SAN FRANCISCO - US social media giant Meta Platforms Inc on Wednesday reported financial results for the quarter and full year ending Dec 31, 2024, with a total quarterly revenue of $48.4 billion, a 21 percent increase year-on-year.

The company's full-year 2024 revenue was $164.5 billion, a 22 percent increase year-on-year. Its diluted earnings per share were $8.02 and $23.86, respectively, for the quarter and the full year.

The company's quarterly net income increased to $20.8 billion, up 49 percent from $14.0 billion year-on-year, said Meta, which is based in Menlo Park, California.

The company recorded a net income of $62.4 billion for the full year, up 59 percent from $39.1 billion in 2023.

The company's family daily active people (DAP) was 3.35 billion on average for December 2024, an increase of 5 percent year-on-year.

Its cash, cash equivalents, and marketable securities were $77.8 billion as of Dec 31, 2024. Free cash flow was $13.15 billion and $52.1 billion for the fourth quarter and full year 2024, respectively, according to the company.

ALSO READ: Meta to phase back in political content on social platforms

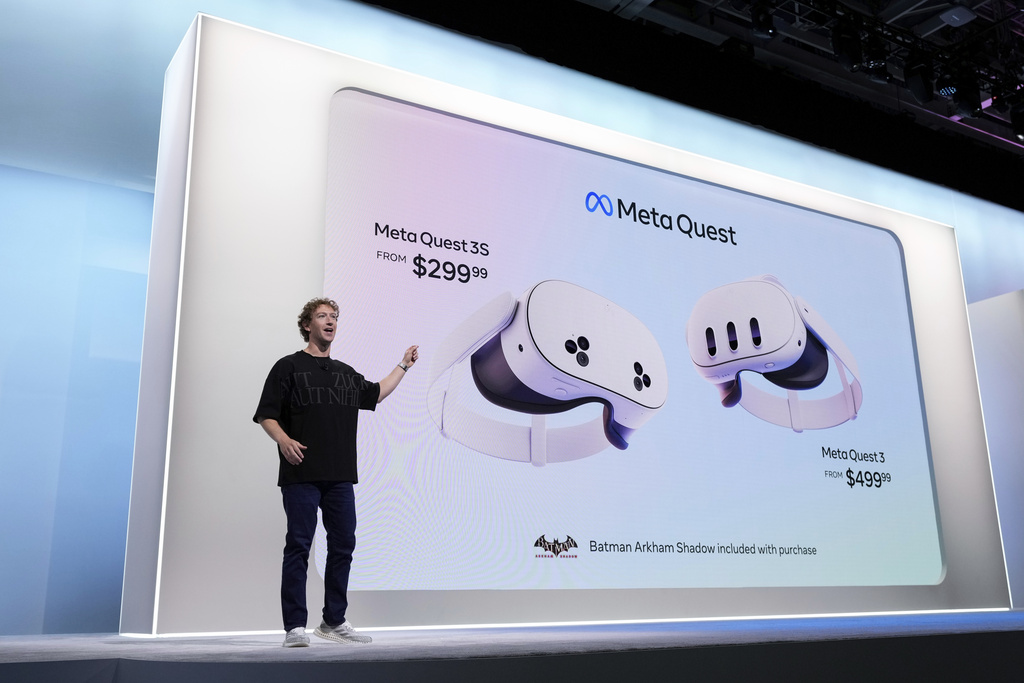

"We continue to make good progress on AI, glasses, and the future of social media," said Mark Zuckerberg, Meta founder and CEO. "I'm excited to see these efforts scale further in 2025."

The company expects the first quarter 2025 total revenue to be in the range of $39.5 billion to $41.8 billion. This reflects 8 to 15 percent year-over-year growth, or 11 to 18 percent growth on a constant currency basis.

"We expect the investments we are making in our core business this year will give us an opportunity to continue delivering strong revenue growth throughout 2025," Meta said.

It expects full year 2025 total expenses to be in the range of $114 billion to $119 billion. The single largest driver of expense growth in 2025 will be infrastructure costs. Employee compensation will be the second-largest factor as the company adds technical talent in the priority areas of infrastructure, monetization, Reality Labs, generative artificial intelligence (AI), as well as regulation and compliance, according to Meta.

The company anticipates the full year 2025 capital expenditures will be in the range of $60 billion to $65 billion, driven by increased investment to support both its generative AI efforts and core business.

READ MORE: Meta projects sharp acceleration in AI costs after results beat Wall Street targets

"In addition, we continue to monitor an active regulatory landscape, including legal and regulatory headwinds in the EU and the US that could significantly impact our business and our financial results," said Meta.