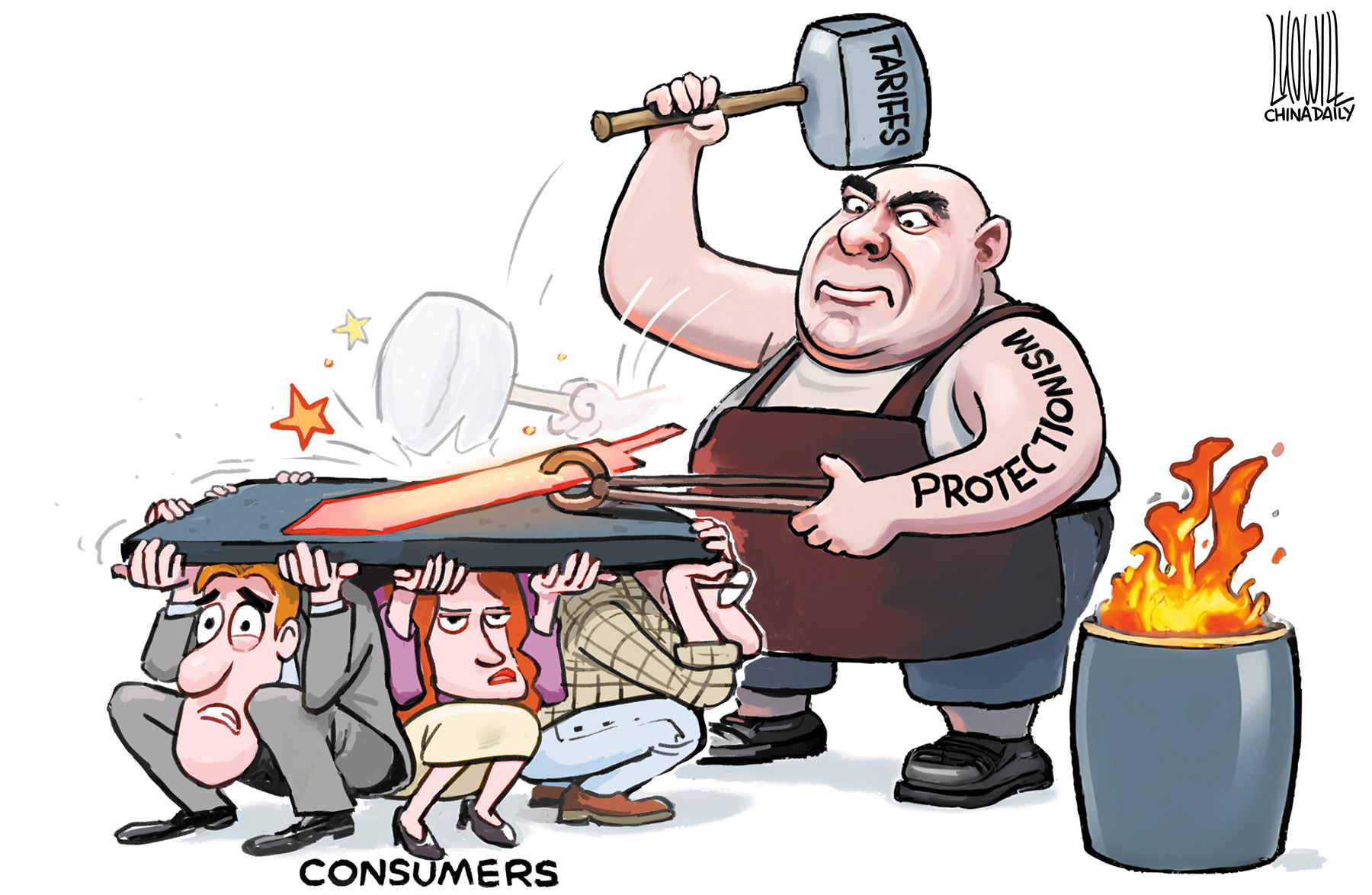

Trump’s planned new tariffs on imported goods amount to a covert tax on US consumers

Every week, the United States seems to unveil new plans for a colossal tariff scheme, which could reshape global trade dynamics in the quest to “Make America Great Again”.

President-elect Donald Trump said in November that he plans tariffs of 25 percent on all imports from Canada and Mexico and 10 percent on all imports from China on day one of his new administration. While campaigning, Trump promised 60 percent or more tariffs on all Chinese imports into the US, combined with a tariff of up to 100 percent on all vehicles imported from Mexico.

President-elect Donald Trump said in November that he plans tariffs of 25 percent on all imports from Canada and Mexico and 10 percent on all imports from China on day one of his new administration. While campaigning, Trump promised 60 percent or more tariffs on all Chinese imports into the US, combined with a tariff of up to 100 percent on all vehicles imported from Mexico.

More recently, he threatened new tariffs on all imports from the EU unless Europe buys more US oil and gas.

Trump also threatened new 100 percent tariffs on imports from all BRICS nations —which make up almost 40 percent of global GDP using a PPP measure — if the BRICS nations work towards any displacement of the US dollar as the global reserve currency. In early November, Australia’s ABC reported that Trump would introduce a global tariff on all imports into the US of “either 10 or 20 percent”.

The US has already imposed a 25 percent tariff on a vast range of Chinese goods (dating from Trump’s first term in office). President Joe Biden has been very busy, too. He recently imposed a new 100 percent tariff on all Chinese electric vehicles, a 25 percent tariff on lithium-ion EV batteries, and a 50 percent tariff on photovoltaic solar cells. A 50 percent tariff on semiconductors made in China is set to go into effect in 2025. Biden’s plan also provides for a 25 percent tariff on (Chinese-made) ship-to-shore cranes.

READ MORE: Beijing opposes US tariff hikes on Chinese goods

Subsequent discussion of all these extant and proposed tariff measures has been dominated by an apt examination of the grave threat they pose to maintaining healthy, desirable levels of global trade. Thus, in the online journal Pearls and Irritations, Daryl Guppy, an Australian commentator, recently argued that: “The US is about to launch an open attack on global trade stability.”

Takeshi Oto, a Japanese geopolitical commentator, documented in a recent Project Syndicate article, entitled “Trump’s Tariffs Will Backfire”, how globally disruptive the host of proposed new US tariffs may prove to be.

There is, however, another less-headlined, crucial change embodied in all this prodigious tariff planning. If even half of the tariffs being proposed or threatened are implemented, the US is set to experience the most radical reform of its taxation system seen in decades — all unfolding behind an extraordinary political smokescreen. It is instructive to consider how this has happened.

Here is the Oxford online definition of a tax: “A compulsory contribution to state revenue, levied by the government on workers’ income and business profits, or added to the cost of some goods, services, and transactions.”

Many write about “tariffs” as if they are somehow unlike a tax. But you can see from the above definition, that this is a distinction without a difference: every tariff is: “A compulsory contribution to state revenue, levied by the government on certain goods.”

A curious aspect of the US taxation system is the comparatively low fiscal importance of consumption or sales taxes. Unlike most developed jurisdictions, the US has no modern valued added tax or goods and service tax that applies to consumption — only old style retail sales taxes. Major changes to this outdated system have long been stoutly resisted. However, things now look set to change dramatically.

Consider this figure from a recent CNN report: the US today is massively reliant on the annual import of more than $3 trillion in consumer goods — mostly from China — to sustain its preferred lifestyle. As they arrive in the US, new, front-loaded consumption taxes are thus about to be imposed at greatly increased levels on a vast range of crucial, imported consumer items.

But wait — Donald Trump says that is not what is about to unfold (and perhaps water is not wet). He claims that China and other countries will pay “trillions and trillions of dollars into the United States Treasury” under his burgeoning tariff regime. CBS News in the US recently quoted this assertion, noting how Trump believes that “the word ‘tariff’ is the most beautiful word in the dictionary … I love tariffs! … Music to my ears!”

According to Doug Irwin, an economics professor at Dartmouth College quoted in the CBS report, this is a “very misleading way to say what is going on.” It is US consumers who will pay these imposts. This is a federal tax whereby money is transferred “from consumers to the federal government”.

A recent study by the nonpartisan Congressional Budget Office (CBO), requested by the Senate Budget Committee, confined itself to examining a 10 percent across-the-board tariff lift combined with a 60 percent additional tariff on all goods coming from China — notably less than an entire sequence of Trump tariffs threatened so far.

The consequences arising from introducing this limited spectrum of new tariffs, according to the CBO, include a 1 percent increase in inflation by 2026, an average increased cost of $1,560 to every American family, and significant price increases in consumer and capital goods. The CBO also estimated that the tariffs studied would shrink the US economy by $165 billion by 2034, raising around $3 trillion in fresh revenue over the same period. Somewhat more gloomy estimates from the US Tax Foundation confirm these figures.

According to the US treasury, the national debt in 2024 was $35.46 trillion or 123 percent of GDP. Many commentators expect the debt level to rise, partly to allow the new Trump administration to reduce taxation levels that apply to the super-wealthy (many of whom have spent heavily to ensure Donald Trump’s election).

Treasury funds raised by the projected imposition of greatly increased de facto consumption taxation on over 300 million US citizens are also, according to this argument, set to be deployed to assist in this same tax relief project.

ALSO READ: Trump's tariff policy sword with double edge

Imagine how damaging it would have been to Trump’s election prospects had he openly campaigned to introduce a radical change to the US consumption tax system that would cost voters significantly as they shopped (with the worst off being the worst hit). That is what he has campaigned on, but by the application of an extraordinary form of “taxation alchemy”, he has converted that bleak, vote-losing reality into a system of new “tariffs” that mysterious “others” will pay.

An initial tariff-based, sales tax reform scheme was road-tested by the first Trump administration. Now the US looks set to experience a full-blown version of this covert, revolutionary reform of consumption taxation.

Many leading US media outlets seem to have averted their gaze as this fiscal “thimble and pea trick” unfolded before their eyes. It helped, too, that the Biden administration had already proved that it “loved tariffs” almost as much as Trump. Have the US’ primary political parties and the mainstream media conspired against the voters? It is undoubtedly hard to recall a comparable example in the developed world where primary taxation reform has been achieved by relying to such a degree on collective, influential stealth.

The author is an adjunct professor in the faculty of law, Hong Kong University.

The views do not necessarily reflect those of China Daily.