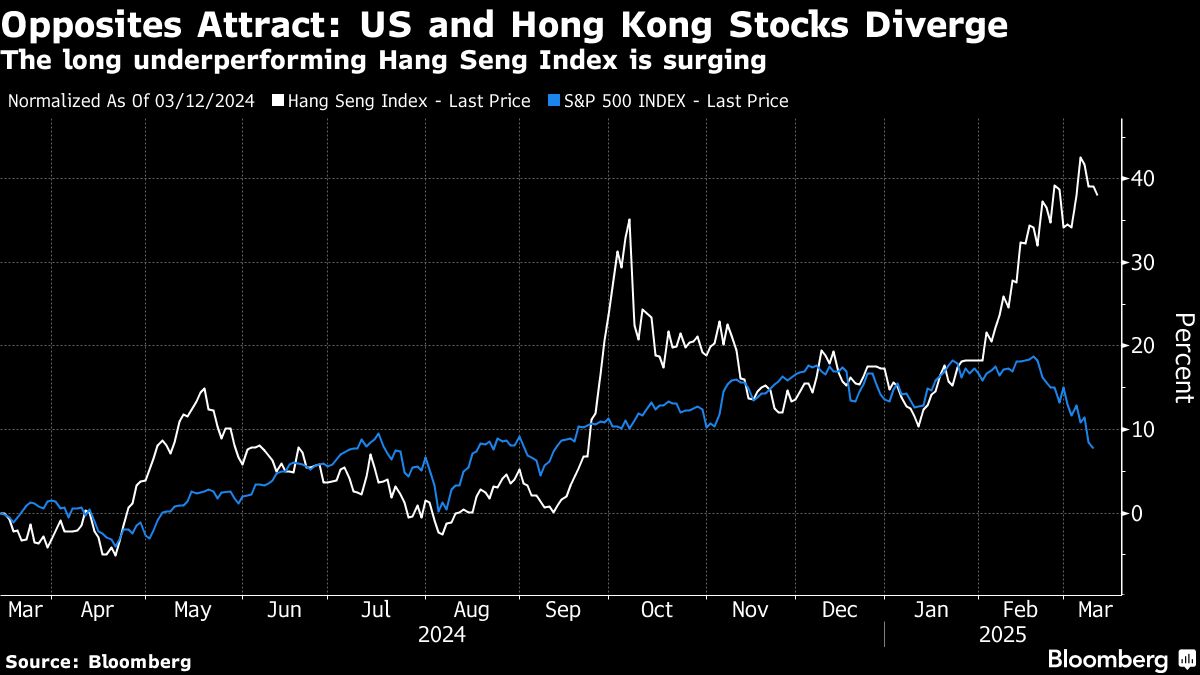

The city’s Hang Seng benchmark has surged 21 percent since Trump assumed the presidency, making it the world’s top performer. The S&P 500 Index has slumped about 7 percent to trail almost all global gauges.

The divergence between the two indexes has become the most extreme since the dotcom bubble burst in 2000, according to a 90-day correlation measure.

Global investors are seizing on the Chinese mainland's dramatic advances in artificial intelligence to pour funds into the Hong Kong Special Administrative Region’s market at a time when Trump’s trade wars and erratic policy making are undermining confidence in the US economy.

ALSO READ: HSI extends cumulative gain of over 6% on policy stimulus

Hong Kong’s $6 trillion bourse stands to benefit because it’s become the preferred home for mainland tech listings, while also being one of the world’s most liquid equities markets.

“We have been waiting for this moment for many years,” said Thomas Ip, executive director at Gaoyu Securities Ltd. “Trump’s policies have created so much uncertainty for the US stock market. As angst grows, the smart money will come to Hong Kong where valuations are cheaper and the policy environment is better.”

As evidence of the increase in global inflows, JPMorgan Chase & Co processed a record amount of currency conversions into Hong Kong dollars and the yuan in recent weeks, according to Serene Chen, JPMorgan’s head of credit, currency and emerging market sales.

Signs point to this historic outperformance continuing, despite Trump increasing tariffs on mainland exports. Analysts are upgrading the nation’s stocks at the same time as they cut US shares.

While anxiety grows over the outlook for American tech giants, inflows into the Hong Kong SAR by mainland investors are climbing to record levels.

The catalyst for the rally in the Hang Seng Index was the shock arrival of DeepSeek and its AI model just days after Trump entered the White House. The breakthrough undermined Trump’s claim the US was the global AI leader and immediately blew a $1 trillion hole in the US stock market.

The realization that the mainland had succeeded in developing AI systems to rival the US was a dramatic wrench to a narrative that had benefited US equities investors for the better part of two years.

ALSO READ: HK's stock market sees daily average turnover exceed HK$200b in 2025

As funds poured into mainland tech stocks and the Nasdaq 100 Index faltered, mainland companies announced their own AI advances and huge increases in spending on the critical technology.

Alibaba Group Holding Ltd, which has been the biggest beneficiary of the tech rally with an almost 70 percent surge since Jan 17, unveiled an open-sourced AI model and pledged to invest more than 380 billion yuan ($53 billion) on AI infrastructure.

“Since February, we have begun to adjust our exposure to the US market in favor of the European and Chinese markets,” said Mabrouk Chetouane, who is head of global market strategy at Natixis Global Asset Management.

Last week, mainland startup Manus claimed to have vaulted ahead of leading developers in the US which have been racing to develop sophisticated AI agents that can carry out more complex tasks on a user’s behalf.

‘Maleficent 7’

Bullish predictions for mainland shares are piling up just as fast as analysts lower their expectations for US stocks. Citigroup Inc upgraded China to overweight this week, while downgrading its view on US equities.

The downbeat view on the US from Citi echoed that at HSBC Holdings Plc, where strategists cut US equities to neutral on Monday, saying they see “better opportunities elsewhere for now.” Goldman Sachs Group Inc analysts dubbed the big US tech stocks the “Maleficent 7” as they slashed their target for the S&P 500 in a note Tuesday.

The result is an outperformance by Hong Kong’s stock market. Deals are now picking up again as companies seek to profit from the rising market.

READ MORE: Beverage maker Mixue soars on HK debut with strong investor appetite

As evidence of the increase in speculative activity, the city’s retail investors sought margin loans worth more than $353 billion to bet on red hot IPOs so far this year.

There is little sign right now the fevered trading will end soon. Mainland investors bought a net HK$29.6 billion ($3.8 billion) of Hong Kong shares on Monday, the most since trading links between the city and the mainland exchanges began in 2016, according to Bloomberg-compiled data.

For US equities investors, the pain may only be beginning.

“Whatever market we consider, investors are looking for two fundamental elements: corporate earnings growth, and economic and financial visibility,” said Natixis’ Chetouane. “These two factors are deteriorating in the US and stabilizing in China.”