China is likely to take countermeasures if France proceeds with a fast fashion bill that could disproportionately impact Chinese e-commerce giants such as Shein and Temu, said experts on Monday.

They made the comments as French lawmakers plan to impose punitive measures on fast fashion, which will see incremental fines of up to 10 euros ($10.83) attached to each garment by 2030, as well as a ban on the advertising of such products.

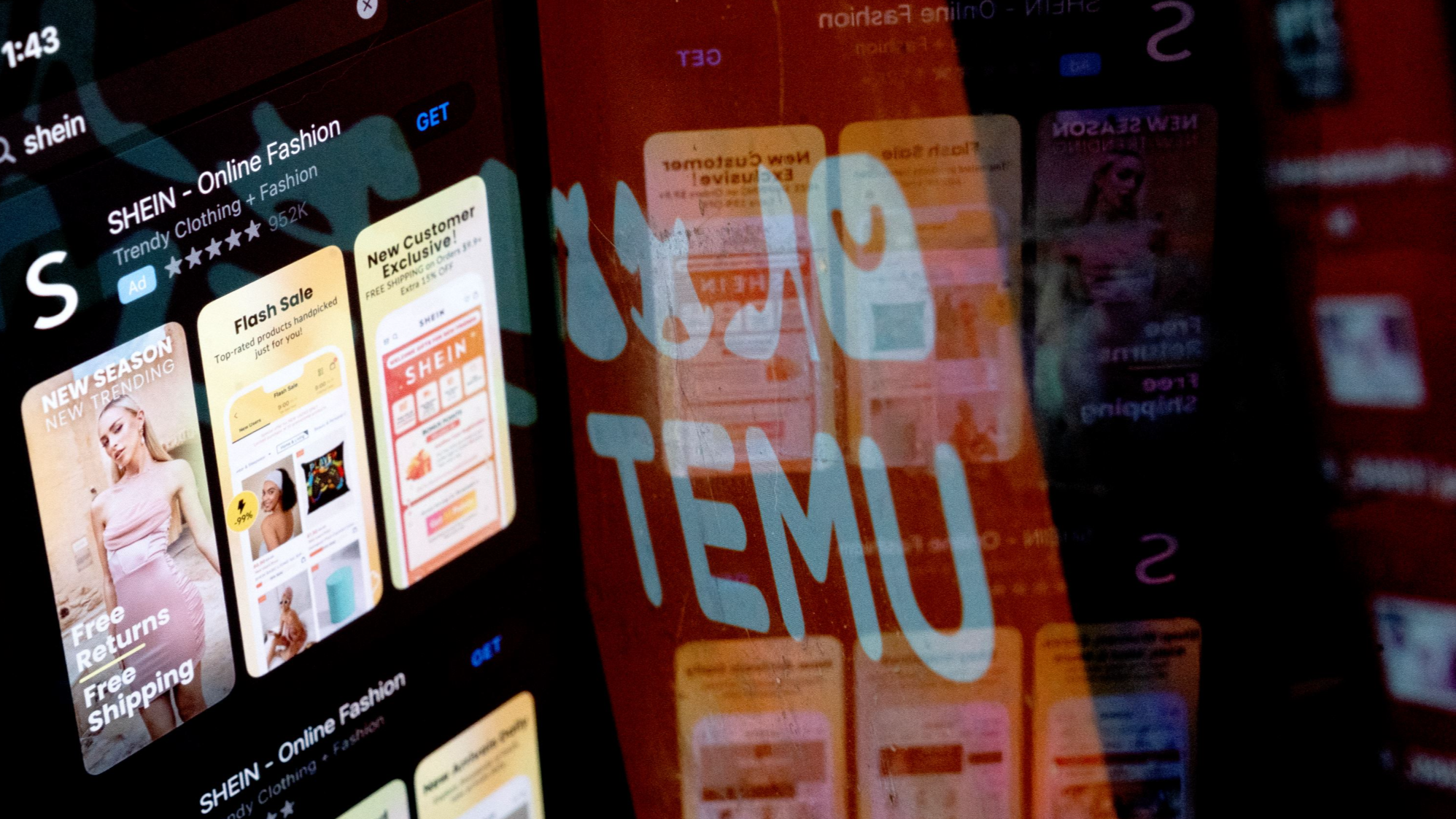

The anti-fast fashion bill, which has already been passed by the National Assembly, is expected to be submitted for review in May. Chinese e-commerce giants such as Shein and Temu are likely to be most affected, while brands like Zara and H&M would remain unaffected.

Chen Jin, chief professor of the modern service research center at the University of International Business and Economics in Beijing, said that the bill is a form of trade protectionism disguised as environmental protection, that is designed against China's burgeoning fast fashion companies.

ALSO READ: Flexible cross-border sales models expand financial frontiers

"The dynamics of global competition have shifted. Trade disputes are increasing because Chinese products now lead in technology, quality and pricing. This unilateral adoption of so-called protective measures severely violates the WTO's principles of free competition and trade," Chen said.

The bill has been created in response to the rapid growth of platforms like Shein, Temu and AliExpress, which have gained significant traction in France. According to a study by shopping app Joko, Shein was the most purchased brand in France in 2024, overtaking Vinted which had held the top spot since 2020. The study also noted that Temu's sales surged by 178 percent year-on-year in 2024, with both companies now handling more parcels in France than Amazon.

French industry groups have expressed concerns over the impact of fast fashion on local businesses. However, Shein has defended its business model, emphasizing that its on-demand supply chain reduces waste by keeping unsold inventory in the low single digits, compared to traditional retailers' 40 percent excess stock.

Market consultancy Boston Consulting Group said in a report that agile supply chains can enable fashion companies to balance supply and demand, thereby reducing inventory costs, improving capital efficiency, increasing revenue and sharing benefits with customers by reducing product prices.

Chen said, "If France implements such trade protectionism measures and Chinese companies are treated unfairly, we must firmly oppose them. In response to such clear violations of fair competition principles, enterprises should actively defend their rights and respond accordingly."

Chen added that French lawmakers should uphold multilateral trade rules and respect the authority of the WTO to create a fair competitive environment.

"Fundamentally, China seeks to maintain the multilateral system and resolve issues within the WTO framework. If a reasonable solution cannot be reached, trade countermeasures remain a possibility," he emphasized.

China's response to the bill could impact French exports, which have seen rapid growth in the Chinese market. France's luxury sector, as well as some brands such as LVMH and Decathlon, has benefited from stable market access in China. Since 2021, China has been the top global export market for French cosmetics, and France is now one of China's largest trading partners worldwide.

ALSO READ: Trump tariff plan to spur US inflation

With billion-yuan sales in China, Decathlon views the market as a key pillar of its global strategy. LVMH Group generated 26.7 billion euros in revenue from Asia (excluding Japan) in 2023, with China dominating sales.

Experts caution that should France proceed with targeted sanctions on China's apparel industry, countermeasures may follow, potentially affecting French luxury brands and other exports.

France has already seen examples of such responses. When the European Union proposed tariffs on Chinese electric vehicles last year, China swiftly imposed anti-dumping measures on EU brandy, requiring importers to post deposits exceeding 30 percent of sales value with Customs.