Hong Kong’s mounting fiscal woes have sparked concern, threatening its coffers, public services and global competitiveness. Financial pundits have called for prudence in rejuvenating the economy to continue attracting international investors and professionals.

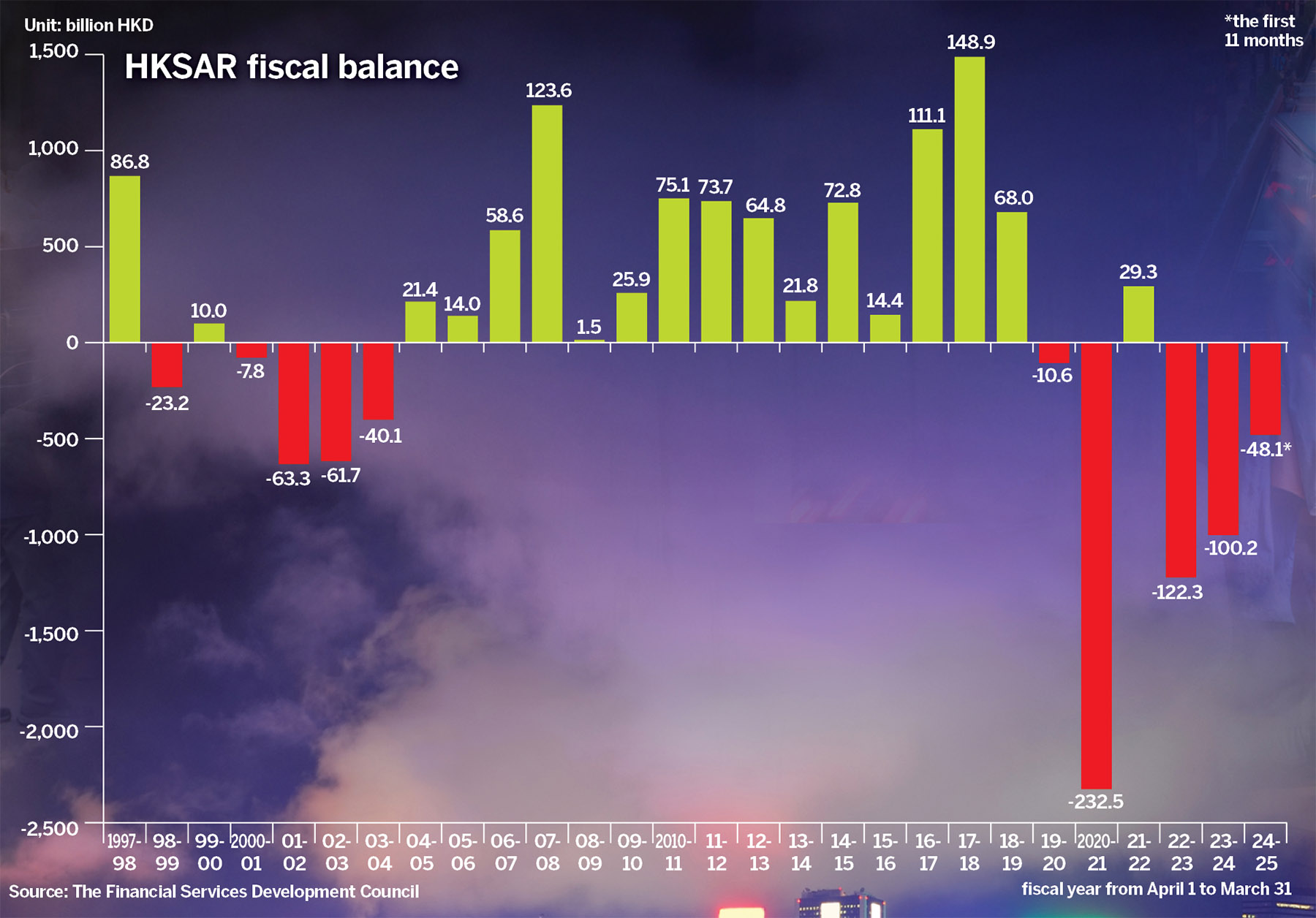

Hong Kong faces its third straight year of fiscal strain as the special administrative region government grapples with mounting deficits, driven by plunging land revenues, weak consumer spending and business headwinds.

Financial Secretary Paul Chan Mo-po expects the budget shortfall to dip below HK$100 billion ($12.85 billion) this fiscal year — more than double the initial HK$48 billion estimate — with three of the “Big Four” accounting firms concurring. KPMG, Ernst & Young, and PwC have predicted deficits of HK$80 billion to HK$98 billion, while Deloitte in November has struck a more pessimistic note, seeing the deficit breaching the HK$100 billion mark.

READ MORE: Chan: Budget deficit to fall below HK$100b in 2024-25

Tax experts and scholars have warned against raising taxes to address the fiscal woes, arguing that such measures could undermine the global trade hub’s reputation as a low-tax jurisdiction — considered to be its competitive edge over other financial centers in attracting foreign investment and capital flows.

Instead, they say reforming property policies and tax concessions might be needed initially to attract market participants, leading to long-term economic benefits, such as higher revenues.

The mounting debt stems from underperformance across key revenue streams, particularly in distressed property-related transactions, a sluggish stock market, and dwindling company income, according to Billy Mak Sui-choi, an associate professor at Hong Kong Baptist University’s Department of Accountancy, Economics and Finance.

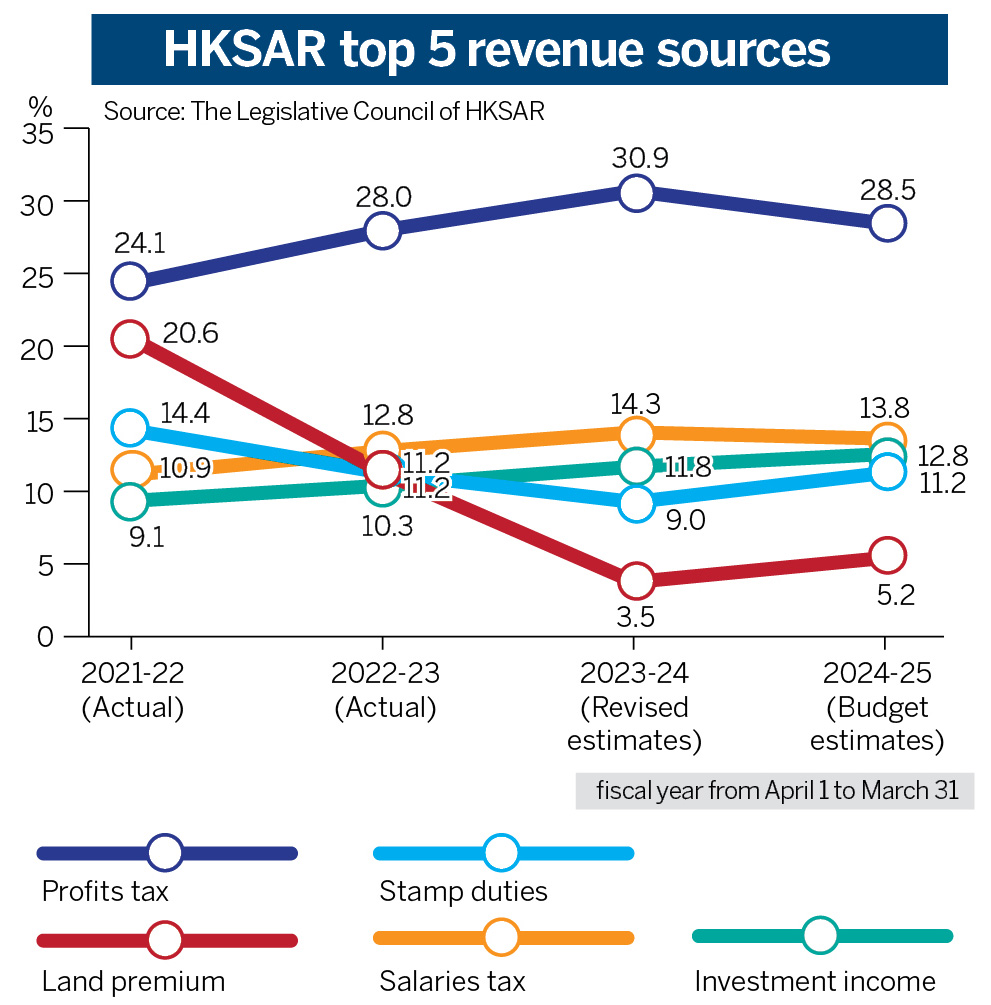

For decades, the SAR’s coffers have relied on five key sources — profits tax, land premiums, stamp duty, salaries tax and investment income — that, historically, have contributed over 60 percent in government revenue.

The collapse in land premiums is especially striking. Against an ambitious target of HK$33 billion for the 2024-25 fiscal year, income stood at just HK$4 billion as of Jan 7 — just 12 percent of the predicted figure.

The shortfall speaks volumes about the property market’s malaise. Land sales, which once accounted for about 20 percent of government revenue, shrank to 11.2 percent in the 2022-23 fiscal year and to 3.5 percent in 2023-24.

Limited land and a dense population have long made the SAR one of the world’s most expensive real estate markets. However, hampered by the COVID-19 pandemic and a talent outflow, home prices have fallen 27 percent from their September 2021 peak.

Ho Lok-sang, an adjunct research professor at Lingnan University’s Pan Sutong Shanghai-Hong Kong Economic Policy Research Institute, blames deeper structural issues, noting that Hong Kong’s fiscal foundation rests on balancing its land-linked revenue model and a low-tax regime. “The city’s success and sustainability depend on maintaining these two elements in equilibrium,” he says.

Reform fiscal policies

This balance carries constitutional weight under Article 108 of the Basic Law, which mandates maintaining Hong Kong’s low-tax system. “Any shift toward higher taxation would undermine our competitive edge,” warns Ho. “Such a move would not only threaten economic growth, but also challenge the fundamental principles that have guided Hong Kong’s prosperity.”

He is proposing an overhaul of public housing to maintain the health of the real-estate market, stressing that, previously, public rental housing tenants, benefiting from low rents, were significant players in private home purchases.

Today’s policies allow high-income families earning up to HK$154,750 monthly to remain in public housing by paying low rent, while offering them discounted Home Ownership Scheme flats. “This approach needs reform,” Ho says. “Tightening eligibility rules for well-off public housing tenants would invigorate the private market, save government resources, and reduce waiting times for those truly in need of public housing.”

He also proposes overhauling the tax system, questioning the standard tax rate that he sees as sheltering high-income earners. “Our top marginal tax rate of 17 percent is already significantly lower than Singapore’s 24 percent,” he says, adding that “removing the standard rate option would allow for a fairer application of progressive taxation without compromising our competitive position.”

READ MORE: Proactive policy, prudent risk management 'key to curb HK budget deficit'

Gary Ng Cheuk-yan, a senior economist with Natixis Corporate and Investment Bank, says Hong Kong should adopt a more progressive tax system based on income and assets to reduce its direct reliance on land.

KPMG China tax partner Stanley Ho sees an opportunity in Hong Kong’s subdued property market to attract overseas investment, suggesting that the Capital Investment Entrant Scheme’s threshold be lowered from HK$50 million to HK$30 million for residential properties. “This could revive developer interest in land sales and support property values.” he says.

The SAR government’s revenue-raising efforts include a new two-tier tax system for salaries tax and tax under personal assessment introduced in the 2024-25 Budget — 15 percent on annual revenues of up to HK$5 million, and 16 percent above that threshold, plus a 3 percent Hotel Accommodation Tax from January. However, the combined annual revenue from these measures, estimated at HK$2 billion, makes only a small dent in the government’s fiscal hole, according to Stanley Ho.

The administration is also expected to raise HK$120 billion from bond issuances for the 2024-25 fiscal year.

Ho sees fiscal predicaments as part of Hong Kong’s economic transformation. The city is “witnessing a shift in tourist spending patterns and economic focus toward asset management and innovation technology,” he says. His optimism is backed by concrete gains — the Office for Attracting Strategic Enterprises successfully drew 66 strategic enterprises to establish or expand their presence in Hong Kong last year.

“There’s typically a lag between job creation and tax revenue generation,” says Ho. “The government’s bond issuance strategy buys time during this transition period.”

Boost economic recovery

Despite the challenges, signs of recovery are emerging for 2025. New immigration and talent attraction programs had attracted nearly 260,000 professionals to the SAR as of November. CGS International, a securities firm, has predicted a 3 percent rise in home prices and a 6 percent increase in transactions for 2025, partly driven by demand from Chinese mainland residents.

Visitor arrivals are expected to surge 28 percent year-on-year to 56.1 million. While retail sales are expected to decline 7 percent last year, CGS International analysts expect a reversal to 5 percent growth in 2025.

The city weathered similar storms, having recorded a budget deficit of HK$23.2 billion during the fiscal year 1998-99 amid the Asian financial crisis, before bouncing back to a HK$10 billion surplus the following year. This was followed by four years of deepening deficits that peaked at HK$63.3 billion in 2001-02, as the SARS outbreak took a toll on the property market. It wasn’t until 2004-05 that the books finally balanced.

Drawing from this historical pattern, Mak foresees a six-year journey to fiscal recovery. But, he says the government’s primary duty is to provide essential public services. Reversing fiscal balance “isn’t just about cutting costs — it’s about finding fair and sustainable ways to support necessary programs while boosting revenue”, he says.

Essential welfare spending, particularly for low-income groups, should be preserved, while nonessential welfare benefits, especially those not serving universal needs, should be targeted for review, suggests Mak.

The HK$2 concessionary transport fare, offered to senior residents aged 60 or above and disabled groups, exemplifies the review. Mak and EY have proposed raising the age of beneficiaries to 65. “Hong Kong sets its retirement age at 65, and working adults aged 60 to 64 are perfectly capable of paying full fares,” says Mak. “While such generosity is sustainable in prosperous times, fiscal prudence demands reassessment during leaner periods.”

ALSO READ: Chan: HKSAR govt wary of broadening revenue channels

Analysts agree that rejuvenating economic vitality plays a pivotal role in addressing revenue shortfalls.

“Taking decisive steps to attract regional headquarters through concessionary tax rates could generate multiple revenue streams,” says Karina Wong, deputy chairperson of CPA Australia Greater China’s taxation committee. “When companies establish regional offices here, it stimulates demand for office space, lifts the property market and increases local spending.”

EY is advocating for expanded tax concessions for real estate investment trusts and commodity traders to stimulate growth. A thriving real estate investment trust market could attract both domestic and international capital, creating a multiplier effect across professional services, including property management, valuation and agency services, it says.

The firm also supports tax concessions for qualified commodity transactions, particularly in gold trading and related services. The initiative comes at an opportune time as gold prices hit decade-long highs in 2024, and the Hong Kong Airport Authority announced to expand its gold vault capacity from 150 to over 1,000 tons.

While initial tax incentives may be necessary to attract market participants, the accounting firm argues that long-term benefits would include increased revenue from trading fees, licensing, storage facilities, and associated financial services.

Against the backdrop of fiscal deficits, Ng warns of challenging times ahead. “Residents will face higher living costs as the government cuts tax allowances and subsidies. We are looking at a year of slower economic growth combined with higher inflation.”

Contact the writer at tianyuanzhang@chinadailyhk.com