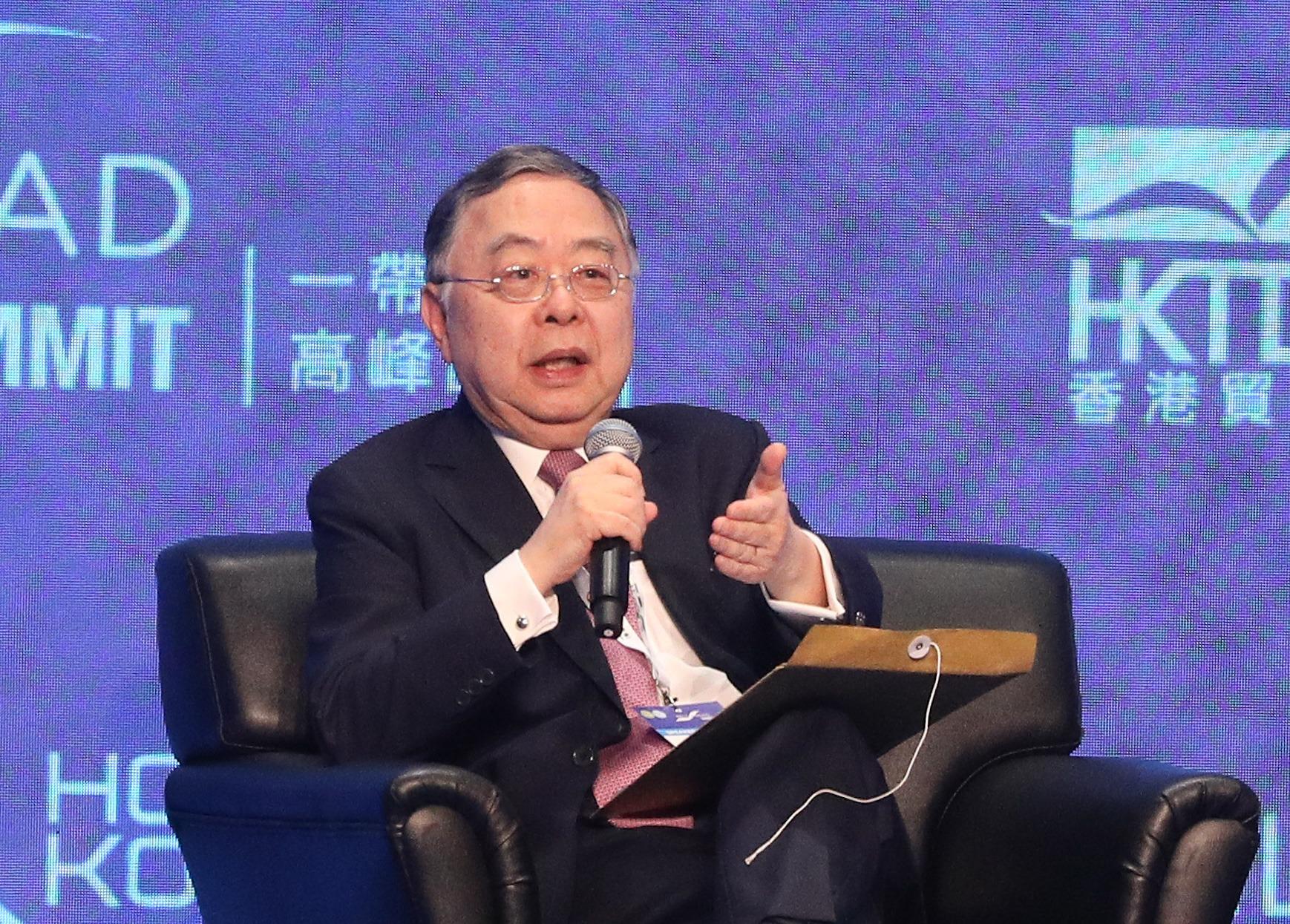

Ronnie C. Chan, the chair of Hang Lung Group Limited, speaks at the business session on "Middle East: Outlook in the Middle East Market" at the Belt and Road Summit 2023 at Hong Kong Convention and Exhibition Centre in Wan Chai on Sept 14, 2023. (CALVIN NG / CHINA DAILY)

Ronnie C. Chan, the chair of Hang Lung Group Limited, speaks at the business session on "Middle East: Outlook in the Middle East Market" at the Belt and Road Summit 2023 at Hong Kong Convention and Exhibition Centre in Wan Chai on Sept 14, 2023. (CALVIN NG / CHINA DAILY)

HONG KONG – Chinese businesses looking to expand their horizons in the Belt and Road Initiative (BRI) corridor should “change their thinking” and seize on the opportunities and developments taking place in the Middle East, business leaders told a forum in Hong Kong on Thursday.

In the panel “Business Session on Middle East: Outlook in the Middle East Market”, which was a highlight of the second day of the 8th Belt and Road Initiative summit, textiles, logistics, artificial intelligence, blockchain, chemicals, healthcare, and automobiles were singled out as some of the fast money-making sectors in the region.

Ronnie C Chan, Chair of Hang Lung Properties Limited and panel chair, spoke of the “amazing opportunities” in the Middle East and North Africa based on his numerous visits to the region.

“Today, the Middle East is perhaps one of the most stable and economically fast-developing region of the world. So, I hope that we change our thinking. I’m talking to our fellow Hong Kong persons now. Please change your mind. The Middle East is a place worth going,” Chan told the audience before he opened the floor to the panel.

Maher Aboud, Group Chief Executive Officer of the conglomerate Ghassan Aboud Group, said that the BRI “has created access to countries that were not accessible before” in Central Asia, Africa, and the Middle East.

“This initiative helped other countries develop their trade infrastructure. It helped us make easier trade with Central Asian countries like Georgia, Uzbekistan, and to UAE. On the other hand, there is a huge business trade between China and Middle East,” said Aboud.

Ahmed Obaid Yousef Al Qaseer, CEO of Sharjah Investment Development Authority, noted that the rest of the world was “going through a decline”, but the Gulf Cooperation Council countries – the UAE, Saudi Arabia, Oman, Qatar, Kuwait and Bahrain – were seeing a rise.

“We dealt with COVID-19. The UAE became a safe haven for people who wanted to come where they wanted security and stability,” said Al Qaseer.

“Another shift in big growth is we’ve seen a rise in many sectors especially green tech, green economy… I think green sustainability is something we look at in the region, especially in the UAE – 2023 in the UAE is the year of sustainability,” he added.

He said the COVID-19 pandemic served as a lesson for everyone and it made the Emirate of Sharjah consider looking at other sectors. Sharjah, he said, is known for manufacturing, education, and is a cultural hub.

“We have researched Sharjah’s technology and advanced manufacturing sectors. Agrotech today is important, especially (since there is the) Russia-Ukraine (conflict). Food security is important. We subsidized the cost of energy in the agrotech sector,” said Al Qaseer.

He also said the government of Sharjah started the largest wheat farm in the UAE, and mentioned other opportunities in renewables, waste management and a recently launched waste-to-energy project.

“The healthcare sector is important, (which we) look at concerning both the growing population and insurance requirements,” said Al Qaseer.

Hossam Heiba, President of General Authority for Investment & Free Zones in Egypt said the country was upgrading its infrastructure, having constructed 13,000 kilometers of roads, expanded the Suez canal’s capacity and built 22 new cities in recent years. He said Egypt also hosts the largest solar farm in Africa and “we are building more”.

He added that Egypt has “been working diligently” for green energy and shared that they used green fuels produced domestically. He also said many Egyptian companies export to Europe and the US and consider themselves the “gateway to Africa”.

“We invite Hong Kong investors to invest in Egypt’s economic growth,” said Heiba, adding that they can also capitalize on the country’s human resources.

No doubt in last few years, GCC countries provided the most stable environment for private sector.

Walid Majdalani, Managing Director, Corporate Investment, MENA Investcorp

In terms of automobile expansion, its industry started 60 years ago and now includes electric cars and incentives. The target is to export 2.5 million cars to Africa and the Middle East. He also said their agriculture industry was expanding after adding 1 million hectares to the country’s agricultural footprint.

“We’re also inviting industries to invest in education and the healthcare sector, which poses huge potential domestically and in the Middle East market as well,” said Heiba.

Representing the private sector, Walid Majdalani, Managing Director Corporate Investment – MENA Investcorp, told the panel that “we chase any fish big or small”, as long as “it provides the right profile to our clients”. He said it was “something that they pursued globally”.

“The Middle East has 23 countries. In every geography, there are investment opportunities,” said Majdalani, citing the Levant, which includes Jordan, which he said has been developing new tech companies.

“No doubt in last few years, GCC countries provided the most stable environment for private sector,” said Majdalani.

He also assured the panel that the GCC region “is following global trends and convenience”, meaning being able to provide service at any point in time to anywhere.

“The whole infrastructure is second to none and that creates investment opportunities,” said Majdalani, adding that any investor “should look at the Middle East” in their risk profile.

He also told the panel there was a realization that “you cannot depend on one geographical relation” and that they “hope to see Middle Eastern companies being listed in Hong Kong and other Asian markets”.

Meanwhile, Nicolas Aguzin, Chief Executive Officer at Hong Kong Exchanges and Clearing Limited, said there was no better venue in the world to raise financial capital than in Hong Kong with 80 percent representation and $200 billion in private equity.

He told the panel that all “the opportunities you talked about, they require financing”.

“When we look at the evolution in our financial market, especially after the 2018 listing regime, we managed to raise $1trillion from companies in new economies. There’s a big role to finance all that vibrancy and technology that is developing in the Middle East,” said Aguzin.

He said that in March this year following some changes, for the first time international companies that choose Hong Kong as a listing venue would be able to tap domestic capital from the Chinese mainland and that includes retail, and trading can be done through the southbound stock connect.

“I think the combination of Middle East, Hong Kong, and (wider) China is so unique. All I can think of is greater development of livelihood. So, I’m very excited about the future,” said Aguzin.

Contact the writer at jan@chinadailyapac.com