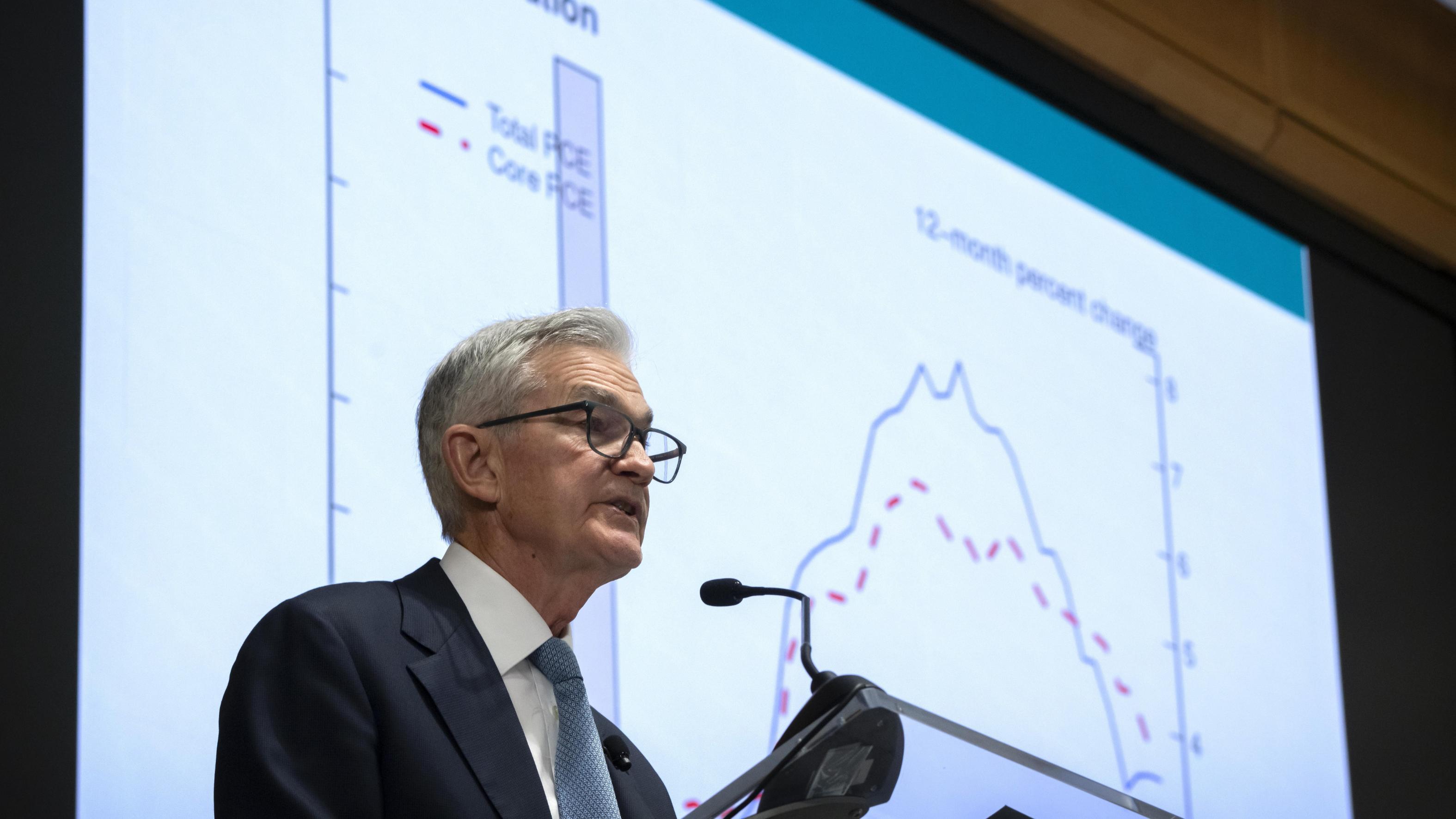

Federal Reserve Chairman Jerome Powell speaks after resuming his speech after climate protestors interrupted at the 24th Jacques Polak Research Conference at the International Monetary Fund, Nov 9, 2023, in Washington. (PHOTO / AP)

Federal Reserve Chairman Jerome Powell speaks after resuming his speech after climate protestors interrupted at the 24th Jacques Polak Research Conference at the International Monetary Fund, Nov 9, 2023, in Washington. (PHOTO / AP)

WASHINGTON - US Federal Reserve officials said they were in no hurry to cut interest rates, cautioning about lowering rates too quickly, according to minutes of the Fed's latest meeting released Wednesday.

"Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent," the minutes stated.

Despite indications of disinflation in the latter half of the previous year, participants emphasized the need for cautious evaluation of incoming data to determine if inflation trends were sustainably converging towards the target

ALSO READ: US Fed leaves rates unchanged amid lower inflation

Concerns persisted regarding the adverse effects of elevated inflation, particularly on households with limited financial resources, the minutes showed.

Despite indications of disinflation in the latter half of the previous year, participants emphasized the need for cautious evaluation of incoming data to determine if inflation trends were sustainably converging towards the target.

Anticipating a moderation in consumption growth for the year ahead, several participants highlighted the expected slowdown in labor income growth and the gradual depletion of pandemic-induced excess savings.

READ MORE: Asian stocks slump as traders temper rate cut bets

In addition, some participants noted signs that the finances of some households — especially those in the low- and moderate-income categories — were increasingly coming under pressure, which these participants saw as a downside risk to the outlook for consumption.

In particular, they pointed to increased usage of credit card revolving balances, buy-now-pay-later services, and increased delinquency rates for some types of consumer loans.

As an upside risk to inflation and economic activity, participants noted that momentum in aggregate demand may be stronger than currently assessed, especially in light of surprisingly resilient consumer spending last year.