Hong Kong’s listing platform for small and medium-sized companies, the Growth Enterprise Market, is poised for an overhaul to reverse its trend of dismal performance over the years, and restore its pristine mission to be ‘Asia’s Nasdaq’. Zhang Tianyuan reports from Hong Kong.

Recent interest-rate hikes in Hong Kong, triggered by US rate increases, have further dented the allure of the city’s small and midcap enterprises to investors who are less willing to put their money in the stock market.

Companies listed on the Hong Kong Stock Exchange’s Growth Enterprise Market have seen years of decline in trading and returns, aggravated by the COVID-19 outbreak in early 2020, which severely disrupted the economic and social environment, as well as global supply chains. But plans are afoot to give them a new lease of life by adopting a carrot-and-stick approach under a possible two-tiered system, in which enterprises that perform well would be upgraded, while those that have yet to make the grade would be demoted.

The main obstacle to implementing a two-tiered system for the GEM is striking a balance between accommodating existing companies in the market and drawing new listings with high growth potential.

Virginia Lee Yuen-man, partner with Clifford Chance

The GEM, which was launched in November 1999 at the peak of the global internet stock bubble, is aimed at accommodating young and promising enterprises — those that have a market capitalization of at least HK$150 million ($19.2 million) — by offering them access to capital markets. The GEM was positioned as a steppingstone for them to the main board of the Hong Kong Stock Exchange.

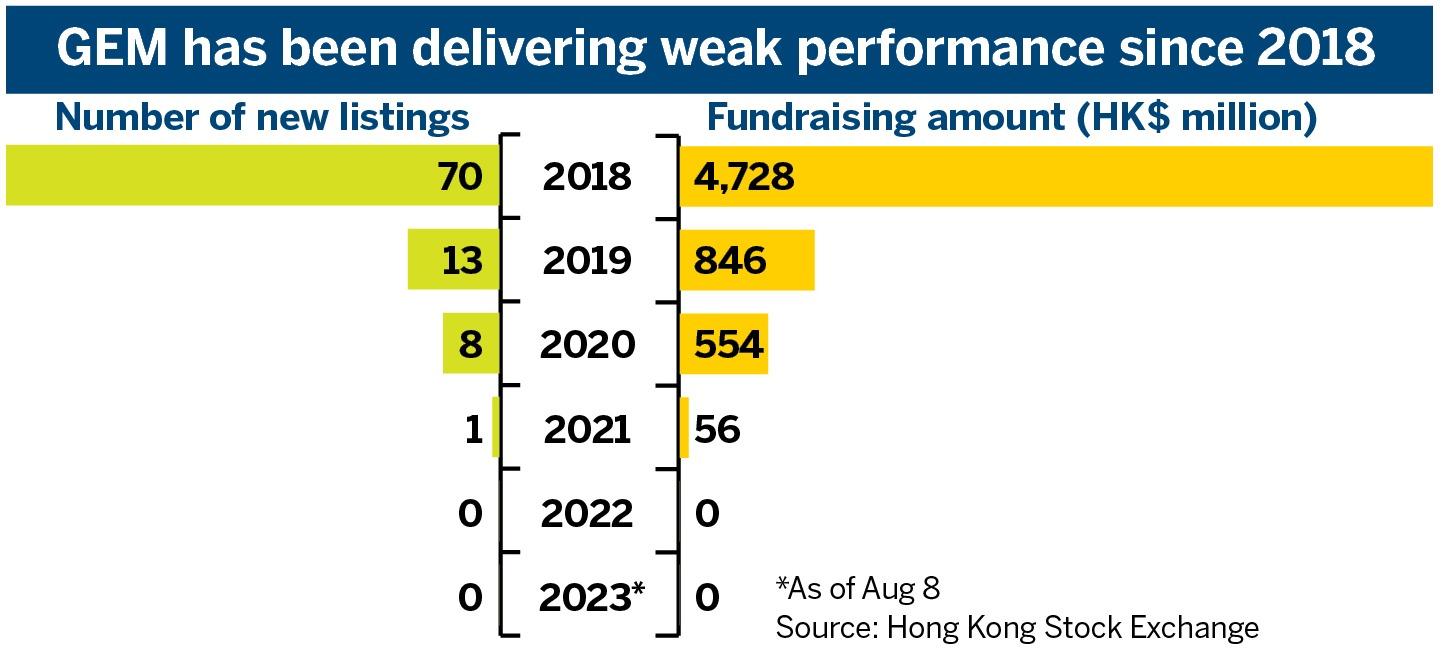

But the dismal trading performance of GEM stocks over the years has left the city’s second board drift away from its pristine mission to be “Asia’s Nasdaq”. The board hasn’t seen any new listings for more than two years, compared with 16 companies that went public within the first four months of its debut in 1999. Between 2019 and 2021, as COVID-19 took hold in Hong Kong, the number of newly listed companies plummeted from 13 to one. Grand Power Logistics Group raised HK$55.5 million in January 2021, making it the last firm to go public on the GEM.

Hong Kong has gone through a rough patch amid growing geopolitical strains, rising interest rates, plus the economic and social impact of COVID-19. “All these factors have heaped pressure on investment,” explained Robert Lee Wai-wang, who represents the financial services sector in the Legislative Council. “Many investors now adopt a conservative approach, and their interest in investing in risky assets has declined.”

The returns for GEM-listed companies have been volatile, with their capital dissipating in an unstable economic environment. The stocks of two-thirds of such companies had been trading well below their prices of three years ago, with the majority of them having plunged by more than 50 percent. The S&P/HKEX GEM index stood at 27.3 as of Aug 10 — down more than 97 percent from its base point of 1,000.

According to Louis Lau Tai-cheong — a partner with the capital markets advisory group at KPMG China — the small-market cap and the thin liquidity have made it difficult for institutional investors to trade in “meaningful volumes, compared to the size of their portfolios”.

For retail investors who have chosen to invest in GEM stocks, Lau thought they are “exhibiting a somewhat speculative mindset. … Trading activity tends to be concentrated on a limited number of stocks that are either in the news or subject to rumors, as investors seek short-term profits.”

Investors are hoping for a turn of the tide after years of weak market performances, and calls from lawmakers and market regulators to reform the GEM have offered small-cap companies a new ray of hope. A public consultation paper is expected to be released later this year on a potential listing overhaul for growth enterprises.

Much-needed overhaul

The fledging market had once proved to be a valuable source of capital for startups that lacked a robust earnings track record. Within the first four months of the GEM’s launch, the total market capitalization of 16 listed firms had surged more than 22 times to nearly HK$100 billion through March 2000. These companies were primarily engaged in high-tech industries, such as the internet, computer science, and telecommunications.

However, the companies enticed by the GEM’s lower bar of entry may “lack good qualities”, observed Virginia Lee Yuen-man, a veteran legal expert on IPOs, and a partner with global law firm Clifford Chance.

Financial shell games have emerged, such as “ramp and dump” scams, in which stocks are artificially inflated and hyped up on social media before being sold off, resulting in losses for unsuspecting investors.

The Hong Kong Stock Exchange has revamped the listing requirements for GEM companies more than 70 times so far to stamp volatility and speculation in small caps in a bid to restore investor confidence. In 2018, Hong Kong Exchanges and Clearing, which runs the city’s bourse, raised the transfer threshold for enterprises seeking to move from the GEM to the main board, and increased the requirement of the minimum market capitalization from HK$100 million to HK$150 million.

GEM’s role as a steppingstone for budding enterprises to move up to the main board, as well as its role in financing startups, have been weakened, which can be partly attributed to the low trading volume. “Instead of going public on GEM, it would be better off for these firms to remain unlisted for businesses until their capitalization and profit records meet the main board’s listing requirements,” said Ringo Choi Wai-wing, EY Asia-Pacific IPO leader.

Julia Leung Fung-yee, CEO of the Securities and Futures Commission, said last month enforcing various regulations in the past few years has resulted in a fairer and more transparent market. However, the GEM should be overhauled to allow it to focus on its original purpose as a platform for boosting the growth of small and medium-sized companies.

With proposed GEM amends on the horizon, the HKEX is expected to take a leaf from ChiNext — the Nasdaq-style unit of the Shenzhen Stock Exchange; the Science and Technology Innovation Board of the Shanghai Stock Exchange; and the Beijing-based National Equities Exchange and Quotations, known as “the new third board”, which is home to over 6,000 small-company stocks. A two-tiered system would be introduced for Hong Kong’s GEM, allowing “B” companies to move up to the “A” tier if they meet the specified business and market value criteria. Conversely, “A”-tier companies that fail to meet the relevant requirements may be downgraded to the “B” tier.

The plans are still in the preliminary stages, and could be significantly modified after final consultations. “We hope the reforms will better serve the fundraising needs of all companies, including innovative startups, which are in earlier development stages and contribute to the development of innovation and technology,” said Secretary for Financial Services and the Treasury Christopher Hui Ching-yu.

Lee, of Clifford Chance, noted that a two-tiered GEM system would reflect the special administrative region government’s eagerness to attract innovative startups with sustainable growth, while taking into consideration existing dormant companies that may not meet the criteria for the designated “A” tier, but still need access to the capital market. These dormant firms have reported no activity for accounting purposes when they borrowed funds.

The main obstacle to implementing a two-tiered system for the GEM is striking a balance between accommodating existing companies in the market and drawing new listings with high growth potential, she said. If the system changes too much or fails to consider their needs, it could have detrimental consequences for these companies. Moreover, the exchange must determine if some companies are no longer aligned with the board’s positioning and require replacement or removal, she added.

Versatile role

Some pundits believe that it is necessary to reintroduce the “steppingstone” function to the GEM, making startups easy transfer to the main board listing.

In Lau’s view, the function helps GEM enhance its appeal to issuers. He said the primary focus should be on cultivating a substantial pool of high-quality issuers in order to rebuild investor trust and enhance the GEM’s reputation. “The listing chapters for the main board … tend to favor larger and better established companies,” he said. “In contrast, the GEM should be ideally positioned to cater to innovative companies with significant potential that are unable to meet the size requirements of the main board.”

EY’s Choi agreed that the GEM should reestablish a mechanism for a simplified transfer to the main board, allowing companies to apply for a main-board listing once they meet the requirements, he said. “The mechanism would incentivize companies to increase liquidity, boost value and strengthen fundraising capabilities, thereby attracting investor interest.” He would like to see the GEM enshrined with distinct characteristics and inherent value. “As the GEM is clearly separate from the main board, it can boldly explore different regulatory environments.”

Lawmaker Lee, who is also CEO of local brokerage Grand Capital Holdings, highlighted the significance of attracting enterprises from diverse sectors and of varying scales, such as manufacturing.

The small-cap stock exchange needs to distinguish itself from the main board, he said. “Listing rules 18C and 18A on the main board have already provided specialized firms without robust earnings records easier access to the fundraising pool.”

Chapter 18C enables advanced, potentially high growth technology companies, including those involved in artificial intelligence and semiconductors, to go public, while 18A offers a lower entry barrier to the capital market for biotech firms.

Given Hong Kong’s role as a bridge linking the Chinese mainland and overseas markets, Lee expected the GEM’s future development to focus on collaborating with other stock exchanges on the mainland against the backdrop of the city’s integration into the nation’s development. “Moreover, competition can be a catalyst for businesses to improve themselves.”

Lai Voon-keat, managing partner at international law firm MB Kemp LLP, said he believes that encouraging retail investors to participate in trading can invigorate a more-dynamic and vibrant market for SMEs and technology startups on the GEM. “The key to a healthier market is not restricting it to ‘professional investors’ possessing HK$8 million or more. A more effective way to safeguard retail investors might be to mandate that those interested in investing in high-risk stocks complete a certain number of training hours and pass an exam to ensure they’re aware of the associated investment risks,” he said.

According to data from the HKEX’s cash market transaction survey, the trading volume of retail investors has plummeted in the past decade. Their contribution to the total market turnover has seen a downward trend — slipping from 27 percent in 2010 to 15.5 percent in 2020. The latest statistics show that retail investors account for about 12 percent of the stock market’s overall turnover.

Contact the writer at tianyuanzhang@chinadailyhk.com