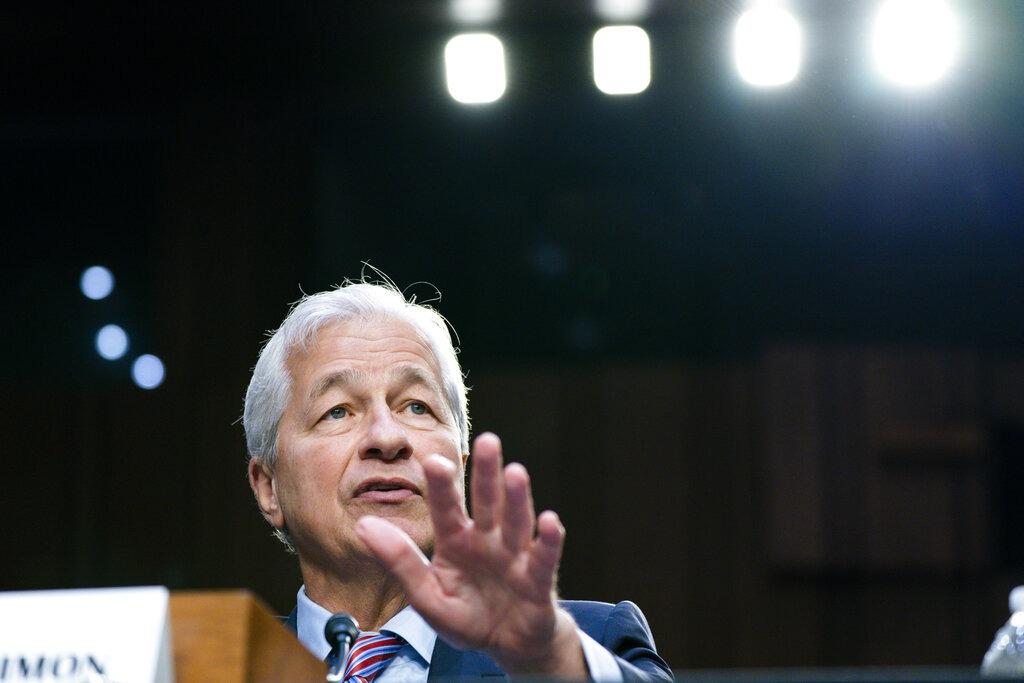

In this file photo dated Sept 22, 2022, JPMorgan Chase & Company Chairman and CEO Jamie Dimon testifies at a Senate Banking Committee annual Wall Street oversight hearing on Capitol Hill in Washington. (PHOTO / AP)

In this file photo dated Sept 22, 2022, JPMorgan Chase & Company Chairman and CEO Jamie Dimon testifies at a Senate Banking Committee annual Wall Street oversight hearing on Capitol Hill in Washington. (PHOTO / AP)

NEW YORK - JPMorgan Chase CEO Jamie Dimon blasted stricter capital rules proposed by US regulators, telling investors on Monday that they could prompt lenders to pull back and stymie economic growth.

The proposal to require banks to set aside more capital to guard against risk was "hugely disappointing" and involved a "lack of transparency" from regulators about the rationale, Dimon said at a conference in New York.

"I wouldn't be a big buyer of a bank," the chief of the largest bank in the US added, drawing laughter from the audience. "I'd be no better than equal weight."

JPMorgan bought First Republic earlier this year in a government-backed deal.

Dimon questioned what the regulators were trying to accomplish with the rules. "All I want is fairness, transparency, openness," he said.

The Federal Reserve, Federal Deposit Insurance Corp and the Office of the Comptroller of the Currency declined to comment.

ALSO READ: Yellen: Climate change could harm asset values, US economy

People walk past a branch of JPMorgan Chase Bank in New York, the United States, on May 1, 2023. (PHOTO / XINHUA)

People walk past a branch of JPMorgan Chase Bank in New York, the United States, on May 1, 2023. (PHOTO / XINHUA)

On US economy, Dimon said that he was more cautious than others on the economic environment, even though the consumer and the banking industry remains strong.

"I just think people make a mistake to look at real-time numbers and not look at the future. And the future has quantitative tightening. We've been spending money like drunken sailors around the world, this war in Ukraine is still going on," he said, adding that to assume that the environment would be booming for years was a huge mistake.

Quantitative tightening refers to a reversal of the massive central bank asset purchases undertaken to support bond markets as the coronavirus hit in 2020 and during the global financial crisis 15 years ago.

READ MORE: JPMorgan CEO recovering after emergency heart surgery

Even though the economy looks buoyant currently, the impact of withdrawing of fiscal stimulus measures could only be clearer in the next 12 to 18 months, he warned.