Hong Kong one-hundred dollar banknotes are arranged for a photograph in Hong Kong, Jan 20, 2016. (JUSTIN CHIN / BLOOMBERG)

Hong Kong one-hundred dollar banknotes are arranged for a photograph in Hong Kong, Jan 20, 2016. (JUSTIN CHIN / BLOOMBERG)

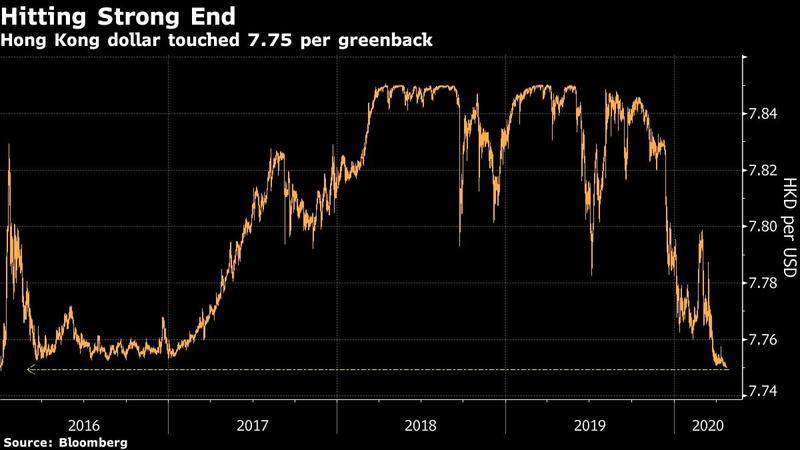

The Hong Kong Monetary Authority (HKMA) sold the local dollar for the first time since 2015 after the currency rose to the strong end of its trading band.

The Hong Kong Monetary Authority sold HK$1.55 billion (US$200 million) of the city’s currency in exchange for the greenback Tuesday, according to its page on Bloomberg. The Hong Kong dollar, which had earlier strengthened to its upper limit for the first time since 2016, traded near that level at 7.75 per greenback, according to data compiled by Bloomberg.

The HKMA sold HK$1.55 billion (US$200 million) of the city’s currency in exchange for the greenback, according to its page on Bloomberg, after the Hong Kong dollar touched 7.75 per greenback

Hong Kong effectively imports US monetary policy thanks to the currency peg, even if local rates don’t always track those across the Pacific.

Recent strength in the city’s currency is a reflection of a widening gap between local borrowing costs and those in the US, rather than investor confidence in Hong Kong’s outlook. The interest rate spread makes the local currency more appealing to hold versus the greenback, and is the reverse of the situation that prevailed in recent years.

ALSO READ: HK dollar's best run since 2003 shows no signs of abating

Interventions to buy the local dollar in 2018 and 2019 helped shrink the aggregate balance in the city - an indicator of interbank cash supply - by 70 percent to HK$54 billion before Tuesday. The limited cash supply has helped to amplify the volatility in Hibor. The one-month borrowing cost was recently at its highest relative to US Libor since 1999.

Hong Kong has suffered a double blow of economic disruptions from widespread anti-government protests last year and the coronavirus pandemic in 2020. Fitch Ratings on Monday downgraded Hong Kong’s long-term, foreign currency debt to AA- from AA, with a stable outlook. The ratings agency said the city’s real gross domestic product is expected to fall by 5 percent this year after a 1.2 percent decline in 2019.

READ MORE: Govt rejects Fitch downgrade, says HK's core competitiveness intact

The currency will likely stay close to 7.75 throughout the second quarter, said Stephen Chiu, a foreign-exchange and rates strategist at Bloomberg Intelligence. This means the HKMA may boost the aggregate balance by more than HK$100 billion through retiring some outstanding exchange-fund bills and notes and intervening at the strong end, he added.