(From left) Rhonda Lam, HKMA’s chief communications officer; George Chou, chief fintech officer of the HKMA; Howard Lee, deputy chief executive of the HKMA; and Danny Chau, fintech director of the HKMA, attend a press conference a new wholesale central bank digital currency in the city on March 7, 2024. (CALVIN NG / CHINA DAILY)

(From left) Rhonda Lam, HKMA’s chief communications officer; George Chou, chief fintech officer of the HKMA; Howard Lee, deputy chief executive of the HKMA; and Danny Chau, fintech director of the HKMA, attend a press conference a new wholesale central bank digital currency in the city on March 7, 2024. (CALVIN NG / CHINA DAILY)

HONG KONG – The Hong Kong Monetary Authority on Thursday unveiled a new wholesale central bank digital currency, or wCBDC, project to provide support for the development of the tokenization market in Hong Kong.

Project Ensemble will seek to explore innovative financial market infrastructure that will facilitate seamless interbank settlement of tokenized money through wCBDC, the HKMA, the city’s de facto central bank, said in a statement.

The project will initially focus on tokenized deposits, which is a digital representation of commercial bank deposits, issued by commercial banks and made available to the general public.

READ MORE: HK at the forefront of central bank digital currencies

With wCBDC as the foundation, tokenized deposits can be used for tokenized asset transactions, unlocking new opportunities for optimization and innovation in the tokenization era, said the HKMA.

We welcome global talents and industry players to come to Hong Kong and be part of this very exciting tokenization journey.

Eddie Yue Wai-man, Chief Executive, HKMA

“Project Ensemble will provide fresh impetus to our vibrant financial industry and reinforce our forefront position in tokenized money and assets,” said the HKMA chief executive, Eddie Yue Wai-man.

Saying that Hong Kong has always championed innovation and international collaboration, he welcomed global talents and industry players to come to Hong Kong and be part of “this very exciting tokenization journey”.

If the wCBDC Sandbox garners sufficient interest from the industry, the HKMA will conduct a “live” issuance of the wCBDC at the appropriate time, the statement added.

At the core of Project Ensemble is a wCBDC Sandbox that the HKMA will launch this year to further research and test tokenization use cases that include settlement of tokenized real-world assets like green bonds, carbon credits, aircraft, electric vehicle charging stations, electronic bills of lading and treasury management.

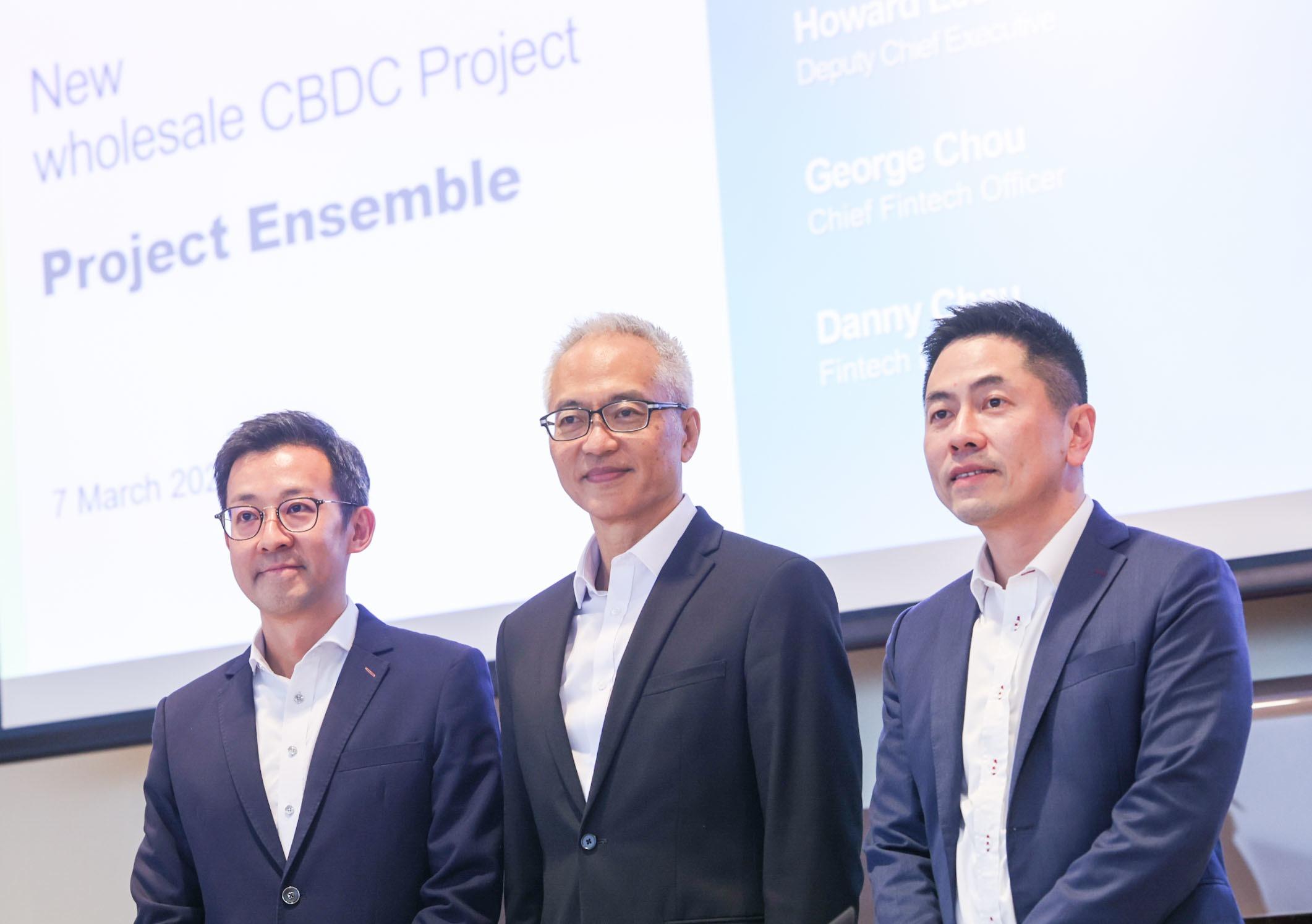

(From left) George Chou, chief fintech officer of the Hong Kong Monetary Authority; Howard Lee, deputy chief executive of the HKMA; and Danny Chau, fintech director of the HKMA, pose before a press conference on a new wholesale central bank digital currency in the city on March 7, 2024. (CALVIN NG / CHINA DAILY)

(From left) George Chou, chief fintech officer of the Hong Kong Monetary Authority; Howard Lee, deputy chief executive of the HKMA; and Danny Chau, fintech director of the HKMA, pose before a press conference on a new wholesale central bank digital currency in the city on March 7, 2024. (CALVIN NG / CHINA DAILY)

“It could potentially forge a new financial market infrastructure that bridges the existing gap between tokenized real-world assets and money in transactions,” reads the statement.

ALSO READ: From collectibles to investibles

The HKMA will form a wCBDC architecture community comprising local and multinational banks, key players in the digital asset industry, technology companies and the CBDC Expert Group to help set industry standards and a future-proof strategy.

It will also continue its partnership with Cyberport and the Hong Kong Science and Technology Parks Corporation to foster the development of asset tokenisation and support homegrown fintech innovation, it added.