Hong Kong, often envied for its efficient transportation, enacts repeated fare increases, with an adjustment mechanism applied to both the subway monopoly and bus franchises. Vexed members of the public, legislators, and academics, have called for a review of the fare revision mechanism to better reflect economic reality. Oasis Hu reports from Hong Kong.

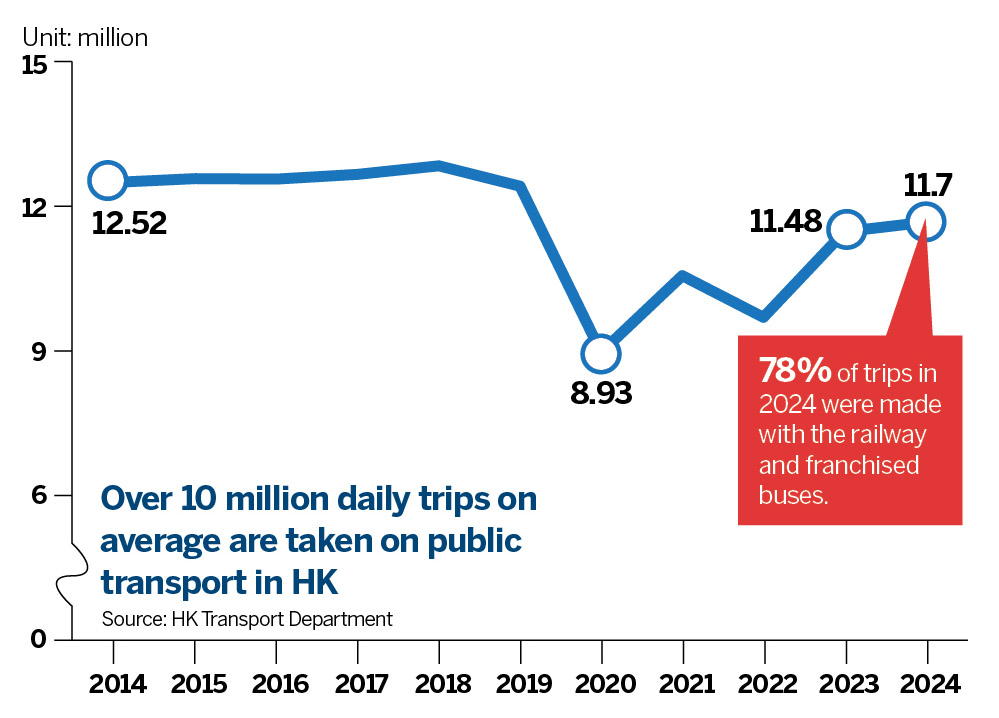

Since 2010, Hong Kong’s subway monopoly, Mass Transit Railway (MTR), has revised travel fares 11 times, while bus companies have raised fares seven times since 2008. Residents have questioned these repeated fare hikes as the Hong Kong Special Administrative Region government owns 70 percent of the MTR and grants route franchises to bus companies. The fare increases have caused particular ire as public transport is a vital daily service for people living in both rural and urban areas.

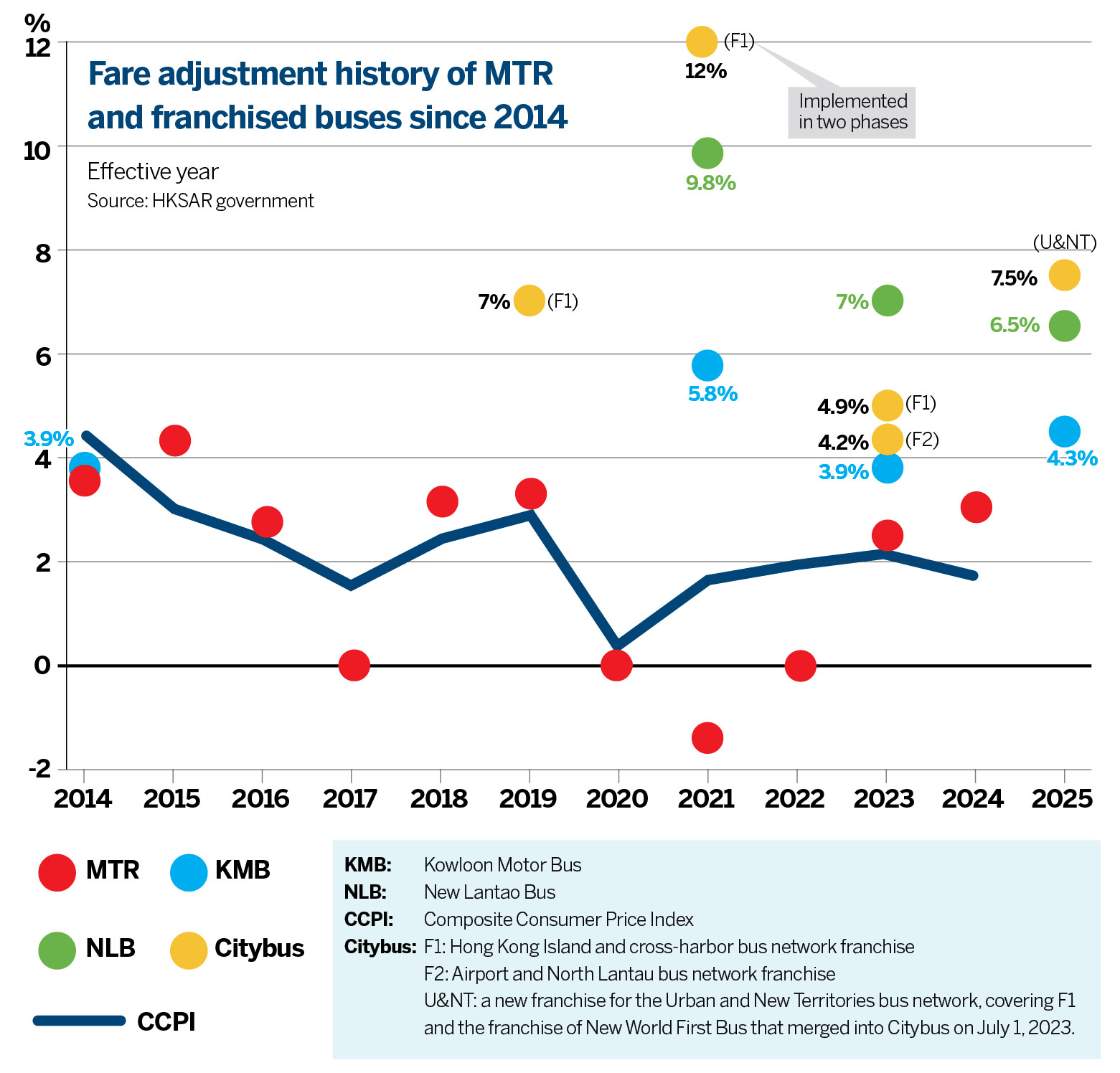

On Jan 5, three bus companies raised fares across 120 routes by HK$1 ($0.13) or more: Kowloon Motor Bus Co Ltd by 4.3 percent, Citybus by 7.5 percent, and New Lantau Bus by 6.5 percent.

READ MORE: HK bus companies seek fare rises of close to 10%

In June 2024, the MTR raised fares by 3.09 percent. Post-adjustment fares for a single journey ranged from HK$4 to HK$60.8. Meanwhile, from 2014 to 2024, the year-on-year change in real payroll-per-person per quarter varied between -1.1 percent and 3.8 percent. In the third quarter of 2024, labor in Hong Kong saw only a 0.9 percent wage increase against the previous year.

The disconnect between repeated transport fare hikes and lagging real wages bothers the public and academics. The SAR government has opted to allow for-profit private ownership and operation of public transport, under strict guidelines.

Public transport, private operator

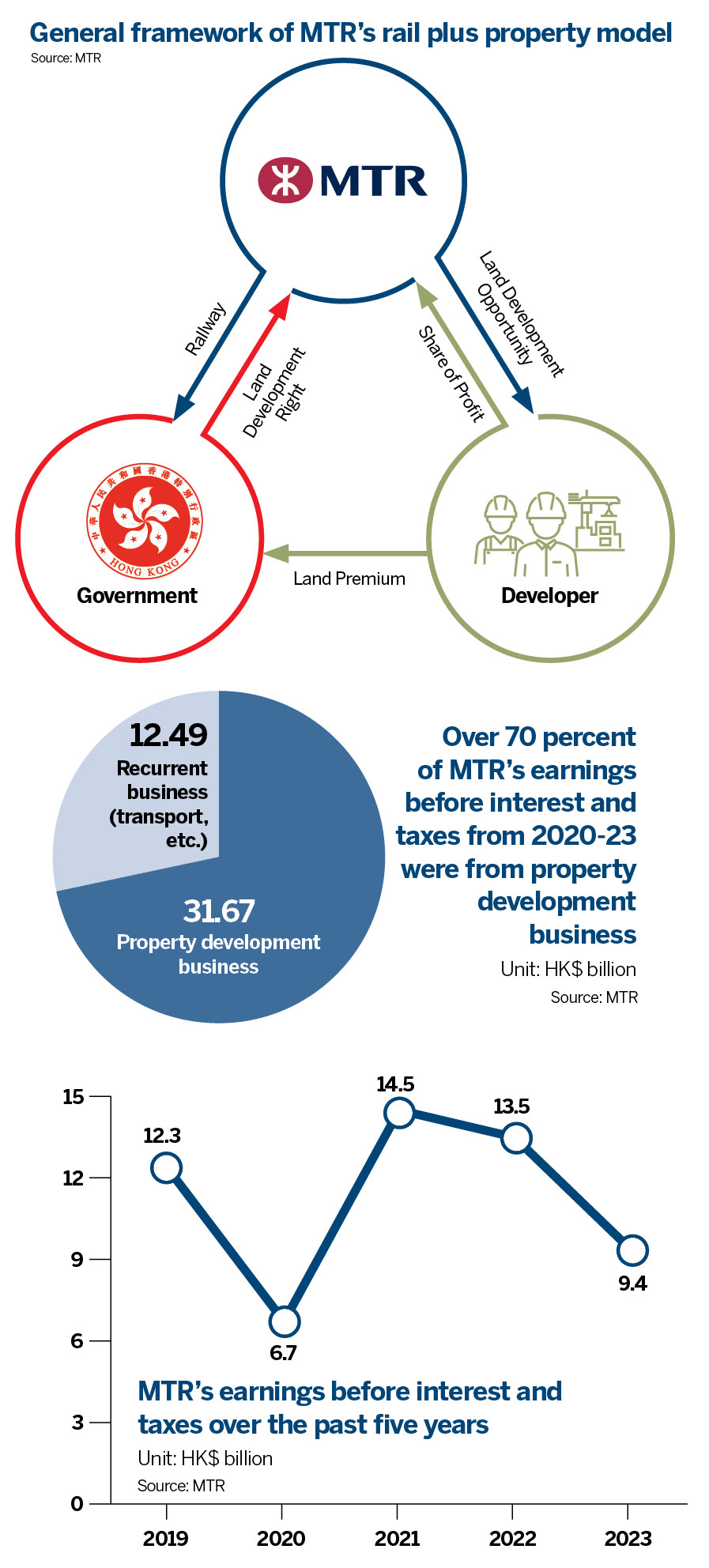

The MTR Corp is listed on the Stock Exchange. The high capital investment for underground railroad construction, infrastructure development, and operations, is compensated by the unique “rail plus real estate” business model.

The MTR is granted land development rights adjacent to its tracks, allowing it to generate revenues from both passenger traffic and appreciating property values, in land-scarce Hong Kong.

The MTR’s profits are significant at HK$14.5 billion in 2021, HK$13.5 billion in 2022, and HK$9.4 billion in 2023 (dropping due to the effects of the COVID-19 pandemic). The dominant 70 percent equity ownership of the government gives it the clout to optimize service quality, and value to the public.

Most subways worldwide operate at a loss. The New York subway system, despite being one of the busiest globally with high traffic, struggles to break even and carries high debt, relying on city government subsidies to operate. It is overdue for renewal.

The London Underground is outdated too. It strives to minimize reliance on government funding, with over 80 percent of revenue coming from ticket sales. Passengers bear high fares, ranging from $3 to $7 for a single journey.

“By contrast, the Hong Kong MTR stands out as one of the rare, self-sustaining subway companies in the world, a highly advanced operation model,” said transport geography expert James Wang Jixian, council member of the Hong Kong Society for Transport Studies, who worked in the University of Hong Kong’s geography department for 24 years.

The MTR’s profitability guarantees the provision of an affordable, clean, efficient, and modern facility, run with clockwork precision. It is called upon to advise, and in some cases comanage, operations abroad.

MTR fare revision

Wang also noted that while Hong Kong’s economy is market-led, the city’s public transport sector is mainly government-led and regulated.

As one of the most densely populated cities globally with scarce land resources, Hong Kong must optimize its land use. That drives the city to design public transport systems that can carry a high number of passengers while occupying minimal ground space. Most buses in Hong Kong are double-decker, to exploit vertical capacity.

Wang said the government adjusts the fare pricing mechanism for public transport to ensure the synergy of different transport modes. Travel time is inversely proportional to the price of a ticket, he added. For the same journey, if taking a bus is more time-saving than the MTR, bus fares will be more expensive. If traveling by MTR is faster, MTR fares will be higher.

Through these initiatives, Hong Kong’s public transport system has achieved a high utilization rate. In 2023, the city’s daily journeys on public transportation reached approximately 11.48 million. To ensure efficiency, quality, and optimal value to residents, the government accepts that private sector operators need to be profitable.

Independent formula

Hong Kong lawmaker Gary Zhang Xinyu, a former MTR station manager, noted that public complaints regarding fare hikes do not necessarily challenge the entire system. “The complaints show some specific pricing mechanisms are not that reasonable. Could they be further adjusted to be more beneficial to the public?” he said.

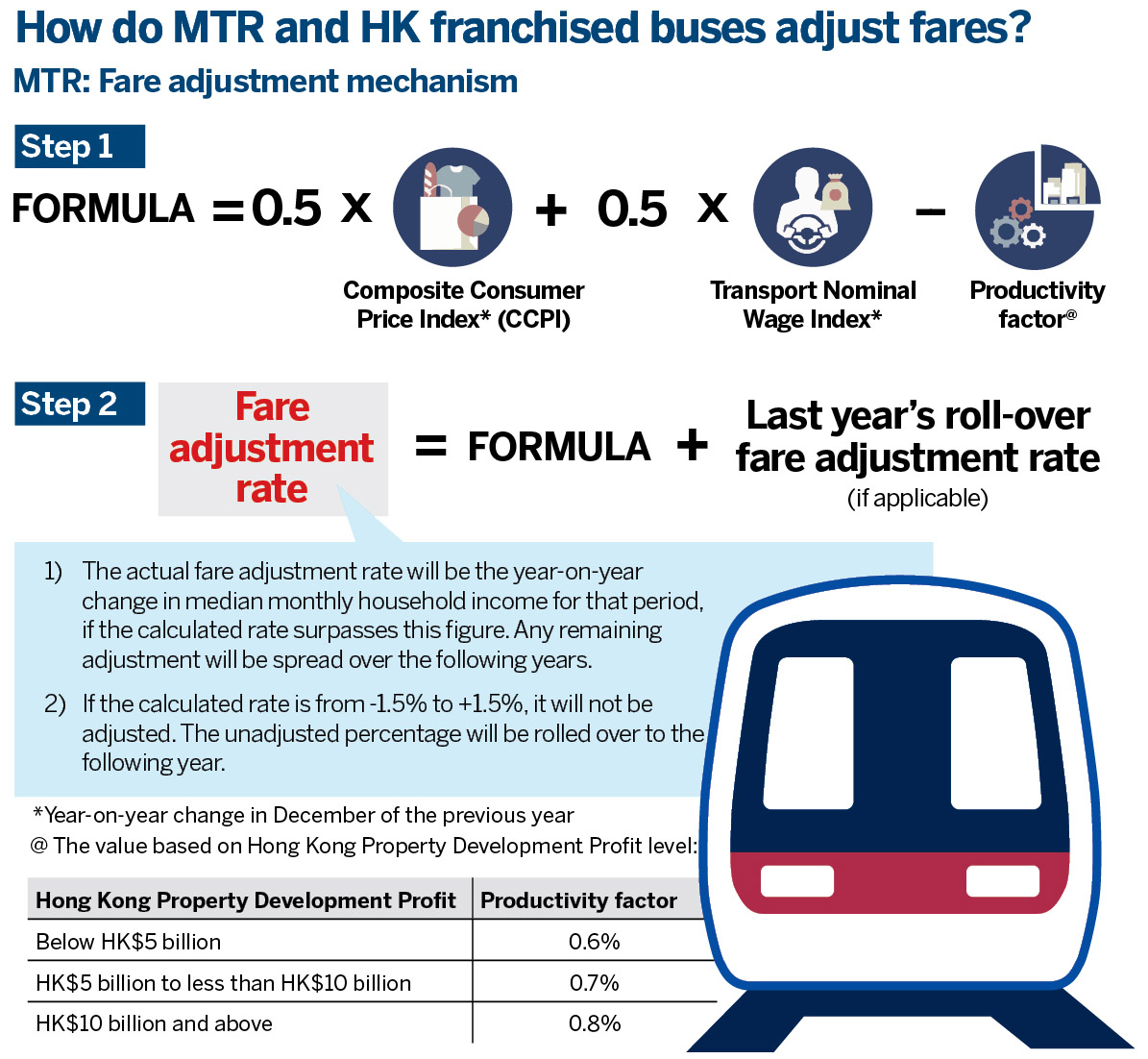

The fare adjustment mechanism was established following a merger of the MTR and the Kowloon-Canton Railway (KCR) in 2007. Over the past decade, through cycles of reviews, the computation formula for fare adjustments has factored in the composite consumer price index (CCPI) plus nominal wage index (transport) (NWI(T)), less the productivity factor.

The Census and Statistics Department provides the CCPI and NWI(T), which reveal the MTR’s primary cost change. The productivity factor links to profitability of the MTR’s property-development assets in Hong Kong. If profits are below HK$5 billion, the productivity factor is 0.6 percent; above $5 billion and under $10 billion, it is 0.7 percent; and at $10 billion and above, it is 0.8 percent.

The mechanism stipulates that the annual fare change cannot surpass the increase in the median monthly household income for that period. However, the excess beyond that threshold is not cancelled or waived but rolled over to subsequent years.

How does it work?

In 2023, the CCPI rose by 2.4 percent, and the NWI(T) by 5.2 percent. The productivity factor was set at 0.6 percent. Additionally, the deferred 1.85 percent increase from the previous year was due to be added in.

Consequently, the MTR fare adjustment rate for 2024 was calculated as follows:

Overall fare adjustment rate = (0.5×2.4 percent) + (0.5×5.2 percent) — 0.6 percent + 1.85 percent = 5.05 percent.

The change in median monthly household income was 3.09 percent, which caps the final fare adjustment rate. Therefore, in June 2024, the MTR fare increase of 3.09 percent was officially implemented. The remaining 1.96 percent (5.05 — 3.09) increase is deferred to the following year.

What irks the public however, since the 2010 annual fare review mechanism, is that ticket prices have been raised 11 times in 15 years. In a forum discussing the city’s transportation, one resident wrote, “The fare adjustment mechanism has become a fare increment mechanism.”

Accurate and fair?

Lawmaker Zhang said he wondered if the well-intentioned price calculation formula to enhance openness, objectivity, and transparency, is accurate and fair. Kwan Cheuk-chiu, director at economic think tank ACE Centre for Business and Economic Research, said the formula fails to capture Hong Kong’s larger economic landscape.

The CCPI reflects price levels. Wage levels are influenced by the labor market and the city’s aging demographics. The productivity formula captures only part of the property profitability of the MTR. That composite does not truly reflect Hong Kong’s economic profile.

Even amid economic downturns like the COVID-19 pandemic, MTR fares were still increased — dictated by the fare calculation formula. Kwan suggested that the formula integrate an index directly linked to Hong Kong’s total economic reality.

Quentin Cheng Hin-kei, a spokesperson for the Public Transport Research Team, said that the current formula inadvertently double counts: the CCPI already indicates the inflation level, but the wage index, which relies on nominal rather than real data, also includes inflation adjustments. The public ends up paying for inflation twice, which is not fair, said Cheng.

Lawmaker Michael Tien Puk-sun warned that the productivity factor in the formula is only linked to the profit from property development. Revenue from passengers, and income from property rental and management services, are not linked to the productivity factor in the fare adjustment formula.

In 2023, the MTR’s earnings before interest and taxes from property development reached HK$2.33 billion, while the figure from passenger services amounted to HK$2.68 billion, and income from its property rental and management business stood at HK$4 billion. As the MTR continues to expand, the figure from these segments will grow. However, the public does not benefit from these profits omitted from the formula, Tien said.

“There is certainly room for improvement of the current pricing mechanism,” observed Zhang. “The government could initiate a mid-term review next year, once the new Legislative Council takes office.”

Zhang proposed linking the disputed “productivity factor” to the total profit from the MTR’s business ventures. Billy Mak Sui-choi, associate professor in the department of accountancy, economics, and finance at Hong Kong Baptist University, disagreed. He said he believes the MTR has a responsibility to its shareholders as a publicly listed company.

Mak distinguished profits from facility investments that should be shared with the public, from other investments such as overseas projects, which the MTR can retain. However, in the MTR’s current financial statements, the distinction between government-backed facility projects and other investments, is not clear. This lack of clarity might lead to ambiguity and potential for manipulation, said Mak, recommending the MTR improve the transparency of its financial statements.

In an email response to China Daily, an MTR spokesperson said the fare adjustment mechanism undergoes a comprehensive review every five years. The 2023 review of the FAM, he said, incorporates the perspectives of all stakeholders.

Since 2007, the average annual fare adjustment rate of the MTR has remained below the average annual inflation rate of the city during the same period, said the spokesperson.

Moving forward, the MTR will allocate more resources to offer fare concessions to its passengers, he added.

Bus franchises

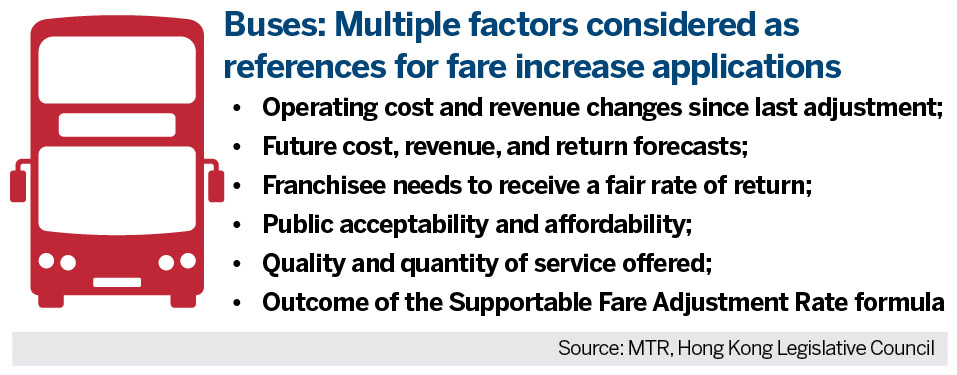

There are four bus companies in Hong Kong, managing around 700 routes. All four bus companies are private, for-profit enterprises, or subsidiaries of listed companies. The government consults these companies to rationalize routes, and to establish a fare pricing and revision mechanism. They run under agreed franchise terms. The bus companies are self-financing and operate independently.

The government introduced a fare adjustment formula as a reference, for franchised buses in 2006: Supportable fare = (adjustment rate 0.5 x change in wage index) + (0.5 x change in CCPI) less (0.5 x productivity gain).

Bus companies retain the independence to determine whether to request a fare adjustment, and the extent of the increase. These companies submit their applications for the government to review and decide the magnitude of the fare increase.

Many argue that bus companies should also be subject to an independent pricing formula, but Mak said he regards this as impractical. “The cost structure of the MTR being relatively fixed, allows the use of a formula for calculation. The costs of bus operations for expenses like electricity, fuel, and natural gas, fluctuate annually. Furthermore, each bus company’s cost profile varies, making it challenging to apply a single fare adjustment formula to all,” he said.

Excessive fare rise

Zhang concurred with Mak that an independent fare pricing formula for buses would be difficult, but he urged the fare mechanism be made more transparent. Even with the existing reference formula, fare revisions greatly exceeded the calculations. In 2024, the formula indicated a 3.75 percent revision, but Citybus submitted a 9.5 percent increase, which the government approved at 7.5 percent — twice the formula level.

“In 2024, there was no pandemic or social unrest in Hong Kong. Oil prices didn’t spike, and the bus company experienced a rise in passenger numbers. How could it justify a 9.5 percent increase? The government’s approval of a 7.5 percent rise begs the question: How was this figure of 7.5 calculated?” Zhang said.

In December 2024, the government released a statement on the fare increase, saying it considered a range of factors including costs and revenue, projections of future costs and revenue, and returns. The documents provided to the Legislative Council for fare increase evaluation had no detailed breakdown of operating costs, future revenue projections, or returns.

Zhang proposes a double vetting mechanism: When a bus company requests a fare increase, the application should first be scrutinized by the government, and then be presented to the Legislative Council for review. Zhang added that public grievances about buses extend beyond fares. He called for a comprehensive review of the whole franchised bus operation model.

“Striking a balance between public welfare and market orientation is always crucial. Achieving this equilibrium requires continuously refining existing mechanisms based on real-time changes and evolving circumstances,” said Zhang.

What’s next

- Conduct midterm review of MTR’s pricing formula

- Improve clarity of MTR’s financial reporting

- Bus fare adjustment should have double-vetting involving LegCo

- Undertake comprehensive review of bus operations

Contact the writer at oasishu@chinadailyhk.com