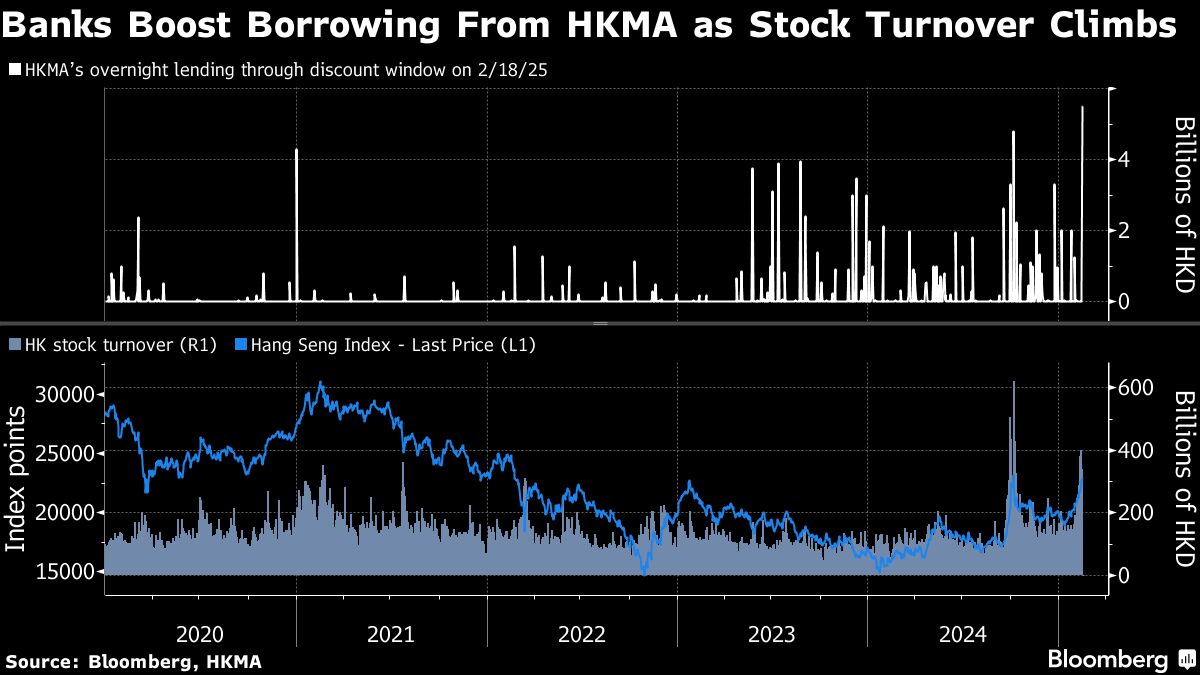

Surging demand for Hong Kong equities sapped interbank liquidity in the city, prompting local banks to borrow the largest amount of overnight cash from authorities in more than five years on Tuesday.

The Hong Kong Monetary Authority loaned out HK$5.5 billion ($707 million) through its so-called discount window, the most since December 2019, according to data compiled by Bloomberg.

“The tightening of liquidity in Hong Kong is, in our view, driven by demand for HK equities,” said Wee Khoon Chong, a strategist at BNY. Liquidity “probably will stay tight in the near term as HK equities’ momentum continues.”

ALSO READ: AI hype supercharges mainland stocks to three-year high in Hong Kong

The lending comes as benchmarks for Chinese mainland stocks traded in the city and Hong Kong equities have both outperformed global peers in the past month amid optimism over DeepSeek’s artificial intelligence capabilities.

When mainland and overseas investors buy Hong Kong shares, they need to convert their foreign-exchange holdings into the city’s dollars. Such demand has driven local banks to seek more cash in the money market for their clients, leading to a surge in funding costs.

Some lenders may have resorted to HKMA for such temporary liquidity during this process, said Stephen Chiu, chief Asia foreign-exchange and rates strategist at Bloomberg Intelligence.

READ MORE: Chan shows cautious optimism about HK stock market

Investors’ stock purchases “could also cause temporary liquidity swings because not all banks have unlimited trading limit with other banks so might have to use the HKMA’s discount window,” he added.

A gauge measuring the one-month funding costs in Hong Kong surged some 40 basis points over the past week to 4.07 percent, a near six-week high, amid a rebound in local stocks.

On Tuesday, mainland investors bought HK$22.4 billion worth of Hong Kong stocks, the biggest daily purchase since early 2021, according to data compiled by Bloomberg.