A breakfast table is prepared for a business class seat of a Singapore Airlines Ltd Airbus SE A380 aircraft with refitted cabins during a media tour at Changi Airport in Singapore, on Dec 14, 2017. (NICKY LOH / BLOOMBERG)

A breakfast table is prepared for a business class seat of a Singapore Airlines Ltd Airbus SE A380 aircraft with refitted cabins during a media tour at Changi Airport in Singapore, on Dec 14, 2017. (NICKY LOH / BLOOMBERG)

The pandemic has left nearly a third of the world’s commercial jets grounded, but air-miles gurus like Ajay Awtaney, founder of India’s biggest frequent-flyer website, say this may be the best time for loyalty members to spend or rack up their points.

“Don’t panic! The opportunity to travel has declined, but earning of miles hasn’t,” said Awtaney, who set up LiveFromALounge.com in 2011. “Airlines are pushing out bigger incentives and people should use this opportunity because miles haven’t lost value.”

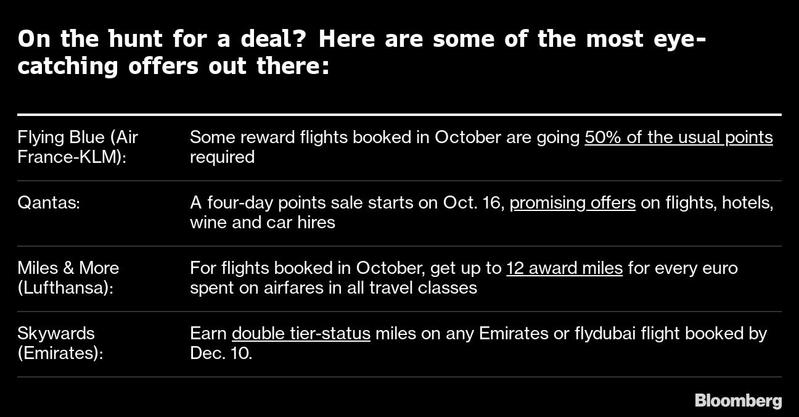

Even with people stuck at home, carriers have been pumping out offers to collect miles more cheaply or redeem them at steep discounts. That is because airlines desperately need money to survive the coronavirus crisis and loyalty programs are a major source of revenue

Even with people stuck at home, carriers have been pumping out offers to collect miles more cheaply or redeem them at steep discounts. British Airways just had a promotion offering flights for 50 percent of the miles usually required. Many have extended the validity of elite member status, lowered qualifying requirements to move up a tier or done away with points expiry as countries restrict entry or make travel less appealing with mandatory quarantines.

The reason: airlines desperately need money to survive the coronavirus crisis and loyalty programs are a major source of revenue, so they are making fresh overtures to their members and trying to bring new ones on board.

ALSO READ: Airlines working with WHO on testing to replace quarantine

These programs have become a vital crutch for carriers so starved of funds they’re converting grounded jets into restaurants, selling drinks trolleys and putting on sightseeing flights to nowhere. The very best plans have armies of followers itching for reward flights and upgrades, and they can generate hundreds of millions of dollars a year for airlines.

In this unprecedented industry crisis, British Airways’ owner IAG SA still managed to land almost US$1 billion by selling points to American Express Co, while others including Delta Air Lines Inc. and United Airlines Holdings Inc laid down their programs as security against billions of dollars of loans and bonds.

Some airlines are making more income from loyalty than flying, a handy lifeline when global air travel has been sliced in half. Qantas Airways Ltd’s membership division was the airline’s biggest source of earnings in the year ended June. The Australian carrier expects the unit to make as much as A$600 million (US$430 million) in profit by June 2024, almost double the current figure.“Modern full-service carriers are data-driven companies based around loyalty programs that happen to fly around some planes,” said Rico Merkert, professor of transport and supply-chain management at the University of Sydney’s business school.

Singapore Airlines Ltd, Cathay Pacific Airways Ltd, Qantas and the major US carriers are among the dozen or so airlines with the most valuable air-miles programs, thanks to their strong brands and links with credit cards, according to OAG Aviation Worldwide.

“The loyalty model remains robust,” said Mayur Patel, OAG’s regional sales director for Japan and Asia Pacific. “The more important, well-structured ones will always do a job and we will see them being more proactive.”

READ MORE: Travelers snap up Asian airlines' scenic 'flights to nowhere'

Frequent fliers are getting swamped with emails pedaling heavily discounted reward flights, hotel stays, consumer goods and wine. The goal is to ensure the accumulation of points remains worthwhile even when travel currently isn’t. Cathay said Monday its September passenger traffic was down 98.1 percent from a year earlier.

“Winning the recovery is bringing new customers to air travel and graduating them to higher tiers of loyalty,” American Airlines Group Inc Chief Revenue Officer Vasu Raja said at a conference last month.

One challenge for carriers is that points can become a liability on the balance sheet when revenue from issuing them isn’t recognized until rewards are redeemed or expire, OAG’s Patel said. That aspect is encouraging airlines to offer more deals to clear the backlog, especially with so many flying at reduced capacity.

“There will probably be some very attractive offers for customers to burn miles in the recovery phase when it is possible to travel,” John Grant, an analyst also at OAG, said during a webinar last week.

Grant said carriers can try to increase income from redemption flights by getting passengers to pay for things such as advanced seat assignments or suitcase allowances.

This undated photo shows a Cathay Pacific Airways lounge at Hong Kong International Airport in 2019. (PHOTO / BLOOMBERG)

This undated photo shows a Cathay Pacific Airways lounge at Hong Kong International Airport in 2019. (PHOTO / BLOOMBERG)

Appetite to amass miles is a gauge of confidence in aviation, because points have no value unless members see a chance sometime soon to redeem them. Paul Jacobson, Delta’s chief financial officer, said spending patterns on Delta-branded credit cards suggest the public believes air travel will return soon.

“If I thought the pandemic was going to last three years and I wasn’t really going to be able to fly anywhere, I would probably shift my spend away from accruing miles,” Jacobson said at a conference in September.

There is some risk for loyalty members and credit-card companies in accruing mountains of miles because they can be exposed if an airline collapses, said Steve Saxon, a partner at McKinsey & Co in Shanghai. Recent airline restructurings, however, have preserved points balances considering the value of the “relationship is too high to alienate customers,” he said.

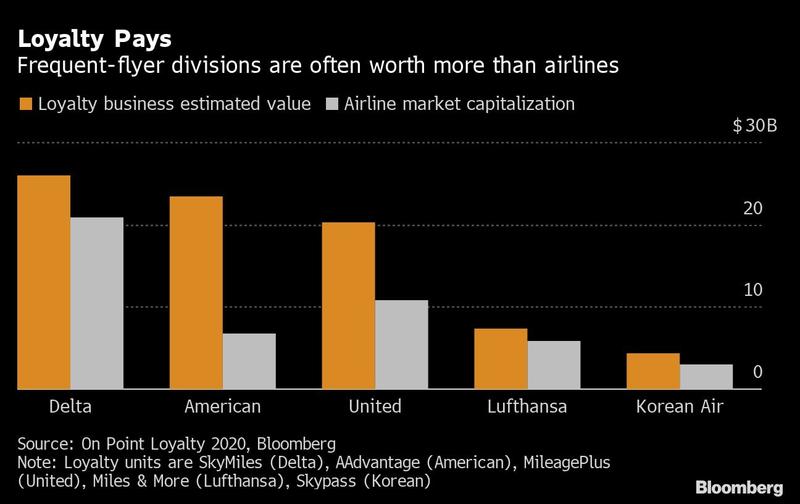

With sufficient scale, loyalty programs become earnings juggernauts, because the larger the membership, the greater the incentive for corporations to buy points.

READ MORE: Turning miles into memories for a lifetime

Qantas’s loyalty division had a profit margin of 28 percent in the year ended June. The margin at United’s MileagePlus, which has more than 100 million members, was 34 percent last year. The unit’s US$1.8 billion of earnings was more than a quarter of the airline’s income, United said in an investor presentation posted on its website. Last week, Delta CEO Ed Bastian, called loyalty “a strategic competitive advantage, one of the most important ones we have.”

“For the first time, the US majors are openly talking about the value of their programs,” said Evert de Boer, managing partner at On Point Loyalty, a consultancy specializing in airline loyalty businesses. “These programs have always been so profitable, but they were hidden under the hood.”