AI-improved humanoids set for mass production, expanded roles in workforce

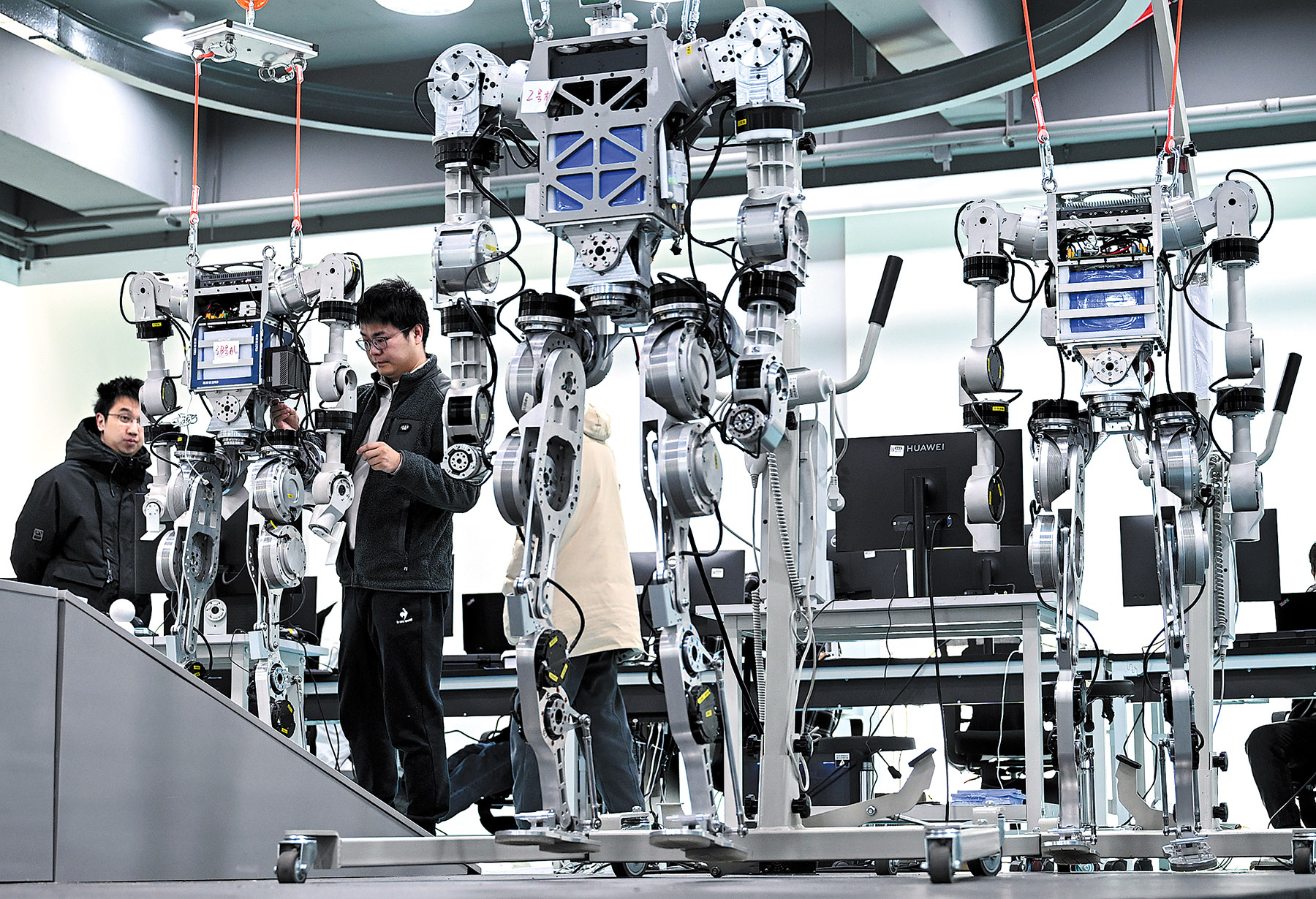

In a cutting-edge facility in Shanghai, engineers are precisely assembling humanoid robots, while rows of newly manufactured units stand ready for quality checks. In an adjacent testing zone, 100 humanoid robots are being trained to perform daily tasks — such as serving tea, folding laundry and setting tables — in simulated environments ranging from cafes to residential spaces.

The factory is in Lin-gang Special Area, Shanghai's first mass production hub for humanoid robots. Despite being operational for less than a year, it has already rolled out over 1,500 units, according to AgiBot, the artificial intelligence and robotics startup that runs the factory.

"We plan to open a second factory in Shanghai this year, and are aiming for an annual capacity of 10,000 units," said Peng Zhihui, co-founder of AgiBot.

In a market traditionally accustomed to United States names such as Boston Dynamics' Atlas robot, the global humanoid robotics industry is now being wowed by eye-catching innovations from Chinese companies.

READ MORE: Robotics sector goes full throttle for self-reliance despite headwinds

This year is widely anticipated to mark the first mass production of humanoid robots, and Chinese heavyweights and startups are scrambling to exhibit their technological and manufacturing prowess.

On the list of 100 global humanoid robotics-related companies, which was recently released by United States investment bank Morgan Stanley, 37 are from China, including UBTech Robotics and BYD.

Humanoid robotics is a perfect example of "embodied AI", the integration of physical hardware and artificial intelligence, a phrase that was highlighted in the 2025 Government Work Report.

According to a Ministry of Industry and Information Technology guideline, China aims to build an innovation system for humanoid robots by 2025, with breakthroughs in key technologies to ensure the safe and effective supply of core components.

By 2027, China will see a secure and reliable industrial and supply chain system of humanoid robots, and related products will be deeply integrated into the real economy, the guideline added.

China has made rapid progress in robotics and artificial intelligence, said Qiao Hong, an academician at the Chinese Academy of Sciences and director of the State key laboratory of multimodal artificial intelligence systems.

"Over the past three years, China has accounted for more than half of the global installations of industrial robots, and its lunar exploration robots have successfully returned lunar soil samples," she said.

Qiao pointed to the development of humanoid robots as a particularly promising area, with China establishing a core foundation of technology for large-scale, cost-effective production of high-performance robotic systems.

China's humanoid robot market is expected to grow into a more than 100 billion yuan ($13.6 billion) market by 2030, up from 2.76 billion yuan in 2024, according to a report from the China Academy of Information and Communications Technology.

Goldman Sachs Research predicts the global humanoid robot market could hit $154 billion by 2035, with optimistic projections reaching $205 billion.

Automakers' crossover

Well aware of the opportunities, Chinese tech heavyweights, automakers and startups are all jumping on the bandwagon for both short-term gains and long-term strategic goals.

Since the beginning of this year, humanoid robots have become the hottest trend in the automotive industry. At least 15 Chinese automakers including GAC, SAIC, XPeng, Chery and Xiaomi, along with supply chain companies like Huawei, Horizon Robotics and Hesai Technology, have entered the humanoid robot race.

Overseas, six automakers — Tesla, BMW, Mercedes-Benz, Honda, Toyota and Hyundai — have also proposed their own humanoid robot concepts.

Virtually all mainstream global automakers have now joined the humanoid robotics arena. Tesla has set an ambitious mass production target: expanding monthly production capacity of its Optimus humanoid robot to 100,000 units by 2027.

The automotive industry has long been considered the largest application field for robotics. Sixty-four years ago, General Motors became the first customer for the Unimate industrial robot, a mechanical arm, ushering in the era of automated manufacturing. Since then, cutting-edge robots have played crucial roles in automotive workshops.

Now, automakers are again at the forefront of robotics innovation, but with greater ambitions in the AI plus robotics domain.

In the short term, they aim to enhance manufacturing and sales efficiency. In the long term, as population growth plateaus and the automotive technology matures, automakers will need new growth drivers, experts said.

From a technical perspective, automakers' crossover into humanoid robotics appears logical — if humanoid robots are seen as general-purpose robots, then smart vehicles resemble specialized robots for specific scenarios, they added.

Both share foundational technologies: intelligent perception, human-machine interaction, decision-making in complex environments and path planning. For automakers, entering this field represents reusing established technology that could reduce costs and production cycles.

Zhang Shaozheng, general manager of manufacturing at AgiBot, said: "We've leveraged synergies with the new energy sector, particularly in components like electric motors and gearboxes. It is precisely these mature supply chains that enabled us to produce humanoid robots at scale in such a short time frame."

Industrial automation

Goldman Sachs Research also forecasts significant demand for humanoid robots in structured environments like manufacturing. That could include use in scenarios such as electric vehicle assembly and component sorting. Industry research indicates that about 70 percent of manufacturing in China is already done by machines and automation. Since humanoids are more flexible and capable of adapting to complex terrains, Goldman Sachs analysts believe they can expand the market for industrial automation.

Humanoids are particularly appealing for tasks that are "dangerous, dirty, and dull", Goldman Sachs Research said, adding that there would be potential demand for robots in mining, disaster rescue, nuclear reactor maintenance, and chemicals manufacturing.

Customers may be willing to pay a higher price for robots that can do dangerous jobs that people are reluctant to do. Importantly, robots could also provide labor in sectors that don't have enough workers, Goldman Sachs added.

Labor is still indispensable in the era of industrial automation. However, going forward, humanoid robots can collaborate with traditional automation equipment to solve complex scenarios of flexible unmanned operations, and independently complete difficult tasks, such as torque tightening and material handling, Zhou Jian, chairman and CEO of UBTech Robotics, said.

The company is exploring the application of humanoid robots in industrial scenarios, such as new energy vehicles, with leading EV makers including Nio and BYD.

UBTech Robotics released a video in March that showed a team of its humanoid robots working collaboratively at an EV factory in China, claiming it as the world's first multi-humanoid robot collaboration across multiple scenarios and tasks.

Zheshang Securities estimates that by 2030, Chinese and US manufacturing sectors will require 1.1 million and 583,000 humanoid robots respectively, indicating the massive market potential.

Shortcomings, challenges

Humanoid robots, however, are still in the very early stages of development. There are shortcomings in their design, and their functionalities are not fully in line with customer needs. Technological hurdles and cost challenges also exist, experts said.

"As a manufactured product, humanoid robots can only have a solid market when costs are lowered to an acceptable level," said Guo Qianqian, an analyst at Essence Securities.

But progress is underway. Last year, Unitree Robotics unveiled a surprisingly low price of 99,000 yuan for its latest G1 humanoid robot, standing in sharp contrast to many robots from other companies that are priced from 150,000 to 200,000 yuan.

According to Unitree Robotics, G1 is about 127 centimeters tall and boasts impressive stability and flexibility, such as 180-degree body rotation and the ability to crack walnuts "barehanded".

The story behind Unitree Robotics' ability to offer such low prices can be traced back to its years of developing quadruped robots and its self-developed electric drive technology.

"The core components of the G1 joint unit, including the servo motor, reducer and controller, are all independently developed and produced by Unitree," said Wang Qixin, chief marketing officer at Unitree Robotics.

The development of the G1 humanoid took about three months from project initiation to launch, primarily due to Unitree Robotics' own technology. Wang also acknowledged that the reduced size of the robot contributed to the lower price.

Humanoid robots' path to commercialization may take even longer than that of autonomous driving vehicles, experts said.

He Xiaopeng, chairman and CEO of Chinese automaker Xpeng Motors, said he recently had a discussion with Wang Xingxing, founder of Unitree Robotics, and Zhou from UBTech Robotics. The trio agreed that current humanoid robot technology approximates to level 2 autonomy, or assisted autonomy, while the industry hopes to achieve commercially viable level 3 autonomy, or conditional automation.

Level 2 is part of broader standards developed in relation to the degree to which autonomous machines take over driving functions. Level 2 means partial driver assistance. Level 3 means that drivers don't need to pay attention in certain situations. Level 4 means that vehicles can perform all driving tasks under specific circumstances, but human overrides are still an option.

He said the leap from level 2 to level 3 in humanoid robots requires "exponentially" greater capabilities, and humanoid robots need to reach level 4 autonomy before operating in households.

Compared with autonomous vehicles, humanoid robots face far greater challenges in perception, decision-making, motion control, and hardware across more complex, unpredictable scenarios, experts added.

Over the years, smart cars have developed high-level autonomous driving, but level 4 and above remain commercially elusive.

Compared to vehicles' controlled traffic environments, humanoid robots demand "higher generality" across diverse, unpredictable scenarios. Current applications focus on grasping, assembly and inspection in factories — processes that require 18 to 24 months of rigorous testing, said Zhou from UBTech Robotics.

Smarter robot 'brains'

The progress of large language models such as China-developed DeepSeek is also injecting new vitality into the sector.

US market research company International Data Corp said that LLMs are key drivers and can help better develop the "brain" of humanoid robots, enhancing perception and enabling autonomous learning and decision-making, while improving motion generalization through behavioral interaction training.

In March, AgiBot launched an AI large language model, the GO-1, to accelerate the training of robots. The model enables robots to rapidly generalize new tasks with minimal training, significantly lowering the technical barriers for embodied AI applications, AgiBot said.

The GO-1 model leverages real-world human demonstrations and internet-sourced video data to enhance contextual understanding of human activities.

ALSO READ: Spotlight on AI as future game changer

Yao Maoqing, a partner of AgiBot and president of its embodied intelligence business unit, said: "Even a simple water-pouring action requires nearly 100 high-quality data samples for training. These data sets, collected from 100 robots, are uploaded to the cloud computing platform for model iteration, eventually enabling universal task deployment."

Repetitive industrial tasks remain the initial focus for the application of humanoid robots. Yao highlighted logistics as a prime example.

"While automated guided vehicles excel at transporting goods, tasks such as packaging different sized items demand real-time adjustments and error correction — a challenge perfectly suited for humanoid robots. AI control allows them to rethink strategies upon failure, much like humans," he said.

As technologies evolve, AgiBot envisions broader applications. "Humanoid robots' flexibility fills the gap between rigid automation and human labor," Yao said.

masi@chinadaily.com.cn